- Best Ever CRE

- Posts

- ☀️ How this all-solar town cracked the development code

☀️ How this all-solar town cracked the development code

Plus: Construction surges, rents rise, investors chase cash flow, and much more.

Together With

👋 Happy Sunday, Best Ever readers!

In today’s newsletter, an all-solar community thrives, construction surges, rents rise, investors chase cash flow, and much more.

Today's edition is presented by Aspen Funds. Aspen's latest oil and gas fund is targeting 29% cash-on-cash returns and an 8.83X equity multiple, with a $50,000 discount on the investment minimum for Best Ever readers. Learn more today.

⚡ Also … join us on Sep. 23 at 2:30 pm EST for Understanding the Energy Crisis — an expert session to learn about what’s really going on in the energy sector and why some of the smartest investors are moving back into oil and gas.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🏗️ Construction Surge: The Dodge Momentum Index jumped 7.5% in August, capping a 51% surge in construction planning over 12 months driven by data centers, warehouses, and hotels despite elevated costs and tariff uncertainty.

📈 Rents Rebound: Multifamily rents climbed 2.6% YoY to $1,790 in August, marking the strongest gains in over two years as construction plummeted 45.4% to 385,000 units. Chicago led with 10.7% rent growth, while Austin recorded 3.1% declines.

🏘️ East Coast Bias: All Mid-Atlantic multifamily markets posted positive rent growth between 1.5-3.5% and occupancy above 95% in Q2, led by Hampton Roads and Richmond with 6% and 5.9% five-year average growth, while Washington commanded the highest rents at $2,240 per unit.

📦 Small Bay Shortage: Philadelphia tenants are clamoring for shallow-bay warehouses under 50,000 SF, but elevated construction and land costs prevent new spec development despite 9% YoY rent growth, the highest among nine markets analyzed by CompStak.

💰 Rising Caps: Multifamily investors remain selective despite opportunities in job-growth markets, with median cap rates rising to 6.36% and properties taking 152 days to sell vs. 146 days last year as price discovery continues amid shortages.

🏆 TOP STORY

WHY DEVELOPERS ARE STUDYING THIS ALL-SOLAR TOWN

While traditional developers chase individual projects, a new breed of master-planned communities is creating integrated ecosystems that generate multiple revenue streams across decades. Babcock Ranch, America's first solar-powered town, shows how visionary developers are building captive markets for commercial real estate while attracting ESG-focused capital and climate-resilient tenants.

Located 20 miles from Fort Myers, Babcock Ranch has grown from zero to 15,000 residents since 2018, with plans for 60,000 people and 6M SF of commercial space. The community's integrated approach combines residential development with utilities, infrastructure, and commercial real estate to create what founder Syd Kitson calls "the most resilient community in Florida."

🌱 ESG Delivers Real Returns, Not Just Good PR: The community generates more clean energy than it consumes through an 880-acre solar field, while all homes meet the Florida Green Building Coalition Bronze Standard certification. This isn't just feel-good marketing — it's creating measurable economic advantages. Residents report electricity bills "half the cost" of comparable homes with "double the square footage," while the community never lost power during Hurricane Milton despite 3.3 million Floridians going dark.

⚡ Climate Resilience Drives Premium Demand: Babcock Ranch's infrastructure advantages go beyond solar power. Underground power lines, Smart Pond systems that automatically adjust water levels based on weather forecasts, and buildings rated for 150 mph winds create a fortress-like environment that appeals to risk-conscious tenants and residents. The community served as an official hurricane shelter, housing 2,000 evacuees during Milton.

🏢 6M SF Commercial Pipeline Targets Captive Audience: The development's commercial strategy focuses on creating a complete ecosystem rather than standalone retail. With 60,000 planned residents and extensive recreational amenities, Babcock Ranch will support "an array of shopping, dining, entertainment, recreation, health care, and services" across its planned commercial footprint.

💰 Build-to-Rent Provides Bridge Financing: The community includes rental neighborhoods starting in the mid-$1,000s, creating stable cash flow during the residential build-out phase while allowing potential buyers to test-drive the lifestyle before purchasing homes ranging from the high-$200,000s to over $1 million.

THE BOTTOM LINE

Master-planned communities like Babcock Ranch show how developers can create long-term value through integrated infrastructure, sustainability features, and captive commercial markets. As climate resilience becomes a tenant priority and ESG investing gains traction, communities that solve multiple problems at once may represent the future of large-scale real estate development.

⛽ TOGETHER WITH ASPEN FUNDS

TARGETING 29% RETURNS IN OIL & GAS

Despite record investment in renewables, the world still runs on oil — and demand keeps climbing. Institutional capital has pulled back due to ESG pressure, creating a massive gap in oil production.

Aspen’s Oil & Gas Fund is designed to help you step into this gap and earn:

✅ Proven Monthly Income: Their previous fund delivered six consecutive quarters of 15% annualized cash yield from producing oil wells, and they’re targeting 29% cash-on-cash returns with this current fund.

✅ Selective Growth: Aspen’s expert team carefully invests in new drilling projects with strong upside, balancing stability and opportunity.

✅ Long-Term Wealth: By reinvesting early cash flow, they project an 8.83X equity multiple over 10 years, significantly growing your investment.

⏰ Limited-Time Offer for Best Ever Readers: Minimum investment reduced to $100,000 (normally $150,000).

“We were new to investing in the Oil & Gas sector and quickly found Aspen's approach to be sound. We've been very satisfied with our experience and delighted with the returns thus far.” —Terri S., Aspen Funds Investor

This is your chance to access high-return opportunities once reserved for institutions — without the complexity or risk of operating wells yourself.

P.S. New to oil and gas investing? 📘 Download this quick-start guide to learn how the energy crisis is creating opportunity—and what every investor should know before jumping in.

💰 CRE TRENDS

10 APARTMENT MARKETS DEFYING THE SUPPLY DROPOFF

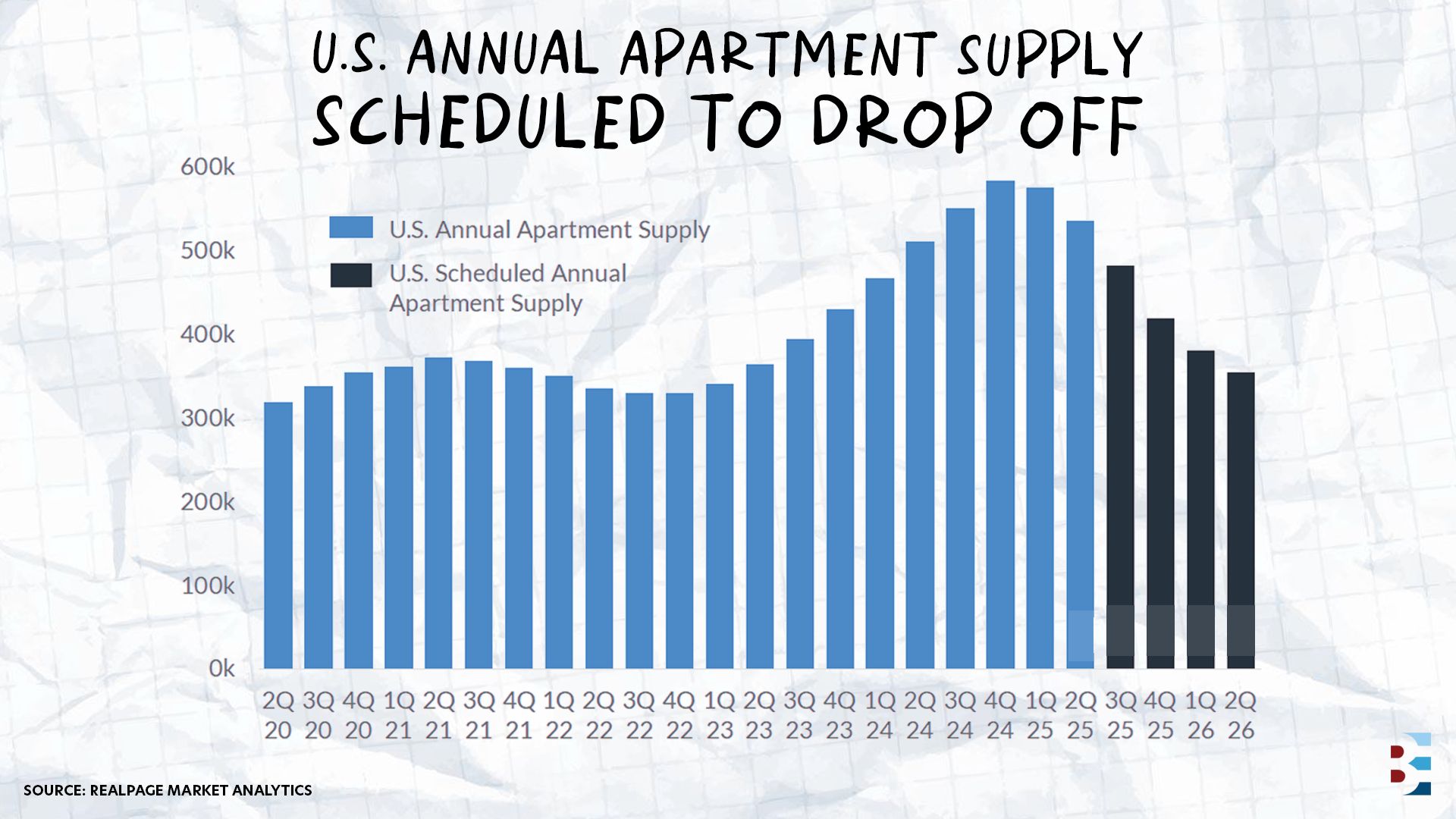

U.S. apartment deliveries are set to drop 33.9% over the next 12 months as developers pull back from the elevated construction volumes of recent years, according to RealPage. This return to normal supply levels will affect most major markets, but 10 of the nation's 50 largest apartment markets are scheduled to see delivery increases.

Los Angeles: 15,540 units (+7,519 units, +93.7%)

Detroit: 3,145 units (+1,373 units, +77.5%)

San Diego: 7,933 units (+3,378 units, +74.2%)

Anaheim: 4,888 units (+2,068 units, +73.3%)

Cincinnati: 3,143 units (+1,011 units, +47.4%)

Fort Worth: 8,059 units (+1,507 units, +23.0%)

Pittsburgh: 1,093 units (+162 units, +17.4%)

Newark: 21,019 units (+2,588 units, +14.0%)

Boston: 7,967 units (+873 units, +12.3%)

New York: 25,266 units (+1,249 units, +5.2%)

The supply pullback reflects developer caution after years of elevated construction, particularly in previously hot markets like Austin, where oversupply pressured rents. These 10 outlier markets may benefit from more disciplined supply growth nationwide while maintaining their own development momentum through 2026.

📩 YOU’RE INVITED!

WHY SMART MONEY IS MOVING BACK INTO OIL & GAS

📢 The headlines scream "green transition," but oil and gas still power 80% of global energy. And years of underinvestment are creating a supply crisis that smart investors are position to profit from.

Join us on September 23 at 2:30pm ET for Understanding the Energy Crisis: Why Oil & Gas May Be the Most Undervalued Asset Today alongside Ben Fraser, CIO of Aspen Funds, as he reveals why the world's wealthiest investors are quietly moving back into energy and how you can access these high-yield opportunities without the complexity of direct ownership.

What you’ll learn:

✅ The real energy crisis beyond the headlines: What's actually driving today's supply-demand imbalances and why they're likely to persist

✅ The renewable reality check: Why fossil fuels will remain dominant for decades, despite massive green energy investments

✅ Billionaire energy strategies: What ultra-wealthy families and institutions know about energy investing that retail investors don't

✅ Yield generation tactics: Strategies for earning predictable income from energy assets, regardless of commodity price swings

Can’t make it on Sep. 23? Register anyway, and we’ll send you the replay. But please note that only live attendees will get an exclusive Q&A with Ben Fraser.

🎙️ THE BEST EVER CRE SHOW

WHAT INVESTORS WANT: THE SHIFT THAT’S RESHAPING CRE

Matt Faircloth joined John Chang on the Best Ever CRE Show this week to discuss the recent pivot his firm has made away from speculative, appreciation-driven deals toward deals with immediate cash flow. The change reflects how investor psychology has shifted, forcing operators to abandon strategies that delivered big returns tomorrow for deals that pay investors today.

The Old Playbook Doesn't Work Anymore: Faircloth highlighted a property that was purchased for $6 million and sold for $16 million after extensive renovation, generating no cash flow for investors during the entire ownership period.

"That deal would not fly in today's marketplace," he said. "You're not going to be able to raise equity on something like that, nor would I want to take the risk of something like that."

The reason: Today's investors demand 7% to 8% early-stage returns, but with multifamily properties trading at 5.5% to 6.5% cap rates while debt costs approach or exceed those levels, positive leverage is nearly impossible, and immediate cash flow can't be delivered.

The Psychology Shift Driving Change: Faircloth attributes the transformation to broader risk sentiment.

"I think that the world has gotten more risk sensitive overall," he said. "The overall sentiment from investment is way less bull, a lot more bear because of all the things — because of COVID, there's COVID hangover going on, there's interest rate hangover going on."

This shift is forcing operators to abandon C-class value-add strategies entirely and focus on assets generating immediate income.

The transition represents more than tactical adjustment — it signals a return to real estate investing fundamentals where current income matters as much as future potential, fundamentally reshaping how deals are sourced, underwritten, and marketed to increasingly cautious capital sources.

▶️ FEATURED REPLAY

THE TOP 1% SECRET

You know them - the CRE investors and operators who seem to effortlessly land deals, speak at every major conference, and get quoted in industry publications. What do they know that you don't?

They know about a thought leadership strategy that elevates them into the top 1% of CRE professionals - publishing a book 📚

Get instant access to our latest workshop - How to Add 7 Figures a Year in Revenue to Your Business by Publishing a Book - for a clear roadmap to leverage publishing as your secret weapon for deal flow, investor relations, and market dominance.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless