- Best Ever CRE

- Posts

- 👵 One class of renters is exploding. Here's why.

👵 One class of renters is exploding. Here's why.

Plus: The debt mountain grows, LIHTC struggles, and raising capital takes longer than ever.

👋 Happy Sunday, Best Ever readers!

In today’s newsletter, renters get older, the debt mountain grows, LIHTC struggles, and raising capital takes longer than ever.

💰 Are you looking for high-quality investors ready for their next deal? Ask us about the Best Ever Signature Sponsorship, a premium, performance-backed campaign that puts your brand in front of serious, high-net-worth investors actively looking for their next opportunity.

📫 Contact us today to learn more.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

💰 Debt Mountain: Commercial and multifamily mortgage debt rose to $4.81 trillion in Q1 2025, up 1.0% quarterly. Multifamily debt increased $19.9 billion while CMBS led growth with $16.2 billion added, despite softer lending activity.

🏗️ Construction Crash: Multifamily construction starts plunged 30% in May to 316,000 units, the lowest since November 2024. Despite the decline, permits rose 1.4% monthly and 13% annually, suggesting an uptick in future activity.

📉 Office Caps: Office cap rates fell 10 bps to 7.34% in recent months while loan volumes surged 123% compared to February. Most sectors saw cap rate compression except hospitality, which rose to 7.95% amid mixed interest rate movements.

🏠 LIHTC Struggles: High apartment supply is creating competition between market-rate and affordable housing operators as filtering pushes rents down, with income-restricted housing struggling against similarly priced market units that require less paperwork.

📊 Reality Check: RealPage economists' 2025 predictions showed varied accuracy through May, with inflation declining to 2.4%, as expected, while consumer sentiment unexpectedly weakened. Job and wage growth matched forecasts, while tariff volatility created unforeseen stock market impacts.

🏆 TOP STORY

HOW SENIORS ARE RESHAPING U.S. RENTAL DEMAND

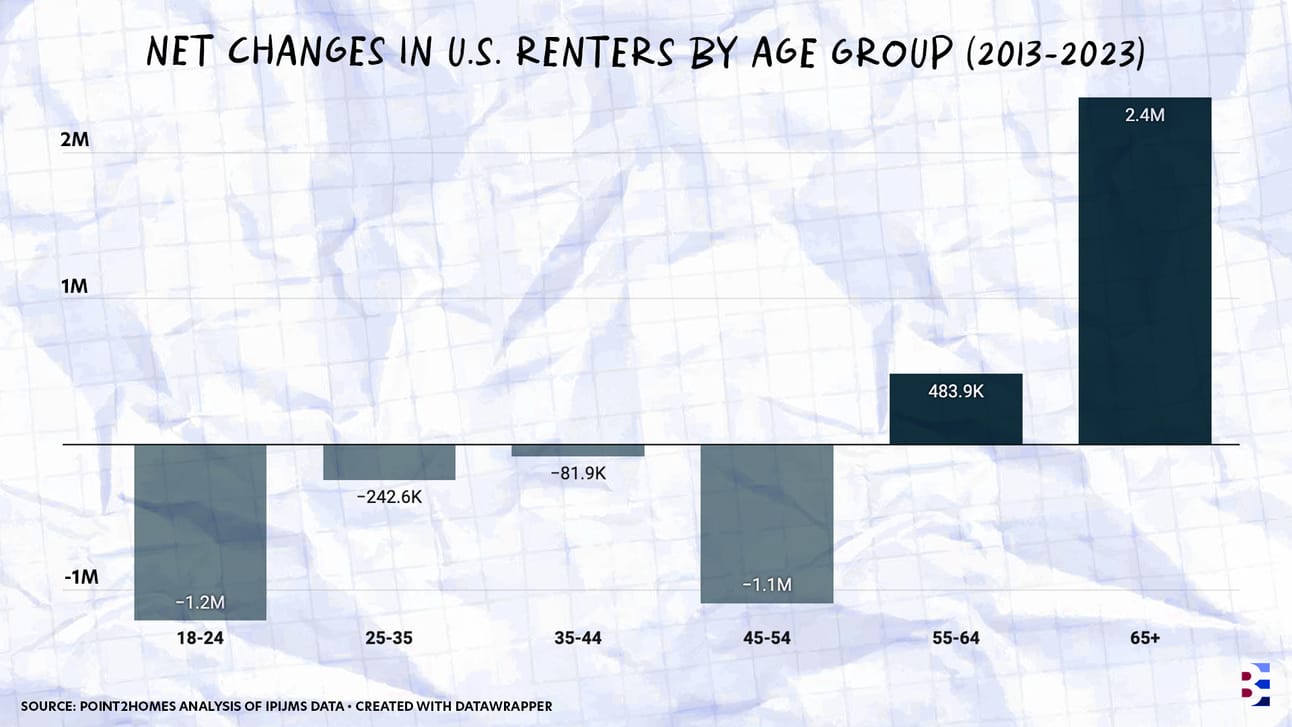

Americans aged 65 and older have become the fastest-growing segment of renters, adding 2.4 million renters over the past decade. This nearly 30% increase far outpaces any other age group and signals a fundamental change in how seniors approach housing.

Geographic Hotspots: Southern cities dominate growth, with Baton Rouge leading at 89% growth in 65+ renters, followed by Jacksonville (84%) and Austin (82%). Florida cities claim the highest senior renter concentrations, with North Port-Sarasota-Bradenton at 21.3%.

Single-Family Preference: House rentals among seniors jumped 25% over the decade, with cities like Omaha, Dallas, and Austin seeing 100%+ increases. This reflects seniors’ need for space for hobbies, guest rooms for family visits, and quieter neighborhoods without ownership commitments.

"Baby Chasing" Migration: Many seniors are following adult children to new markets, combining family proximity with downsizing benefits and escape from homeownership burdens like property taxes and maintenance costs.

While senior renters surged, all younger age groups have declined. Adults aged 25-34 saw a 1.1% drop despite making up 27% of all renters, and those 24 and under declined by 9%.

THE BOTTOM LINE

This demographic shift creates significant opportunities, particularly in Sunbelt markets experiencing sustained senior demand growth. However, since seniors increasingly prefer single-family rentals, the trend suggests potential advantages for build-to-rent communities and properties with age-friendly amenities like accessible design and healthcare proximity.

🌎 SPONSORSHIP OPPORTUNITIES

INTRODUCE YOUR BRAND TO THE BEST EVER AUDIENCE

Introducing the Best Ever Signature Sponsorship — a premium, performance-backed campaign that puts your brand in front of serious, high-net-worth investors actively looking for their next opportunity.

Our community includes 47,000 newsletter subscribers, 100,000+ monthly podcast downloads, and 20,000+ social media followers.

👉 What's included in the Signature Sponsorship?

1 Webinar

1 Dedicated Email

4 Newsletter Header Ads

30 Days of Podcast Ads

3 Performance Guarantees

👉 Check out the full Sponsorship Deck here with further details. Sponsorships are now available for August!

💰 CRE TRENDS

RAISING CAPITAL IS TAKING LONGER THAN EVER

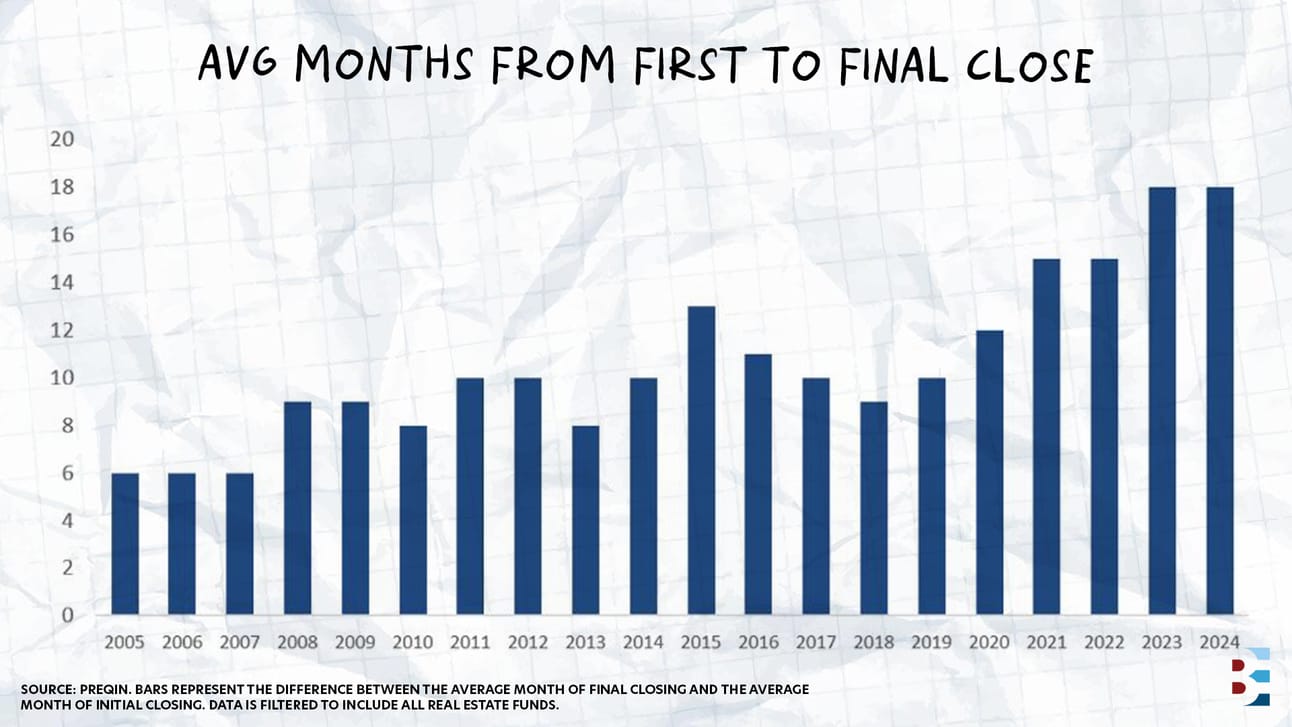

It's no secret that interest rate uncertainty, mounting inflation, and a slew of other factors have made raising capital more difficult than ever. But data is beginning to show us just how difficult fundraising has been.

Record Timelines: CRE funds are experiencing their toughest environment in 30 years, with periods doubling from nine months during the Global Financial Crisis to 18 months today, according to Preqin data.

Even Worse: Financial data provider PitchBook’s analysis paints a picture even more bleak, as it shows funds taking a record 21.8 months to close in 2024, a 65% increase from historical averages.

Capital Collapse: Total capital raised plummeted to $85.8 billion in 2024, down from $241.7 billion in 2022, according to PitchBook.

Flight to Quality: 87.4% of successful fund closes came from experienced managers, the highest percentage in over a decade.

The fundraising drought stems from what PitchBook analysts describe as a perfect storm of challenges, noting that real estate showed the worst performance among all private capital strategies they track. Whether this is the new normal or something investors will have to weather remains to be seen. Either way, record timelines are a very real challenge every GP faces in 2025, and will for the foreseeable future.

🎙️ BEST EVER PODCAST

VET OPERATORS LIKE A PRO: A THREE-PILLAR SYSTEM

After 16 deals as a GP and 28 as an LP, Matt Picheny — a Tony Award-winning Broadway producer (I know, right?) turned multifamily GP — has developed a systematic approach to evaluating syndication opportunities. Matt joined Pascal Wagner on the Best Ever CRE Show this week to share his three-pillar framework that can help investors separate seasoned professionals from dangerous amateurs.

Pillar 1: The Operator — Track record matters, but don't automatically dismiss first-time operators. Instead, look for experienced partners with material participation in the deal. "When you get on an airplane, there's going to be a guy who it's going to be their first time as the co-pilot," Picheny notes. "I want to make sure that somebody on the team who's actually running the day-to-day has experience."

Pillar 2: The Market — Evaluate population growth, job growth, and historical performance data for the specific submarket. Experienced operators should provide detailed market analysis, not just surface-level statistics about the broader metro area.

Pillar 3: The Deal Structure — Examine the underwriting assumptions, debt structure, and business plan. This is where many operators reveal their inexperience through unrealistic projections or poor capital structuring.

Picheny's Secret Weapon: "Get on a phone call and really talk through the deal itself," he says. Ask detailed questions about their assumptions, rent growth projections, and exit strategy. Inexperienced operators quickly reveal themselves when they can't explain their own underwriting.

Red Flag Responses: If an operator won't get on the phone, acts defensive about questions, or can't articulate their investment philosophy and values, walk away. "If the GP won't get on the phone with you, don't invest in their deal," Picheny says.

🎓 BEST EVER TIPS

THE PORTFOLIO MISTAKE EVEN SEASONED LPs MAKE

STRATEGIC DEBT VS. EQUITY ALLOCATION

Most passive investors default to equity positions without considering their actual needs. The sophisticated approach? Match your capital stack position to your income timeline. Use debt investments when you need consistent monthly cash flow — you get paid first, receive regular distributions, and sleep better at night. Reserve equity positions for when you can afford to wait for upside and handle volatility. This strategic allocation transforms your portfolio from a collection of random bets into a purposeful income-generating machine that works whether markets go up or down.

💰 For more tips like these, download the FREE replay of our most recent webinar with passive income expert Pascal Wagner.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless