- Best Ever CRE

- Posts

- 📣 200 firms reveal their 2025 strategies

📣 200 firms reveal their 2025 strategies

Plus: Insurance gets trickier, concession values rise, multifamily starts surge, and much more.

👋 Hello, Best Ever readers! We are officially 56.2% of the way through 2025. Wonder what the remaining 43.8% will bring….

In today’s newsletter, CRE firms pivot, insurance gets trickier, concession values rise, multifamily starts surge, and much more.

📅 Also, please join us TONIGHT alongside the DeRosa Group for a look inside the unique opportunity in the hospitality industry in our FREE live webinar: Hotel Investing Decoded. Register now!

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🔒 Insurance Gap: Standard real estate liability policies may not cover data breach claims despite marketing cyber protections, as insurers invoke "professional services" exclusions to deny coverage. CRE firms face growing legal exposure without explicit cyber extensions.

🏠 Concession Shift: Nearly one in eight U.S. apartments offers concessions averaging 9.3% off rent, according to RealPage, as supply surge drives incentives higher than post-COVID levels. Current discounts stem from oversupply, with 2025 deliveries expected 25% below 2024 levels.

❄️ Funding Freeze: Trump's proposed $27 billion cut to rental assistance programs creates lender uncertainty, stalling affordable housing projects nationwide. The 43% reduction threatens $50 billion in Fannie/Freddie multifamily loans with potential defaults, despite LIHTC expansion victories.

🤝 Deal Momentum: CRE deal volume reached $100.6 billion in Q1, up 14% YoY, as buyers and sellers narrow pricing gaps after an 18-month standoff. Individual sales surged 24% with seller financing expanding to sidestep high rates.

🏭 Pipeline Pivot: Build-to-suit projects now make up 34.5% of the industrial development pipeline, up from 28.6% YoY in Q1 as speculative construction slows. The shift toward pre-leased projects is helping stabilize some markets, with Midwest vacancy rising just 30 bps compared to 210 bps elsewhere.

🏆 TOP STORY

WINNERS AND LOSERS FROM CRE FIRMS’ 2025 PIVOTS

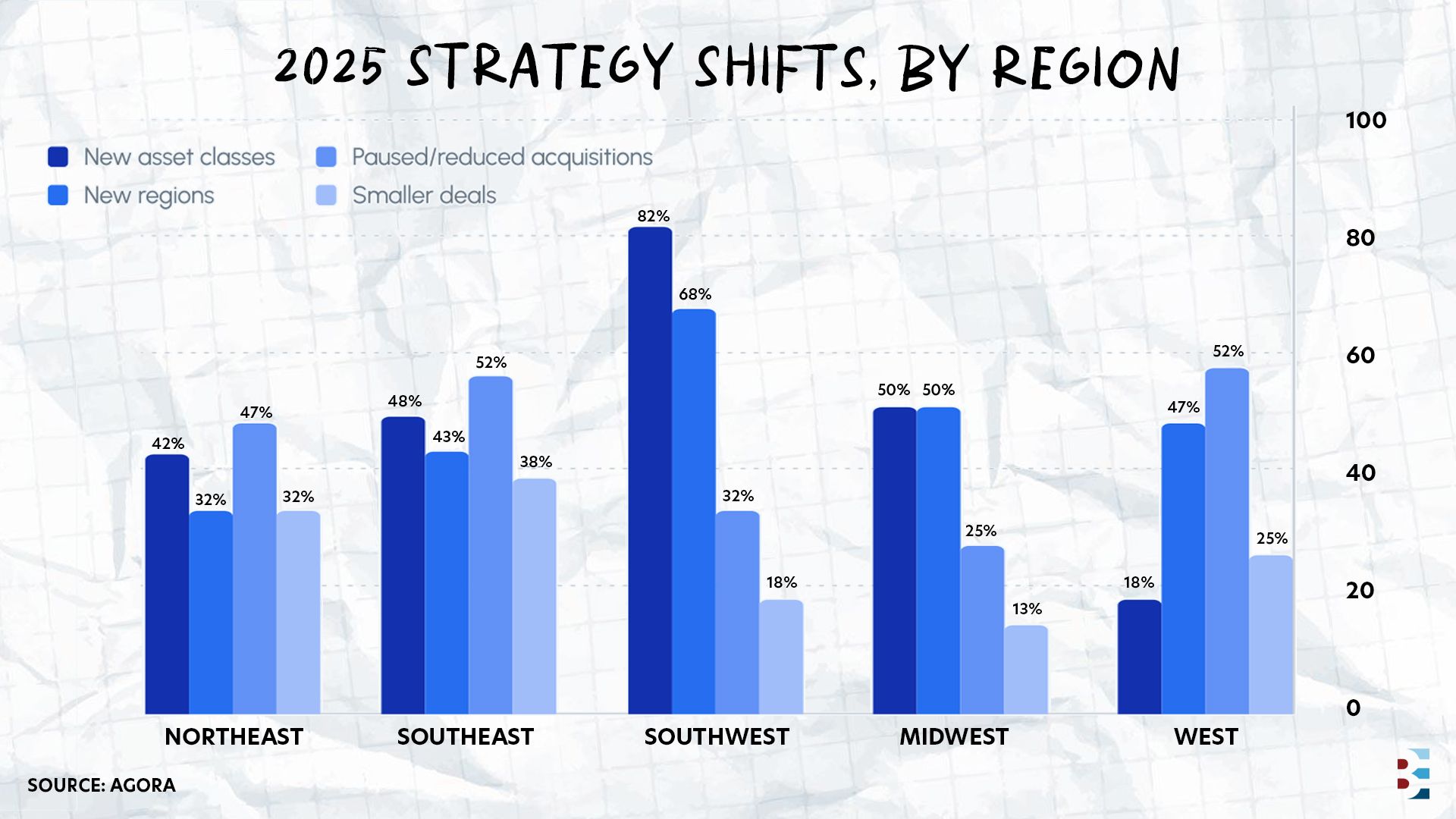

We are officially more than halfway through 2025 (56.2%, to be exact), and the year many were surviving till hasn’t brought the relief they thought, causing investors across the country to pivot. This week, Agora released its 2025 Real Estate Market Sentiment Report, surveying 200 senior real estate professionals — managing partners, CFOs, investor relations pros, etc. — about how their firms are adapting to current market volatility.

The data shows that 58% report capital raising has become more difficult (perhaps the other 42% are in denial?) while 44% of firms have already changed their investment plans in 2025 due to market conditions. Here's who's winning and losing amid the industry reshuffling:

🏅 Winner: Multifamily — 51% of firms are prioritizing multifamily properties, making it the undisputed flight-to-safety choice. The focus on income-stable, recession-resistant assets signals where smart money believes the best risk-adjusted returns exist.

⚰️ Loser: Hospitality — Only 8% of firms are willing to touch hospitality assets, making it CRE's biggest pariah. The operational complexity and volatility have spooked investors completely, creating huge upside for the savvy 8% who do take advantage. Our webinar tonight explains how you can capitalize on this. Save your seat here!

🏅 Winner: The Southeast — 28% of firms are targeting the Southeast for new investments, with the Southwest close behind at 26%. The Sun Belt migration continues, even during market stress, confirming these regions' fundamental appeal.

⚰️ Loser: Silent Operators — Quarterly investor updates are dead, as 38% of firms now provide weekly updates while 31% of investor requests focus on current performance metrics. Firms clinging to old-school reporting are losing the fundraising race.

🏅 Winner: Capital-Rich Investors — With 58% reporting difficult capital-raising conditions, those with available capital hold unprecedented negotiating power. The capital scarcity is creating significant leverage for well-funded players.

⚰️ Loser: Late Movers — 48% of firms describe their strategy as "opportunistic," as the easy repositioning deals have all but disappeared. Firms still operating traditional playbooks risk being left behind in a rapidly evolving market.

THE BOTTOM LINE

The data shows a clear flight toward income-stable assets in growth markets, while firms abandon anything operationally complex. This leaves investors with a choice: follow the institutional herd into proven performers, or find contrarian value in the spaces everyone's abandoning.

🎓 TOGETHER WITH THE DEROSA GROUP

FREE WEBINAR TONIGHT: HOTEL INVESTING DECODED

Join The DeRosa Group for our FREE live webinar TONIGHT, as they provide a look inside the booming hospitality industry. They'll discuss why they decided to pivot from multifamily to hotels and conduct a deep dive into hotel deal analysis.

Here’s what you’ll learn from this FREE live webinar:

✅ Why Hotels? Discover why hospitality is a strong hedge against inflation and a powerful income generator in this market.

✅ Tax Efficiency: Learn how cost segregation and bonus depreciation can enhance your after-tax returns.

✅ Property Deep Dive: Explore DeRosa Capital 20, a dual-Hilton hotel offering, including business plan, risk mitigation, and projections.

✅ National Branding: Learn how working with a brand like Hilton creates predictable cash flow and long-term appreciation.

Matt, Jacob, and Hait will also give you an exclusive walkthrough of DeRosa Capital 20 — a dual-Hilton hotel offering that delivers immediate cash flow, institutional brand strength, and conservative upside.

💰 CRE BY THE NUMBERS

MULTIFAMILY STARTS REBOUND, MED SPAS RISE, AND MORE

📈 31%

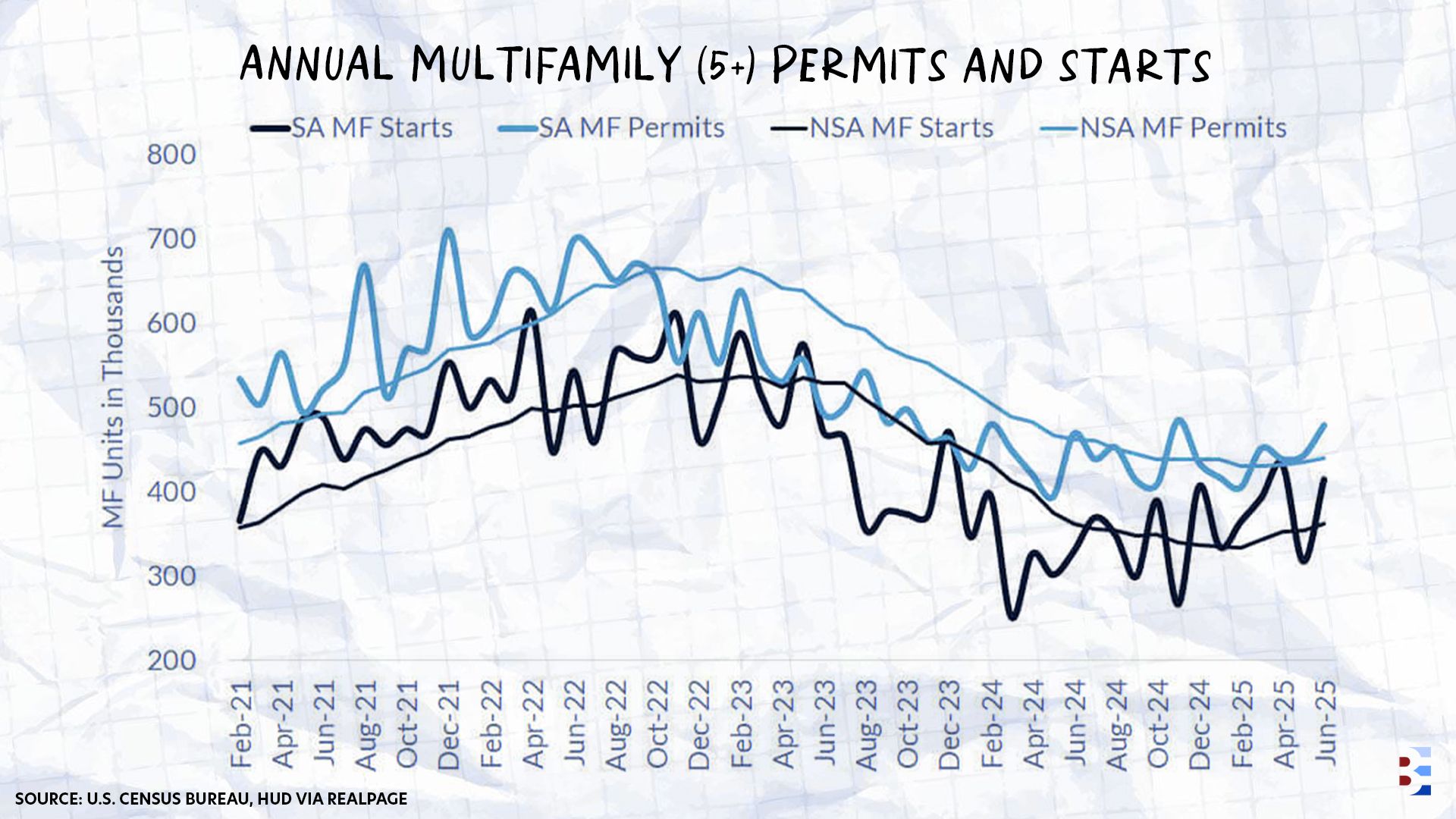

Multifamily housing starts jumped 31% in June to 414,000 units (seasonally adjusted annual rate), up 25.8% YoY despite erratic monthly data, according to RealPage. The increase suggests construction may be bottoming out, though single-family starts fell to their lowest levels since early 2023.

💉 $17 Billion

The U.S. med spa industry reached $17 billion with over 10,000 facilities nationwide, averaging $1.4 million in annual revenue per location. Growth from 8,900 locations in 2022 to 10,500 in 2023 is attracting landlords but raising regulatory concerns over inconsistent oversight.

💰 20%

The Big Beautiful Bill made the Section 199A tax deduction permanent, giving REIT investors a 20% reduction on qualified business income. Top earners now pay a 29.6% effective tax rate on REIT dividends instead of 37%, providing meaningful savings for high-income investors.

🏙️ 17,400

New York City office-to-residential conversions could produce 17,400 new apartments from 44 projects, absorbing over one-third of pandemic office vacancies. The 467-m tax exemption offers up to 90% property tax breaks but will cost the city $5.1 billion in lost revenue over 37 years.

🏘️ DEAL OF THE WEEK

EARLY RETURNS AND A 20-25% IRR IN JUST TWO YEARS

|  |

Ryan Emrich and Blue Canyon Equity Partners closed on their first syndication in July 2023 and are delivering better-than-projected results after just two years.

Here's how they're doing it 👇

🏢 Property details: This deal included a scattered-site portfolio of 12 buildings with 65 total units. The properties are all located in Class C neighborhoods in New Bedford, Massachusetts.

💸 Finances: The portfolio was purchased for $5.67 million and included a $250,000 seller credit (net $5.42 million). The team raised $1.8 million in capital and secured a loan at 75% LTV from a regional lender with a 5.65% interest rate with two years interest only and a 10-year term, five-year fixed.

💼 Business plan: The team raised rents to market rates within the first six months after purchase and made cosmetic updates to units as they turned over tenants. The original business plan was to hold the portfolio for 3-5 years, sell off the smaller buildings, and keep the larger buildings with more units. This would allow them to return capital to investors from the early sales of smaller buildings while maximizing cash flow and returns for the remaining hold period.

🍾 Results: After only two years, Blue Canyon has stabilized the portfolio, sold several of the smaller buildings, addressed deferred maintenance and CapEx improvements, and increased rents to market rates. As a result, they have seen rapid appreciation.

Originally, the bank estimated the portfolio’s post-stablization value to be $7.4 million. It is now closer to $8 million. Likewise, projected returns are currently 20-25% IRR when they were originally 15%.

They are currently deciding whether to sell the remainder of the portfolio this year to return capital and profits to investors or continue holding for cash flow, knowing market uncertainty could impact future values.

👉 If you have a deal you'd like us to feature, share it with us!

🎓 EXPERT RESOURCES

UNDERSTAND THE ENERGY CRISIS TO INVEST IN OIL & GAS

The energy crisis is creating unprecedented investment opportunities for those who understand the market dynamics. Despite decades of renewable expansion, fossil fuels still power 81% of global energy and 91% of transportation, yet investment in new oil and gas projects has plummeted 55% since 2014. J.P. Morgan Research predicts this supply gap could reach 7.1 million barrels per day by 2030, potentially driving oil prices to $150 per barrel.

While headlines focus on transitioning away from fossil fuels, renewable infrastructure simply cannot meet current global energy demands for decades. With the U.S. Strategic Petroleum Reserve at historic lows and oil companies prioritizing returns over expansion, smart investors are recognizing this rare chance to capitalize on fundamental supply-demand imbalances through mineral rights, working interests, and midstream investments.

Read more about Aspen Funds’ energy investment strategy and the opportunities available in their latest venture, the 51 Upstream Energy Fund VII (UEF VII).

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless