- Best Ever CRE

- Posts

- 🏛️ Supreme Court isn’t buying tariffs. What’s next?

🏛️ Supreme Court isn’t buying tariffs. What’s next?

Plus: Risk appetite returns, vacancy hits new heights, Amanda Cruise nets a $420K profit on one mobile home park

👋 Hello, Best Ever readers!

In today’s newsletter, tariffs get scrutinized, risk appetite returns, vacancy hits new heights, Amanda Cruise nets a $420K profit on one mobile home park, and much more.

⏰ TOMORROW: Algorithmic Trading Webinar at 3 pm ET. When your entire CRE portfolio moves in the same direction, you don't have diversification — you have correlation risk. Join us tomorrow to explore how algorithmic currency trading offers returns that move independently of traditional markets. Save your seat.

🔓 Fast-track your capital raising at the Best Ever Pitch Slam. Pitch your deal in front of hundreds of high-net-worth investors ready to deploy capital in a Shark Tank-style competition at Best Ever Conference X. Apply for free today.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

💼 Risk Returns: LP and GP risk appetite is gradually returning as capital allocators engage earlier in deal conversations after prolonged risk aversion. The freeze from late 2022 is thawing, particularly around private credit and preferred equity structures offering yield and downside protection.

⚠️ Fragile Gains: Multifamily operators describe 2025 stability as "hard-won and fragile" despite improved conditions, with insurance premiums jumping 12%-15% while maintenance and labor costs surge. Lenders demand more equity from borrowers, limiting leverage and restraining capital for property improvements.

📈 Delinquencies Rise: Multifamily CMBS delinquencies jumped 53 bps to 7.12% in October, topping 7% for the first time since December 2015 and nearly double the rate from six months ago. Office delinquencies hit an all-time high of 11.76% as overall CRE delinquency climbed to 7.46%.

📍 Sun Belt Slide: Gulf Coast Florida markets lead national rent declines, with Punta Gorda down 6.3% YoY, Naples falling 6.1%, and Fort Myers dropping 5.7%. Sun Belt and West Coast metros face the steepest drops as new supply floods inventories and vacancy rates soar.

🛍️ Holiday Headwinds: Retail faces a challenging holiday season, as Deloitte forecasts just 2.9%-3.4% sales growth — the smallest increase since 2016. Store closures hit 5,822 through June, while seasonal hiring may reach its lowest point since 2009 amid tariff uncertainty and weakening consumer confidence.

🏆 TOP STORY

THE SUPREME COURT ISN’T BUYING TARIFFS. WHAT’S NEXT?

The Supreme Court heard Trump's tariff case yesterday, and justices across the spectrum aren't buying it. Both conservative and liberal justices pressed the administration's argument that emergency powers give the president unchecked authority to impose taxes, a power the Constitution explicitly reserves for Congress.

The case centers on Trump's use of the 1977 International Emergency Economic Powers Act to levy tariffs ranging from 10% to 50% on most U.S. imports, many of which hit CRE hard. Lower courts have uniformly ruled the tariffs illegal. The government argues that they are "regulatory, not revenue-raising," despite Trump repeatedly flaunting the $195 billion in tariff revenue collected this fiscal year — more than three times the previous year.

Here’s what the Justices were saying:

Chief Justice John Roberts: Called tariffs an "imposition of taxes on Americans and that has always been the core power of Congress."

Justice Sonia Sotomayor: "I don't understand this argument. This is a tax." She also highlighted Trump imposing tariffs on Canada over a World Series ad and on Brazil because its Supreme Court prosecuted a former president.

Justice Amy Coney Barrett: Pressed on the refund process if Trump loses, noting "it seems to me like it could be a mess."

Trump appointees skeptical: Both Justices Neil Gorsuch and Amy Coney Barrett asked pointed questions challenging the government's authority, signaling the conservative wing isn't unified behind Trump.

What's at stake for CRE:

Construction costs: Tariffs include 50% rates on steel, aluminum, and copper, plus 10-25% on lumber imports. One in four contractors had projects paused in August, up from one in five in June.

Retail pressure: Carter's is closing 150 stores and laying off 300 employees, blaming tariffs for slimmer margins.

Potential refunds: IEEPA tariffs comprise roughly half of the $195 billion collected — over $100 billion could be refunded if Trump loses.

The decision timeline: Nobody knows. Predictions range from late 2025 to June 2026. Markets are betting against Trump — prediction platforms price his odds of winning at just 36-37%.

If Trump loses: Expect pivot attempts to other tariff authorities, particularly national security provisions. Refunds could ease construction costs and restore supply chain predictability, but the overall trade approach likely won't change dramatically.

If Trump wins: The president gains essentially permanent, unchecked power over trade policy — translation: more volatility, more whiplash, more disrupted dealmaking.

THE BOTTOM LINE

The questioning revealed deep skepticism from justices across the ideological spectrum. A decision won't come for months, but the Court appears poised to curb presidential tax authority. For CRE, that could ease construction cost pressures — though Trump's likely pivot to alternative tariff mechanisms means relief may be temporary. Either way, this ruling will reshape trade policy and its CRE impact for years.

🎉 BEST EVER CONFERENCE

48 HOURS UNTIL PRICES INCREASE

Your real estate portfolio is strong. But when the entire CRE market moves in the same direction — whether it's cap rate compression or rising interest rates — you feel it everywhere at once.

That's the correlation problem.

Join us TOMORROW, November 6, at 3 pm ET, for a deep dive into algorithmic currency trading — a systematic strategy that operates independently of traditional real estate and equity markets.

Here's what we're covering:

✅ The mechanics behind algorithmic trading and why institutional investors are adding it to their portfolios

✅ How to protect your capital with risk management frameworks designed for automated trading systems

✅ Case studies from successful strategies that have generated returns while markets fluctuated

✅ Due diligence essentials: Learn to spot the red flags, scams, and platforms that promise the world but deliver nothing

P.S. Can't attend live? Register anyway — we'll send you the replay so you can watch on your own time.

💰 CRE BY THE NUMBERS

RECORD VACANCY, OUTDOOR STORAGE SURGE, AND MORE

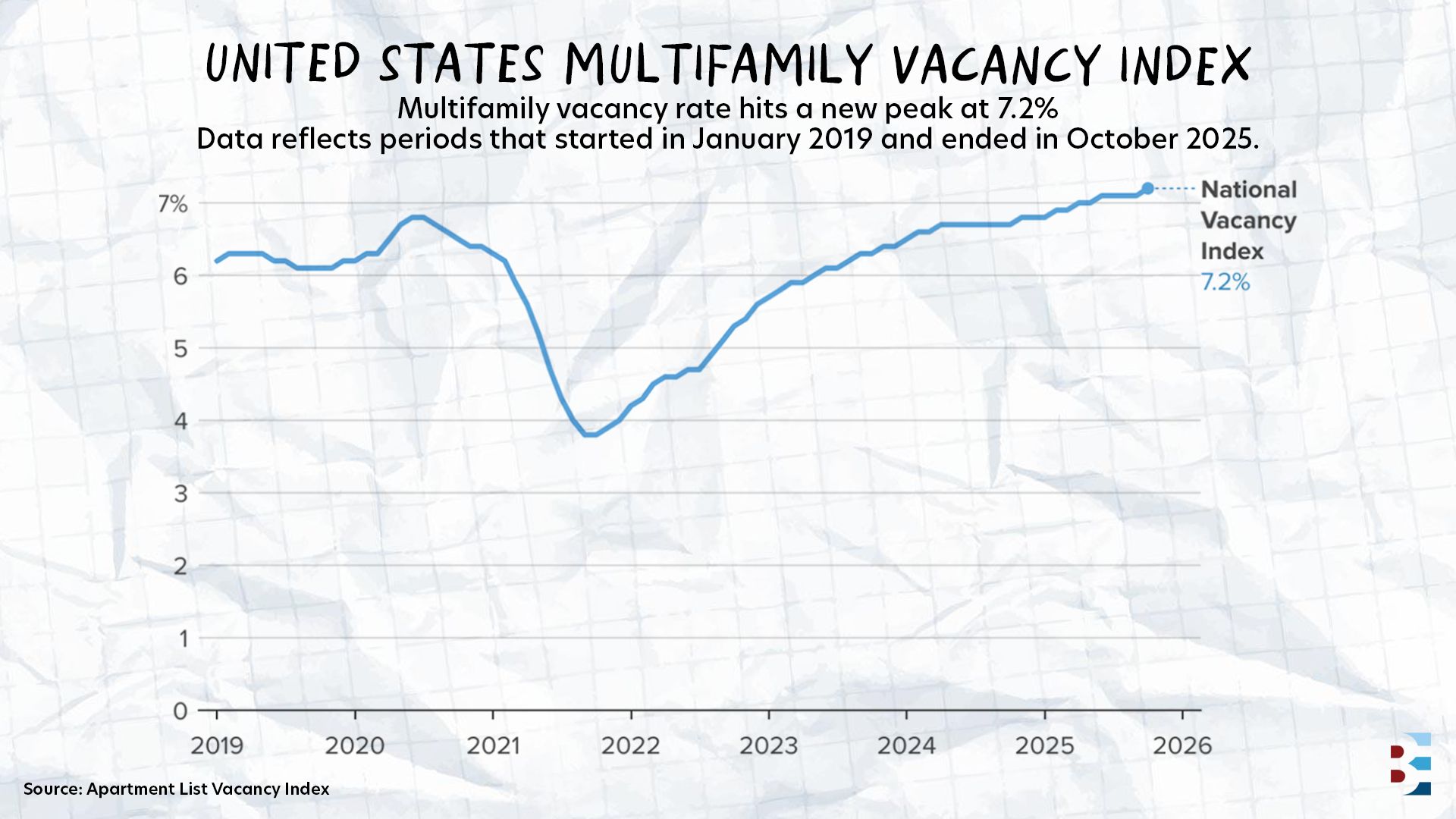

📊 7.2% Vacancy

National multifamily vacancy hit a record 7.2% in October as units took 33 days to lease — one day longer than last year. Rents fell 0.8% monthly and 0.9% YoY, marking the third consecutive month of decline as the market absorbs elevated supply.

💼 $1.8 Billion

Sonida Senior Living agreed to acquire CNL Healthcare Properties for $1.8 billion, creating the eighth-largest U.S. senior housing company with 14,000 units across 153 communities. Senior housing transaction activity reached $13 billion through Q3, up 67% YoY, as occupancy and rents rise fast.

🏭 123% Growth

Industrial outdoor storage rents surged 123% since 2020, delivering twice the rent growth and half the vacancy rate of bulk warehouses. The sector attracted $700 million in institutional capital this year as data center construction drives demand for equipment staging grounds near highways and ports.

🎉 BEST EVER CONFERENCE

FAST TRACK YOUR CAPITAL RAISE AT BEC X

Imagine this: You're on stage. Hundreds of high-net-worth investors are watching. A panel of seasoned LPs (including Joe Fairless) is evaluating your deal in real time.

That's Pitch Slam 2026 at the Best Ever Conference (February 18-20, 2026).

Here's the process:

✅ Apply for free (no cost, no deal required at application)

✅ Video interview if you advance to the next round

✅ Finalists announced before the Conference

✅ Present live in front of hundreds of investors ready to deploy capital

Whether you're a new syndicator raising your first round or an experienced sponsor with a fresh opportunity, this is your chance to fast-track your capital raise in front of a room full of qualified LPs.

Don't have a deal lined up yet? No problem. You can apply based on previous experience, but finalists must have an active deal to present at the conference in February.

🏘️ DEAL OF THE WEEK

DESPERATE SELLER LEADS TO $420,000 PROFIT IN 2 YEARS

Amanda Cruise turned a desperate seller's two-week closing deadline into a profit of over $420,000 on a 20-space mobile home park she never even visited.

Here's how she did it, as explained on the Best Ever CRE Show 👇

🏢 Property details: The 20-space mobile home park in Columbia, South Carolina (started as 16-17 lots) was purchased in August 2023. The seller's husband had passed away, and she was tired of collecting rent door-to-door in cash. The property was stuck in probate for over a year, with no business systems in place.

💸 Finances: Amanda and her husband and business partner, Jonathan, acquired the property for $190,000 after the seller was about to accept $150,000 from another buyer the next day. Amanda was willing to pay up to $270,000 for the deal. Total investment was $240,000 (purchase plus improvements, including new homes, infrastructure upgrades, and mailboxes), funded by private lenders at 10% annual interest paid monthly.

💼 Business plan: Amanda had to close in two weeks instead of the typical 45 days, completing all due diligence in 10 days. She brought in pre-owned homes (a mistake, she later acknowledged — new homes would have been better), raised rents, implemented proper business systems, and made infrastructure improvements. An encroachment issue with a neighbor was resolved for $7,000. The biggest operational challenge was that, at only 20 lots, the park lacked the scale to hire quality management, relying on a local on-site manager with Jonathan handling asset management.

💪 Biggest Challenge: Compressed timeline requiring all due diligence in 10 days. "I'm calling every septic contractor in town, like, ‘No, I need you there tomorrow,’" Amanda says. "Not next week, tomorrow. I don't care what it costs." Also, being their only park in South Carolina meant no economies of scale for management.

🍾 Results: Amanda and Jonathan sold the property for $735,000 in September 2025, netting over $420,000 after broker fees and returning principal to private lenders — over $210,000 per year over the two-year hold period. The remarkable part? She never visited the property in person during the entire ownership period.

👉 If you have a deal you’d like to share with us, please email us here.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless