- Best Ever CRE

- Posts

- 😶🌫️ LPs are ghosting GPs. Here's why.

😶🌫️ LPs are ghosting GPs. Here's why.

Plus: Boomers boom, renters move, and one investor saves a deal after his partner dies.

👋 Happy Sunday, Best Ever readers!

In today’s newsletter, LPs flee, boomers boom, renters move, and one investor saves a deal after his partner dies.

🤖 48 hours left to join us for The AI Investor Magnet, a free workshop where you’ll learn Marcin Drozdz's AI-powered system that nurtures thousands of leads into dozens of investors every month. Join us on October 7 at 3 pm ET. Save your spot now!

Capital raising is tougher than ever. That’s why more CRE pros are turning to an unexpected strategy — publishing a book — to attract investors on autopilot. See how you can make this strategy work for you. Watch the workshop today.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🏘️ Boomer Boom: Senior living occupancy rose for the 17th consecutive quarter to 88.7% in Q3 as baby boomers fill communities faster than developers can build, with independent living surpassing 90% occupancy.

🚚 On the Move: Gen Z renters comprise 72% of "hyper-movers" relocating within two years versus 43% of millennials, with Austin leading at over 50% turnover.

🏀 Girl Power: Women's professional sports facilities are attracting hundreds of millions in investment, with WNBA teams building $150 million training centers and women's soccer securing purpose-built stadiums, driving mixed-use development.

🏗️ Counting Cranes: North American crane counts dropped 44% in Q3, with seven cities declining over 20%, though Denver surged 50% on mixed-use projects amid financing constraints and completions.

📊 Buy vs. Build: New research finds development returns peak early in cycles at 22.7% versus 14.4% for acquisitions, while late-cycle development drops to 7.5% as risk increases, suggesting developers should secure land and entitlements earlier.

🏆 TOP STORY

WHERE HAS ALL THE LP MONEY GONE?

There’s a shift in how CRE deals get financed, and if you're a developer, you've probably felt it. Institutional LPs — the pension funds, insurance companies, and sovereign wealth funds that used to reliably show up as equity investors — are ghosting the equity side of the capital stack. They haven't disappeared entirely. They've just found somewhere else to be: on the debt side, where the returns look better and the risk feels more manageable.

It's not exactly a mystery why. Between sky-high interest rates, a stock market that keeps hitting records, and private credit funds promising equity-like returns with less drama, LP equity in CRE is facing some serious competition.

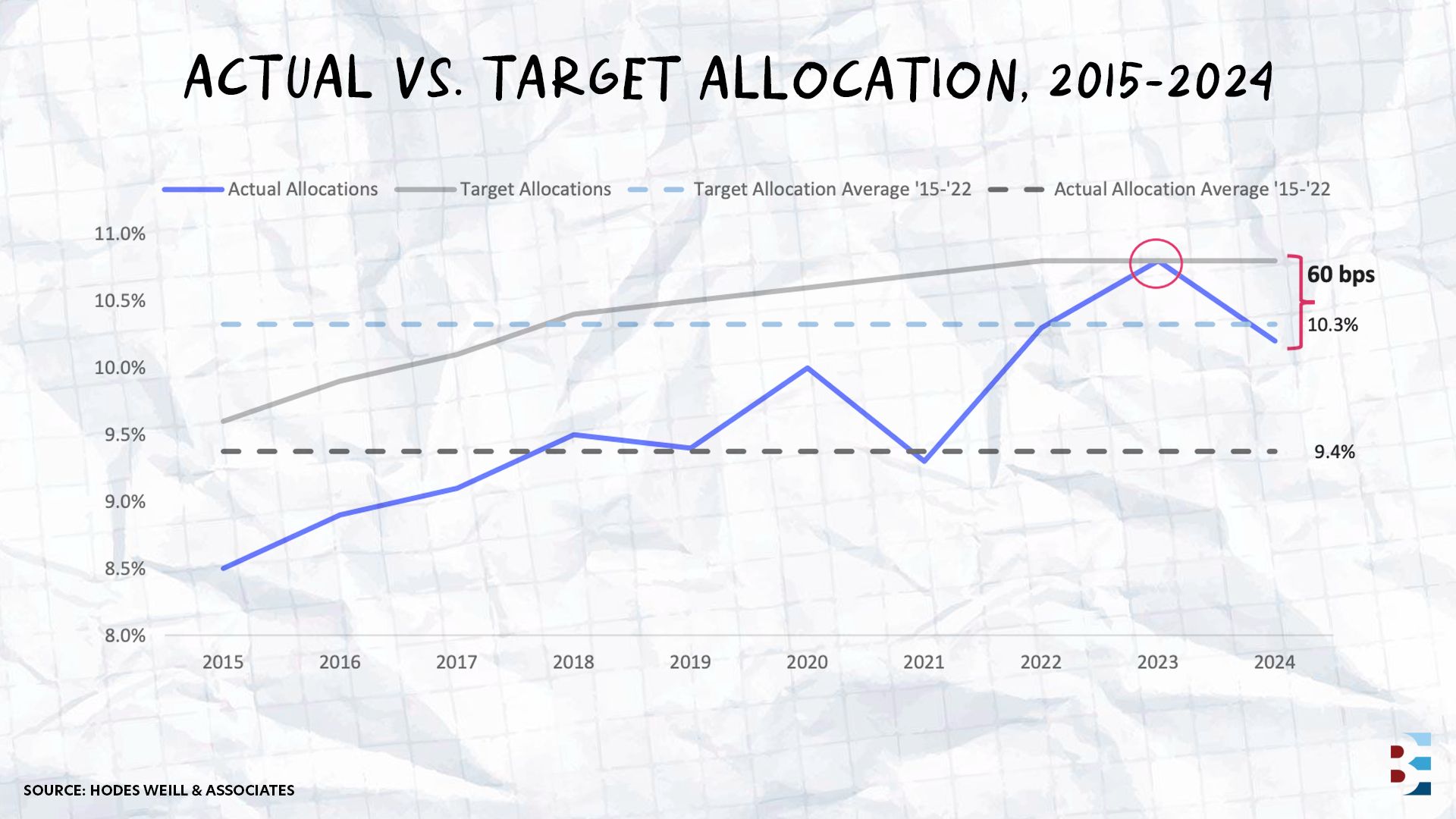

Institutional allocations to real estate dropped 60 bps in just one year — from 10.8% in 2023 to 10.2% in 2024 — even though their target allocations stayed put at 10.8% (see chart above). A year ago, these same institutions were over-allocated. Now they're under. The culprit? Real estate values have declined by 20-25% since mid-2022, while public equities have kept climbing.

What's pulling LPs away from equity:

Private debt funds targeting North American CRE have raised over $20 billion so far in 2025, on track for the second-strongest year on record.

Private debt AUM has more than doubled in a decade, jumping from under $600 billion to over $1.6 trillion by 2023.

About 27% of LPs now rank private credit and debt as their best opportunity, putting it in direct competition with real estate equity.

Interest rates remain the top concern for 85% of institutions, with asset valuations and capital availability close behind.

THE BOTTOM LINE

Deals are still happening, just with different capital structures. Developers are taking on more debt and getting more control in exchange. One industry observer summed it up: LP equity providers haven't left real estate, they've just moved to a different spot in the capital stack. It's a trade-off — higher leverage now, with hopes that the market conditions improve down the line.

🗺️ ON THE MAP

RENTERS ARE MOVING. HERE’S WHERE THEY’RE GOING.

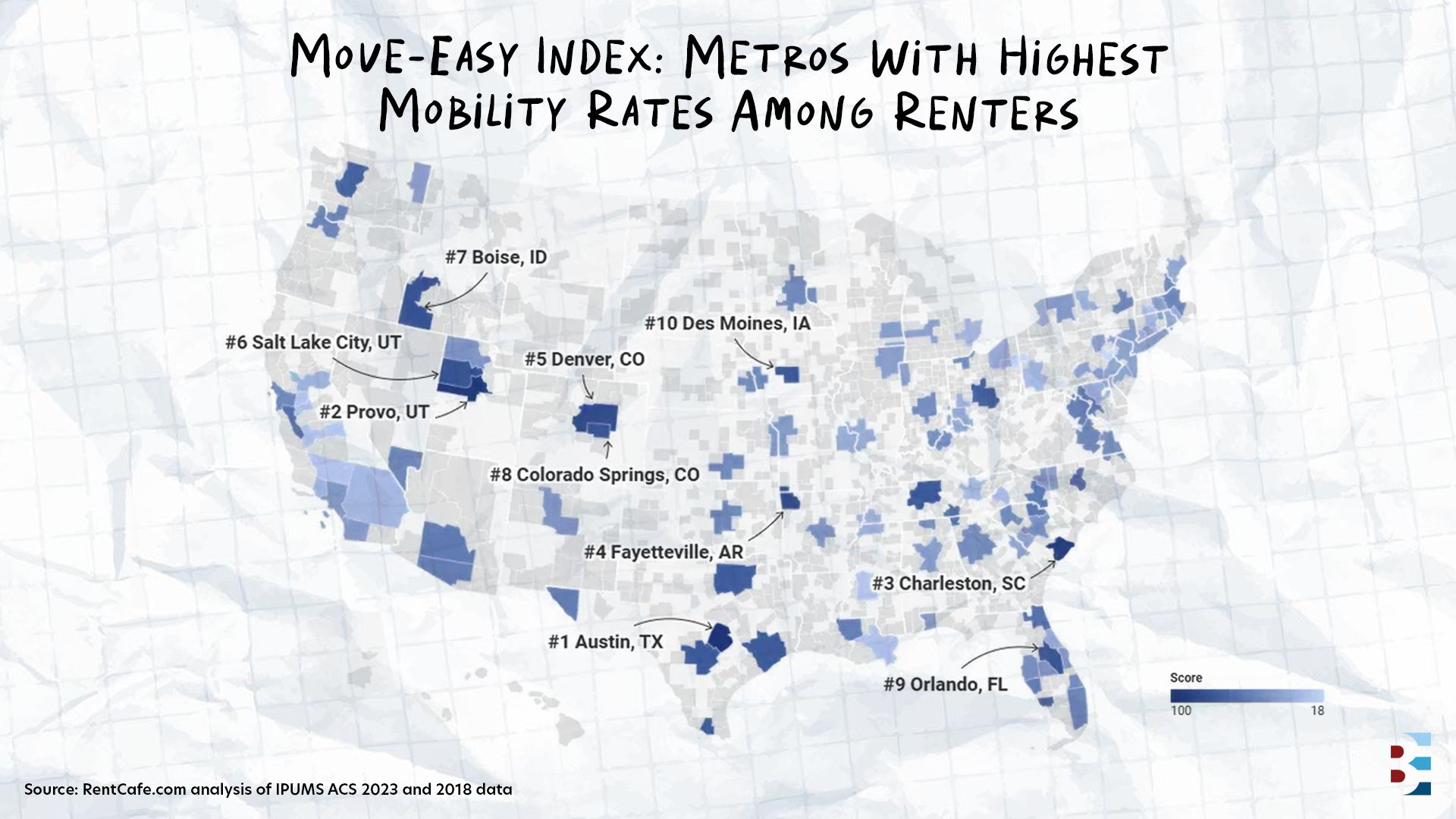

Nationwide, 38% of renters move to a different apartment within two years of signing a lease, making frequent movers the largest group in America's rental housing churn. This trend intensified between 2018 and 2023 as economic swings, pandemic-era housing needs, remote work shifts, and return-to-office mandates drove millions of renters to relocate quickly. Gen Z leads the pack with 72% moving within two years, while 43% of Millennials also change apartments frequently.

The Southeast dominates America's move-easy metros, claiming 12 of the top 30 spots. Notably, Charleston, SC, saw the fastest increase in quick movers nationwide — skyrocketing 43.9% in five years — while the Northeast is entirely absent from the top 30 as supply-constrained renters hold onto apartments once they find them.

Here’s a rundown of the top 10 move-easy metros:

Austin, TX: In Austin, 54% of renters move within two years, fueled by a 32.4% surge in apartment supply that created aggressive leasing incentives, encouraging renters to shop around.

Provo, UT: Provo boasts the highest mobility rate nationally at 60%, driven by Brigham Young University's transient student population and the booming "Silicon Slopes" tech sector.

Charleston, SC: Charleston sees 55% of renters move frequently with the fastest growth nationwide at 43.9%, attracting renters across all generations to the "Silicon Harbor" tech hub.

Fayetteville, AR: Nearly half (48%) of Fayetteville renters move within two years in the nation's hottest small rental market, powered by University of Arkansas students and Northwest Arkansas's economic boom.

Denver, CO: Denver's 53% mobility rate is driven primarily by Millennials, with 60% of this generation moving within two years despite moderate apartment supply growth of just 9.8%.

Salt Lake City, UT: Salt Lake City's 51% frequent mover rate grew 25% between 2018 and 2023 as the emerging AI job hotspot attracted tech workers and university students.

Boise, ID: Boise's mobility rate of 48% surged 38.4% as Gen Z frequent movers nearly doubled to 86% amid the metro's expanding semiconductor and manufacturing industries.

Colorado Springs, CO: Colorado Springs posts the second-highest mobility rate nationally at 56%, driven by military relocations and growing aerospace and tech job opportunities.

Orlando, FL: Orlando's 46% mobility rate jumped 20% between 2018 and 2023, supported by tourism and hospitality jobs alongside 23.7% growth in apartment supply.

Des Moines, IA: Des Moines matches Charleston with 55% frequent movers despite a 10.6% drop in renter population, as Gen Z mobility soared to 82% from just 58% five years prior.

High renter mobility reflects strong local economies and robust apartment construction rather than housing instability. Markets with growing job opportunities, expanding housing supply, and younger populations see the most frequent moves, while supply-constrained metros like those in the Northeast see renters staying put once they secure housing.

🤖 YOU’RE INVITED!

FREE WORKSHOP: THE AI INVESTOR MAGNET

Stop chasing investors. Make them come to you.

Marcin Drozdz has raised nine figures using AI to convert thousands of cold leads into dozens of new investors every month, and he's sharing his exact system in this free workshop — The AI Investor Magnet: Tuesday, October 7, at 3 pm ET.

What you'll learn in this 30-minute session:

✅ AI tools that find investors before they know they want to invest

✅ The "Investor Attraction Algorithm" that categorizes leads by investment capacity

✅ A 3-step trust-building sequence that works before you ever make contact

✅ "Set it and forget it" workflows that nurture prospects around the clock

✅ Why this system works regardless of market conditions or deal type

🎙️ THE BEST EVER CRE SHOW

PARTNER DIES, A CRISIS HITS, AND HE STILL SAVES THE DEAL

David Hrizak was $4 million deep into a multifamily townhome development in suburban Chicago when the 2008 financial crisis hit. Then, his partner died unexpectedly from a heart attack. This week on the Best Ever CRE Show, David joined John Casmon to dive into this deal and discuss how he turned a potential disaster into a profitable exit by leveraging the one asset that mattered most.

David’s project broke ground in 2008 as a build-to-sell townhome development. But as the economy collapsed, home sales froze, people lost jobs, and the project's entire business model became impossible. When his partner passed away amid the crisis, David was forced to lay off his entire staff due to financial pressures, leaving him working 18-hour days, handling everything from on-site construction to office administration.

But he had one critical advantage: a relationship with a small community bank where he could sit directly with the majority owner and CEO.

Here’s what happened next, as David tells it:

"I went to the lender at the time and said, 'Hey, there's an opportunity here to make the bank whole and make myself whole by changing philosophy.' So we were intending to build and sell these townhome units. We just decided to build and put them into a rental pool instead. And the bank went along with that...

“Instead of losing it to the bank and bankruptcy, the bank gave me enough money to complete the project. They rewrote my loan, put it on a low interest with principal and interest amortizing. Ultimately, we rented out all the units. I held that property as an investment for about four more years. Instead of being a two-year flip of construction to completion, we held it for four more years until the market came back and ultimately sold every unit for a profit. The bank was whole, I was whole."

The Lesson: Hrizak could pivot because his lender knew him personally and trusted his judgment. "Any property I wanted to buy or develop, we would have a 30-minute sit-down session and my loan would basically get approved after those 30 minutes," he says.

You hear it all the time: CRE is a relationship business. David’s story is Exhibit A. When the crisis hit, his relationship gave him options that most investors don’t have.

▶️ WATCH THE REPLAY

CAPITAL RAISING FEELING HARDER THAN EVER?

Chasing investors doesn’t scale. That’s why the top CRE professionals publish books — a 24/7 lead magnet that establishes authority and attracts capital.

In this replay, Chandler Bolt (Forbes 30 Under 30) shows you how to:

Draft your book in a weekend (without writing a word)

Launch it to position yourself as the go-to authority

Use it to generate 7-figure revenue streams

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless