- Best Ever CRE

- Posts

- 🌿 Cannabis cafes are coming to retail

🌿 Cannabis cafes are coming to retail

Plus: Trump threatens institutional investors, a $372M ponzi scheme, office leasing picks up steam, and more.

👋 Happy Sunday, Best Ever readers!

In today’s newsletter, cannabis lounges arrive, Trump threatens institutional investors, a $372M ponzi scheme, office leasing picks up steam, and more.

📩 Join us January 15 at 1 pm ET alongside Richard McGirr and Chris Lopez of Property Llama for a FREE webinar to learn their framework for protecting capital and generating predictable returns through private lending. Save your spot.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🏠 Investor Ban: President Trump announced plans to ban large institutional investors from buying single-family homes, though congressional approval may be needed. Institutional investors own roughly 2-3% of all homes nationally but hold over 20% in hot markets like Houston and Phoenix.

📉 Movin’ Out: U.S. apartments recorded net move-outs in Q4 for the first time in three years, according to RealPage, as 40,400 units lost demand. Effective rents fell 1.7% with 23% of properties offering concessions averaging 7%.

🏘️ Middle Market: Mid-tier multifamily outpaced luxury in Q4 as three-star properties posted 0.5% rent growth versus negative 0.2% for high-end assets. Luxury oversupply persists with four- and five-star units comprising 70% of the construction pipeline.

🏢 Office Divide: Office REITs maintained 85.3% occupancy in Q3 versus 80.8% for broader markets, as high-quality properties retain tenants and fill vacancies faster. Active REIT fund managers increased office allocations 2.1% YoY despite negative 14% sector returns.

⚖️ $372M Ponzi Bust: The SEC has charged Drive Planning executives with running a $372 million Ponzi scheme promising 10% semiannual returns on fake bridge loans. Executives allegedly spent millions on jets and yachts while repaying $155 million to early investors.

🏆 TOP STORY

CANNABIS LOUNGES ARE HERE, BUT THE OUTLOOK IS HAZY

Cannabis lounges are getting regulatory approval in a growing number of states, creating new demand for retail real estate in an unlikely sector. Massachusetts became the 13th state to green-light social consumption in December, joining California and others in what's become a regulatory wild west with vastly different rules, profit models, and failure rates.

The regulatory framework creates three permit types: supplemental on-site consumption for existing dispensaries, permits for non-dispensary consumption venues, and event organizer licenses. For the first five years, permits go exclusively to social equity program participants from communities disproportionately impacted by marijuana prohibition.

The Massachusetts market is struggling, not surging. Thirteen retail licenses were surrendered, revoked, or not renewed in fiscal 2025 — up from nine the prior year. Average prices for an eighth-ounce of cannabis flower collapsed from $45 four years ago to $14.20 today, suggesting oversupply and margin pressure that lounges may not solve.

Real estate challenges compound operational hurdles. Cannabis retailers face limited zoning options, federal loan restrictions blocking major landlords, and premium rents for dispensary-zoned properties. Well-capitalized operators like Stem in Haverhill, Massachusetts, can navigate these costs, but smaller equity participants lack the square footage and capital to build viable lounges.

Watch California for what works and what fails. California lounges faced 50-60% turnover rates despite 2024 reforms allowing retail, live music, and food service. The viable lounge models will emerge from California's shakeout while Massachusetts municipalities decide between restrictive zoning frameworks and more permissive approaches that allow revenue diversification.

President Trump's December recommendation to reschedule marijuana from Schedule I to Schedule III could allow retailers to deduct rent, payroll, and marketing costs from federal taxes for the first time — potentially providing meaningful cash flow relief for lounge operators.

THE BOTTOM LINE

For now, cannabis lounges offer limited upside as real estate tenants, given their unproven economics. Opportunities favor existing dispensaries with excess square footage over speculative builds, while the potential federal tax deduction matters more to cash flow than lounge revenue in the near term. We will learn a lot from how approved states navigate this terrain, even if the first Massachusetts lounge likely won't open for 12 to 18 months as municipalities decide whether to allow them locally.

📩 YOU’RE INVITED

MASTERING CAPITAL PROTECTION: FREE WEBINAR

Rule #1: Don't lose money.

Rule #2: Don't forget Rule #1.

Too many real estate investors learned this the hard way over the past few years. The macro environment crushed multifamily equity deals that looked great on paper. In private real estate, protecting your capital is the entire game, and monthly distributions are the reward for playing it right.

📆 Join us January 15 at 1 pm ET for this free webinar alongside the co-founders of Property Llama to learn their framework for protecting capital, how to analyze loan portfolios to avoid problems before they happen, and why private credit outcomes are predictable, while multifamily equity outcomes depend on everything going right.

What you’ll get out of this session:

✅ The Private Lending Advantage — Why private real estate credit delivers more predictable outcomes than equity investments, with substantially less variance in returns

✅ Capital Stack Protection — What truly protects your investment beyond just LTV ratios, including collateral quality, ease of workout scenarios, and why being first in the capital stack changes everything

✅ Reading Loan Portfolios Like a Pro — Property Llama's step-by-step process for evaluating lending opportunities and how to "crack the loan tape" to analyze loan portfolios the way institutions do

✅ Track Record vs. Pro Forma Analysis — Why investing in existing lending operations with proven performance data is fundamentally superior to evaluating equity deals based on projections

Property Llama's last fund returned 21.28%+ in cash in 2025, paying out over $2 million in distributions, and not losing a single dollar on over 100+ loans made.

Can’t make it to the live event? Register anyway, and we’ll send you the replay.

💰 CRE TRENDS

OFFICE LEASING IS PICKING UP STEAM

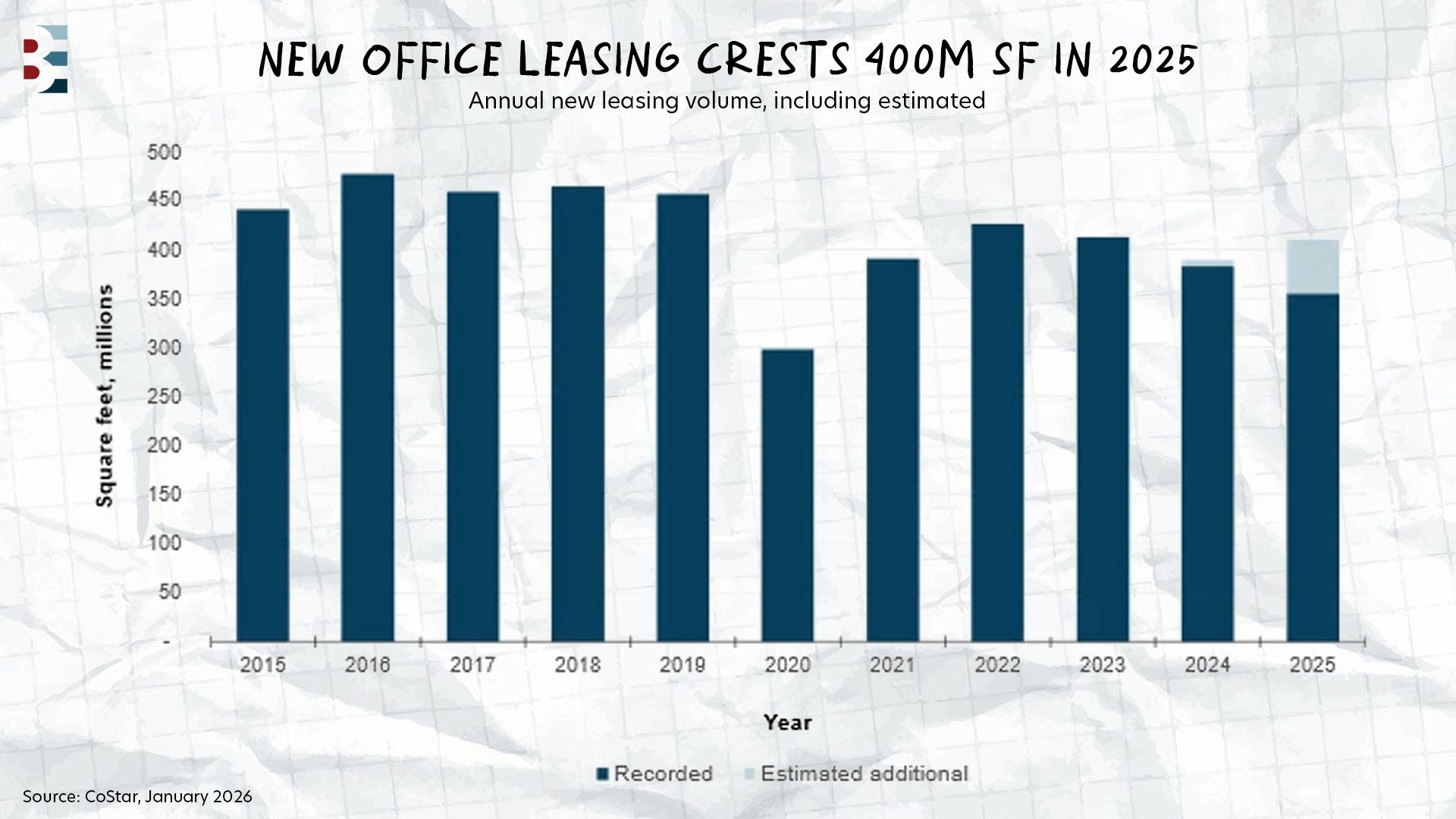

U.S. office leasing activity climbed 5% in 2025 to 410M SF after hitting a 15-year low in 2024, according to CoStar. The market closed with three consecutive quarters exceeding 100M SF — the first time that's happened since early 2022.

Boston led all markets with 52% YoY growth, pushing annual volume back to pre-pandemic five-year averages. San Jose and San Francisco followed with 40% gains, while Seattle, Atlanta, Houston, and Philadelphia saw declines.

Deal volume tells a different story than square footage. Transaction activity hit near all-time highs at roughly 30,000 lease deals in 2025, but average lease size dropped to 3,500 SF — more than 15% smaller than the five-year pre-pandemic average of roughly 4,100 SF.

The recovery remains incomplete. Despite 2025's rebound, leasing activity hasn't returned to late-2010s levels. The data reflects only new leases executed during 2025, including estimated deals not yet recorded, and excludes renewals.

Tech markets are driving growth. The 40% jump in San Francisco and San Jose points to AI companies expanding office footprints in traditional tech hubs, creating a geographic split between markets benefiting from AI investment and those still working through pandemic-era contraction.

The data suggests office demand is stabilizing around smaller footprints rather than returning to pre-pandemic norms, with tech markets creating a two-tier recovery as AI-driven growth concentrates in coastal hubs.

💡BEST EVER RECOMMENDATION

MEET BRIEFCASE: SHARP CRE INSIGHTS, ZERO FLUFF

💼 Briefcase is the real estate newsletter for people who want the truth about housing, but served with a wink and a sharp elbow.

Briefcase skip's the beige “rates did a thing” recaps and digs into the undercovered stories that actually move markets: policy landmines, developer drama, lender shenanigans, and the quiet structural shifts rewriting entire neighborhoods while everyone’s arguing on X.

🌶️ If you like your insights crisp, your takes a little spicy, and your real estate news free of corporate lullabies, sign up below, and we promise your group chat will get smarter overnight.

🎙️ THE BEST EVER CRE SHOW

THE SHOPPING CENTER REPOSITIONING PLAYBOOK

Micah Lacher has spent 16 years buying distressed shopping centers. His firm, Anchor Investments, sources 90% of deals off-market by targeting second-generation owners who inherited properties from their parents and stopped reinvesting in maintenance years ago.

These centers follow a predictable decline. The anchor tenant leaves. The owner doesn't want to spend the time or money to attract a replacement. Without the anchor driving traffic, service tenants struggle. The barber shop closes. The nail salon follows. Eventually, the center sits half-empty with deferred maintenance — leaking roofs, overgrown landscaping, faded paint — in an otherwise strong neighborhood.

That's when Lacher steps in with a strategy — which he shared on the Best Ever CRE Show this week — that comes down to understanding what actually drives retail:

Anchor economics drive everything. TJ Maxx and Burlington accept lower rents because they know what they bring: foot traffic that lets you charge service tenants $20-30 PSF. Grocery stores deliver two to three weekly visits, which makes the taco shop next door worth twice what it would be as a standalone.

Medical conversions solve two problems at once. Doctors need parking and visibility, not prestige addresses. Shopping centers deliver both at rates well below medical office buildings. Better yet, medical tenants drop serious capital on buildouts and sign long leases, turning distressed retail into cash-flowing stability.

Omni-channel retail is rewriting the rules. One of Lacher's Birmingham tenants runs 30,000 SF as both a department store and an eBay fulfillment center. The store's staff packs and ships online orders between helping walk-in customers. The tenant chose retail over warehouse space because the rent was lower, and the online operation now generates 30-40% of revenue.

Lacher's thesis is simple: Retail with good bones in strong demographics trades at discounts that absorb million-dollar renovations. You just need to find owners who've given up before the neighborhood did.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless