- Best Ever CRE

- Posts

- 🚀 Crypto just got one step closer to CRE

🚀 Crypto just got one step closer to CRE

Plus: The 'revenge tax' fails, Gen Z speaks, multifamily holds its own, and much more.

👋 Happy Sunday, Best Ever readers!

In today’s newsletter, crypto inches closer to real estate, the “revenge tax” fails, Gen Z speaks, multifamily holds its own, and much more.

🎙️ Also, ICYMI: We had a stellar week on the Best Ever CRE Show, releasing podcasts featuring Ken Gee, Ben Fraser, Kevin Bupp, among others. Listen here for those interviews and much more.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🚫 Tax Scrapped: Congressional Republicans have agreed to remove the controversial "revenge tax" from Trump's tax bill after Treasury Secretary Scott Bessent struck a G7 deal exempting U.S. companies from global minimum taxes, calming Wall Street fears about foreign investment.

🏠 Affordability Crash: Harvard's 2025 housing report shows home prices up 60% since 2019, requiring $126,000 annual income for mortgage payments. Meanwhile, homeownership dropped to 65.6% in 2024, the first decline in eight years, falling further to 65.1% in Q1 2025.

📱 Gen Z Speaks: A recent poll shows that 72% of Gen Z’ers say renting is financially smarter than buying, with 83% using rental savings for travel and career development, while 63% prefer tech-first leasing experiences over traditional property management.

🛍️ Mall Revival: Class A malls bucked decline trends with 1.7% foot traffic growth in 2024 and steady 94% occupancy, while Class B properties dropped 580 basis points to 90% occupancy as retailers consolidate to higher-quality locations.

⚽ World Cup Prep: Dallas leads the nation's hotel construction pipeline with 203 projects totaling 24,000 rooms ahead of hosting nine World Cup matches next year, when an estimated 150,000 hotel rooms will be needed over one month.

🏆 TOP STORY

FHFA ORDERS FANNIE, FREDDIE TO CONSIDER CRYPTO

Crypto may finally be coming to real estate. This week, the Federal Housing Finance Agency ordered Fannie Mae and Freddie Mac to include cryptocurrency holdings when evaluating borrowers for home loans, opening the door for a significant shift toward mainstream acceptance of digital assets in real estate.

The directive supports President Trump's vision of America as the "crypto capital of the world." Like volatile stocks, crypto would likely be discounted to account for potential price swings. And while the FHFA's directive applies only to single-family mortgages, CRE investors are watching closely, as it could set a precedent for broader crypto integration across property markets.

Crypto Creeps In: Miami developers Rilea Group completed a $529,000 bitcoin condo sale in April, while multiple investment vehicles have launched recently, including SteelWave's $500 million tokenization fund and Grant Cardone's real estate-bitcoin hybrid fund. Deloitte predicts $4 trillion of real estate will be tokenized by 2035.

Future Integration: Industry experts envision Bitcoin and digital assets evolving beyond risk assessment to become integral transaction components, potentially serving as collateral for down payments while blockchain technology streamlines property transactions through enhanced transparency and efficiency.

Implementation Hurdles: Significant challenges remain, including Bitcoin's inherent volatility, which requires sophisticated analytical tools and standardized evaluation methods, plus the need for robust security protocols and consumer protection measures as regulatory frameworks continue evolving.

THE BOTTOM LINE

Crypto's wild price swings have historically spooked traditional lenders, but the FHFA's directive signals policy evolution that may lead to clearer rules that could unlock broader crypto adoption. So, like with most potentially seismic policy shifts, many investors will be watching from the sidelines, waiting to see how early crypto deals pan out before jumping in themselves.

💰 CRE TRENDS

THE STATE OF MULTIFAMILY

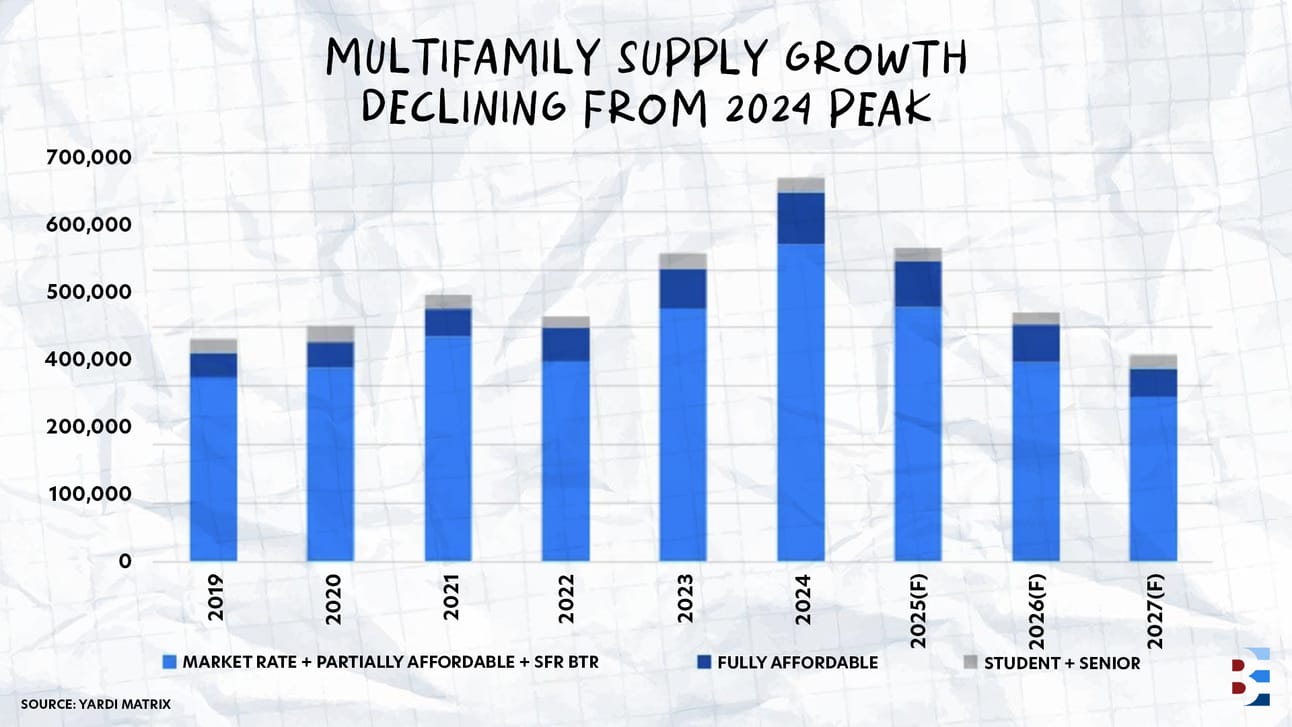

The U.S. multifamily market appears to be holding its own despite headwinds, according to Yardi Matrix’s latest Multifamily National Report. Oversupply is beginning to wane with 536,000 units expected to deliver in 2025 following a record 663,000 completions in 2024, while construction starts decline due to high financing costs and policy uncertainty. National rent growth remains modest at 1.5%, setting the stage for recovery beginning in 2027, though the path varies by region.

Sun Belt metros like Austin, Charlotte, and Nashville have expanded their multifamily inventories by over 30% since 2020, creating significant oversupply that continues to pressure rental markets.

Northeast and Midwest markets with limited new supply are posting the strongest rent gains, led by New York (5.7%), Kansas City (4.0%), and Philadelphia (3.4%).

High-supply markets continue to experience rent declines as new inventory outpaces demand, with Austin (-5.2%), Denver (-3.5%), Phoenix (-3.4%), and Orlando (-1.8%) leading losses.

Construction starts have dropped nearly 50% from recent peaks, with new supply projected to bottom at 350,000 units in 2027.

Despite various headwinds and policy uncertainty around tariffs and immigration, the multifamily sector's strong fundamentals position it for steady recovery, with rent growth forecast to reach 2.7% in 2027 and stabilize at 3-3.5% by 2028 as supply normalizes and markets rebalance.

🎙️ BEST EVER VOICES

BUILDING RELATIONSHIPS THAT SURVIVE TOUGH TIMES

In a recent conversation on the Legacy Builders podcast with Kyle McGee, our own Joe Fairless — co-founder of Ashcroft Capital with $2.8 billion AUM, if you haven’t heard — shared how his business partnership has not only survived through the recent market turbulence, but strengthened.

"When things get tough,” Joe says, “you either grow tighter together or you grow apart.” He went on to highlight that this principle applies whether you're managing investor relationships, partnerships, or team dynamics.

Here are some of Joe’s tips on how to lead — and how to strengthen relationships — during turbulent times:

Reframe Challenges as Opportunities: "You grow on the last rep when you're pumping iron,” Joe says. With that in mind, he suggests viewing market pressure as a strength-building opportunity rather than an obstacle.

Start Difficult Conversations with Mutual Purpose: Before addressing disagreements, establish what all parties want to achieve together.

Avoid the "Attack and Nitpick" Trap: During stress, resist micromanaging or blaming others. Instead, focus on solutions and support.

Maintain Empowering Internal Dialogue: Choose thoughts like, “This will make us stronger" over "this sucks" or "woe is me."

Focus on Your Current Portfolio: Prioritize immediate action items like refinancing floating-rate loans and streamlining operations rather than getting distracted by external market noise.

"You have to go through it either way,” Joe says. “So you might as well have empowering [thoughts] so that you can grow and get better as a result." For CRE investors facing today's market volatility, the question isn't whether challenges will come — it's whether you’ll merely survive the turbulence, or emerge stronger.

🎓 BEST EVER TIPS

AVOID THIS SILENT DEAL KILLER

REQUIRE AN ESTOPPEL URGENCY CLAUSE IN YOUR LEASE

Estoppels are silent deal killers. These tenant certificates confirm lease details, and lenders won't close without every single one. National tenants drag this out for months through attorney reviews, turning smooth closings into nightmares.

In his recent book, Value Over Volume, investor Tanh Truong urges investors to always include language requiring tenants to return estoppels within 30 days, with potential default beyond 45 days. Without this clause, you're at the mercy of slow corporate machines while your closing gets pushed out. Start requesting estoppels immediately after signing your purchase agreement. Many deals die because investors underestimate how long these "simple" confirmations actually take.

📚 For more tips and stories like these, Value Over Volume is available now.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless