- Best Ever CRE

- Posts

- ⚠️ Billions in CRE are at risk. Here's why.

⚠️ Billions in CRE are at risk. Here's why.

Plus: Greystar pays, a comedian builds a theme park, dealmaking is back, and much more.

👋 Happy Sunday, Best Ever readers!

In today’s newsletter, billions in CRE are at risk, Greystar pays, a comedian builds a theme park, dealmaking is back, and much more.

🔥The Best Ever Conference X program just dropped — and it’s packed. See the full lineup, and lock in $100 off with code PROGRAM100 before the Thanksgiving chaos and December 1 price jump. View the Full Program.

▶️ Missed last week’s institutional investing session with Mark Khuri of SMK Capital Management? The replay is now live, and it’s packed with insights private investors almost never get to see. Get the free replay now.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🏢 Greystar Pays: Greystar has settled for $7 million with nine states over rent-setting algorithms using competitors' confidential data, adding to its $50 million class-action payout and forcing the nation's largest landlord to abandon the pricing software across 946,000 units.

⚖️ Rate Limbo: Fed minutes reveal "many participants" want no more cuts in 2025 despite October's quarter-point reduction to 3.75%-4%, with "strongly differing views" on December slashing market odds from near-certainty to just one in three.

🏢 Office Momentum: October office visits were down 30.8% from 2019 but up 4.7% YoY, with Miami and New York leading recovery and San Francisco posting 12% annual growth, though Friday remains quietest as hybrid habits persist.

🎢 Nateland Rising: Comedian Nate Bargatze has partnered with Storyland Studios to develop a 100+ acre Nashville theme park, with a feasibility study due Q1 2026 and the world's top-earning comedian eyeing expansion to other states.

💳 Delinquency Surge: Mortgage delinquencies hit 3.99% in Q3, with FHA loans deteriorating most as the seriously delinquent rate jumped 47 bps YoY to 10.78% while Southern states report the highest missed payment rates.

🏆 TOP STORY

HOW THE GOVERNMENT PUT BILLIONS IN CRE AT RISK

Cities across the U.S. thought they had a plan to protect their infrastructure from floods, earthquakes, and wildfires. Then the federal government pulled the rug out.

The Trump administration canceled FEMA's Building Resilient Infrastructure and Communities program in April, calling it "wasteful" and "politicized." The move clawed back $882 million in unspent funding and killed applications for roughly 2,000 projects that had received $4.5 billion in grants over four years. Local governments were left scrambling to plug multimillion-dollar gaps — and the commercial real estate tied to those neighborhoods now faces mounting risk.

Extreme weather events doubled in frequency in 2024 vs. the previous two decades.

Commercial property insurance premiums are projected to jump 80% by 2030.

Markets without mitigation plans are seeing red-hot premium increases as insurers pull back coverage.

Without hazard mitigation, owners in vulnerable markets face shrinking options and ballooning costs. Insurance markets are already pulling back on coverage in areas where exposure keeps increasing, creating volatility around both availability and affordability.

The rescission forced cities to pursue projects in costly phases rather than efficient full builds. Twenty states sued to restore the grants and won a preliminary injunction, but the damage is done. New York alone had 31 open BRIC projects worth $224.5 million, plus seven more totaling $138 million now at risk of defunding.

Rising costs hit small owners hardest. Large corporations can spread risk across umbrella policies, but smaller players are almost unable to move forward on projects when insurance becomes prohibitive. The insurance market isn't waiting for cities to find alternative funding — premiums are spiking now in markets without mitigation plans.

THE BOTTOM LINE

Cities now face a brutal calculus: find alternative funding or watch neighborhoods become uninsurable. Some are exploring government bond sales or braiding capital stacks with local philanthropies and developers. But every dollar counts — U.S. Chamber of Commerce research shows $1 spent on resiliency saves $13 in post-disaster costs. Without federal support, that math just got harder for owners and cities alike.

🎉 BEST EVER CONFERENCE

THE BEC X PROGRAM IS HERE!

Your 2026 game plan starts now — speakers, sessions, roundtables, and networking events have officially been released for Best Ever Conference X!

🦃 Beat the Thanksgiving Chaos: Lock in your ticket before the holiday whirlwind hits, and grab your spot at the sessions everyone will be talking about.

Program Highlights Include:

The Road Ahead: The State of the Economy & Multifamily with J Scott

Why the Future of Wealth Is Female (and Why It Matters to Every Serious Investor) with Liz Faircloth

GP–LP Speed Networking

AI in CRE: What’s Real, What’s Hype, and What’s Coming with Spencer Burton

Small-group expert roundtables for tactical insights & real-world problem-solving

And so much more!

⚡ Program Launch Special: Use code PROGRAM100 to save $100, but don’t wait. Prices jump on December 1.

▶️ NOW AVAILABLE

INSIDE THE INSTITUTIONAL MINDSET

Missed last week’s deep dive with SMK Capital Management? The replay is now ready, and it’s packed with insights private investors rarely get access to.

Mark Khuri breaks down how institutional capital actually evaluates opportunities across 130+ assets and $1.5B AUM. More importantly, he reveals the patterns, pitfalls, and deal dynamics that separate consistent winners from avoidable disasters.

Here’s what you’ll take away from the replay:

🔍 Deal Filters That Matter: How seasoned investors screen opportunities in minutes—and what instantly signals elevated risk.

🧩 How Pros Vet Sponsors: The advanced questions and pressure-tests SMK uses to uncover blind spots before committing capital.

📈 Where Capital is Moving Next: A forward-looking view of asset classes and structures positioned for strong risk-adjusted outcomes heading into 2026.

🛡️ Portfolio-Level Thinking: Why individual deals often fail investors but portfolio construction rarely does.

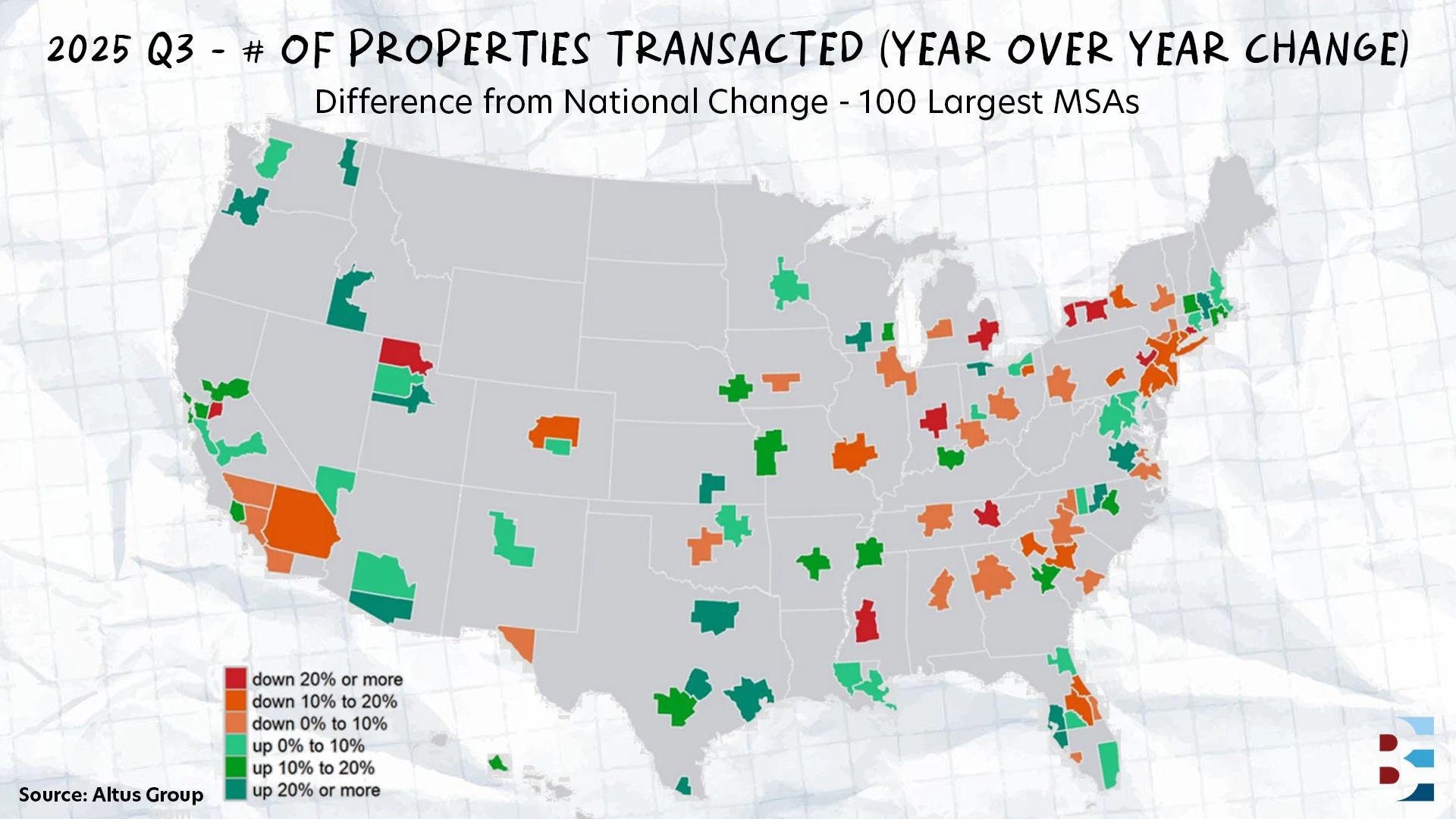

🗺️ ON THE MAP

WHERE DEALS ARE CLOSING AS VOLUME RAMPS UP

CRE transaction volume roared back in Q3, shaking off years of post-rate-hike slump and reshaping the investment map as buyers and sellers finally found common ground:

$150.6 billion in total transactions, up 25.1% YoY

45,893 properties changed hands, up 6.8% annually

Multifamily led the surge, jumping 51.1% to $45 billion and claiming 30% of all activity

Industrial wasn't far behind with a 26.5% climb to $29.6 billion, while office rose 28% to $19 billion. Even general commercial got in on the action, surging 48.9% to $8.8 billion.

The median transaction value climbed double digits across every sector. Multifamily deals grew 27.3% and office jumped 23.8%, suggesting the bigger fish are finally swimming again as pricing stabilizes and buyers regain confidence.

The recovery wasn't evenly distributed across metros. Miami office posted the strongest gain at 32.7%, while Los Angeles saw declines across all sectors. Overall, median prices per square foot rose 14.2% annually to $126, with multifamily up 17.3% and office up 14.8%.

The caveat? Year-to-date single-property volume of $265 billion still looks anemic by historical standards, even if it beats 2023 and 2024. But after two years of price discovery and rate anxiety, investors are deploying capital again.

🎉 BEST EVER CONFERENCE

SAVE UP TO 40% ON YOUR BEC HOTEL STAY

Best Ever Conference is coming to Salt Lake City this February, and our exclusive room block at the Hyatt Regency is filling up fast. Here's why you should book now at our conference hotel rather than staying elsewhere:

Our Rate: $240/night vs. up to 40% more at other downtown hotels

We've compared rates across downtown Salt Lake City, and other hotels are charging $350-360/night or more. That's up to 40% more expensive than our group rate. You'll save hundreds while staying steps from the Conference action. No shuttles, no commutes. Just walk from your room to sessions in minutes, and maximize every networking opportunity from the lobby to the rooftop bar.

🎙️ THE BEST EVER CRE SHOW

THE BROKER HACK THAT UNLOCKS OFF-MARKET DEALS

While most operators sat on the sidelines waiting for the market to shift, RSN Property Group closed five deals in 15 months and grew its portfolio by 1,100 doors. Christian Macellari, RSN's Chief Investment Officer, broke down the company’s three-pronged off-market strategy on the Best Ever CRE Show — and none of it involves cold-calling motivated sellers.

RSN built relationships with preferred equity groups and lenders holding troubled assets. When a pref equity partner had to take back keys on a distressed property, they came to RSN first — ultimately selling at $3 million below the original contract price.

The playbook, according to Macellari:

Be the trusted operator when deals go sideways.

Watch for creative financing — some lenders now offer 90% loan-to-cost on REO properties.

Start conversations early — even if deals don't pencil today, relationships pay off in six to eight months.

The second strategy targets the middle-market sweet spot. RSN runs CoStar screens for 100-200 unit properties where private owners and family offices aren't required to take deals to market. Macellari analyzes purchase dates, gross rent multipliers, and even negative value situations that signal pain points.

The twist: When direct outreach fails, he leverages broker relationships: “I'll say, Hey, I've tried to reach these 10 owners and can't get through. Do you have a relationship? If you do, we'll pay you a fee,” Macellari says.

Three of RSN's last five deals came through off-market channels, including their July closing in Macon, Georgia. The deal that took three months of broker-facilitated negotiation with five decision-makers but delivered at the right basis, proving that sometimes the best deals never hit the market — you just have to know which doors to knock on.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless