- Best Ever CRE

- Posts

- 🔮 The rent growth map is changing. Here's how.

🔮 The rent growth map is changing. Here's how.

Plus: RealPage fights back, affordability plummets, REITs raise big, and much more.

Together With

👋 Hello, Best Ever readers! The Fed cut interest rates by 25 bps yesterday and sees two more coming this year. Read on for John Chang’s take.

In today’s newsletter, the rent growth map changes, RealPage fights back, affordability plummets, REITs raise big, and much more.

Today's edition is presented by Aspen Funds. Aspen's latest oil and gas fund positions investors to capitalize on the emerging supply-demand gap in the energy sector, with an exclusive $50,000 discount for Best Ever readers. Learn more today.

📚 Plus, your book isn’t just a passion project — it can be the most powerful growth tool for your business. Watch the replay of our Book Publishing Workshop to see how.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🏠 Affordability Shift: Apartment asking rents fell 2.2% YoY in August, the 25th straight month of YoY declines, dropping median rents to $1,713 and spurring increased renter mobility as tenants seek more affordable or larger apartments amid historically high renewal rates.

⚖️ Fighting Back: RealPage vows to file lawsuits "sooner rather than later" against jurisdictions banning rent-setting algorithms, as the company faces federal antitrust charges and local regulations in nine cities, including San Francisco and Philadelphia, over alleged price-fixing facilitation.

📊 Outdoor Storage: AI-driven data center construction is fueling record demand for industrial outdoor storage lots, with Wall Street firms pouring $4.7 billion into IOS properties since 2021 while rents have jumped 123% since 2020, far outpacing warehouse rates.

🏪 Retail Rising: Single-tenant net-lease retail investment volume rose 9.6% in H1 to $5.7 billion as cap rates compressed to 6.8%, with convenience stores netting the highest prices at $925 PSF and restaurants leading transaction volume.

🏨 Hotel Squeeze: Hotel RevPAR fell 1.1% in July and 0.6% in August MTD as short-term rentals capture 16% demand share near pandemic peaks, while inbound international travel dropped 3.1% and operating profits declined 2.7% as costs outpaced revenue growth.

🏆 TOP STORY

THE RENT GROWTH MAP IS CHANGING. HERE’S HOW.

The geography of multifamily rent growth is shifting dramatically, with traditionally overlooked Rust Belt and Northeast markets poised to deliver the strongest rental increases over the next five years while former boom markets face supply-driven headwinds. New analysis from Markerr covering over 100 major metro areas projects rent growth through 2030, highlighting this shift.

Augusta, Georgia, leads projected rent growth through 2030 at 5.7% annually, followed by Syracuse, New York at 5.6% and Youngstown, Ohio at 5.4%.

The top ten markets include Albany, Rochester, Scranton, Springfield (Missouri and Massachusetts), Dayton, and Providence — a stark contrast to the Sunbelt markets that dominated rent growth from 2020 to 2022.

Other key takeaways from the report include:

Tertiary Markets Dominate Growth Projections: These emerging leaders share affordable rent bases, modest supply pipelines, and stable demand dynamics, with Northeast and Rust Belt regions capturing more national rent growth after years of Sunbelt dominance.

Former Boom Markets Face Oversupply Headwinds: Seattle, Austin, and Salt Lake City rank in the bottom three for projected growth at just 2.5% to 2.8% annually, while Florida metros struggle with pandemic-era overbuilding that created rental unit gluts and forced operators into concessions.

Supply Economics Drive Performance Gaps: Surging deliveries in Austin, Sarasota, and Cape Coral created oversupply, while rising insurance premiums and HOA assessments in Florida further strain landlord economics and dampen growth prospects.

National Trends Show Cooling Momentum: Rent growth decelerated to just 0.50% YoY as of August, with national average effective rent reaching $2,038, reflecting continued but more measured growth than recent years.

THE BOTTOM LINE

The next five years favor markets with affordable rent bases and disciplined supply over traditional growth darlings. Investors chasing rent growth may need to look beyond established Sunbelt markets toward overlooked Rust Belt and Northeast metros where fundamentals support sustained pricing power without the supply pressures plaguing former boom markets.

🏆 TOGETHER WITH ASPEN FUNDS

CAPITALIZE ON THE OIL INVESTMENT GAP

The energy landscape is shifting dramatically — while green investments dominate headlines, global oil demand continues its relentless climb. With institutional investors stepping back under ESG pressure, a significant opportunity has emerged for savvy private investors.

Aspen's Oil & Gas Fund VII positions you to capitalize on this market gap through:

✅ Reliable Monthly Distributions: Fund VI achieved six straight quarters of 15% annualized distributions from producing assets, with Fund VII targeting 25-35% total returns.

✅ Strategic Asset Selection: Aspen's geological and engineering team methodically acquires cash-flowing wells and high-potential drilling opportunities, optimizing both immediate income and long-term growth.

✅ Compounding Wealth Strategy: Through their reinvestment model, early cash distributions fuel new acquisitions, projecting substantial equity multiples over the fund's lifecycle.

🎯 Exclusive for Best Ever Readers: $50,000 off the minimum investment requirement for a limited time only.

Join us on Sep. 23 at 2:30 pm EST for Understanding the Energy Crisis — an expert session to learn about what’s really going on in the energy sector and why some of the smartest investors are moving back into oil and gas.

💰 CRE BY THE NUMBERS

AFFORDABILITY PLUMMETS, REITs RAISE BIG, AND MORE

💰 12.7%

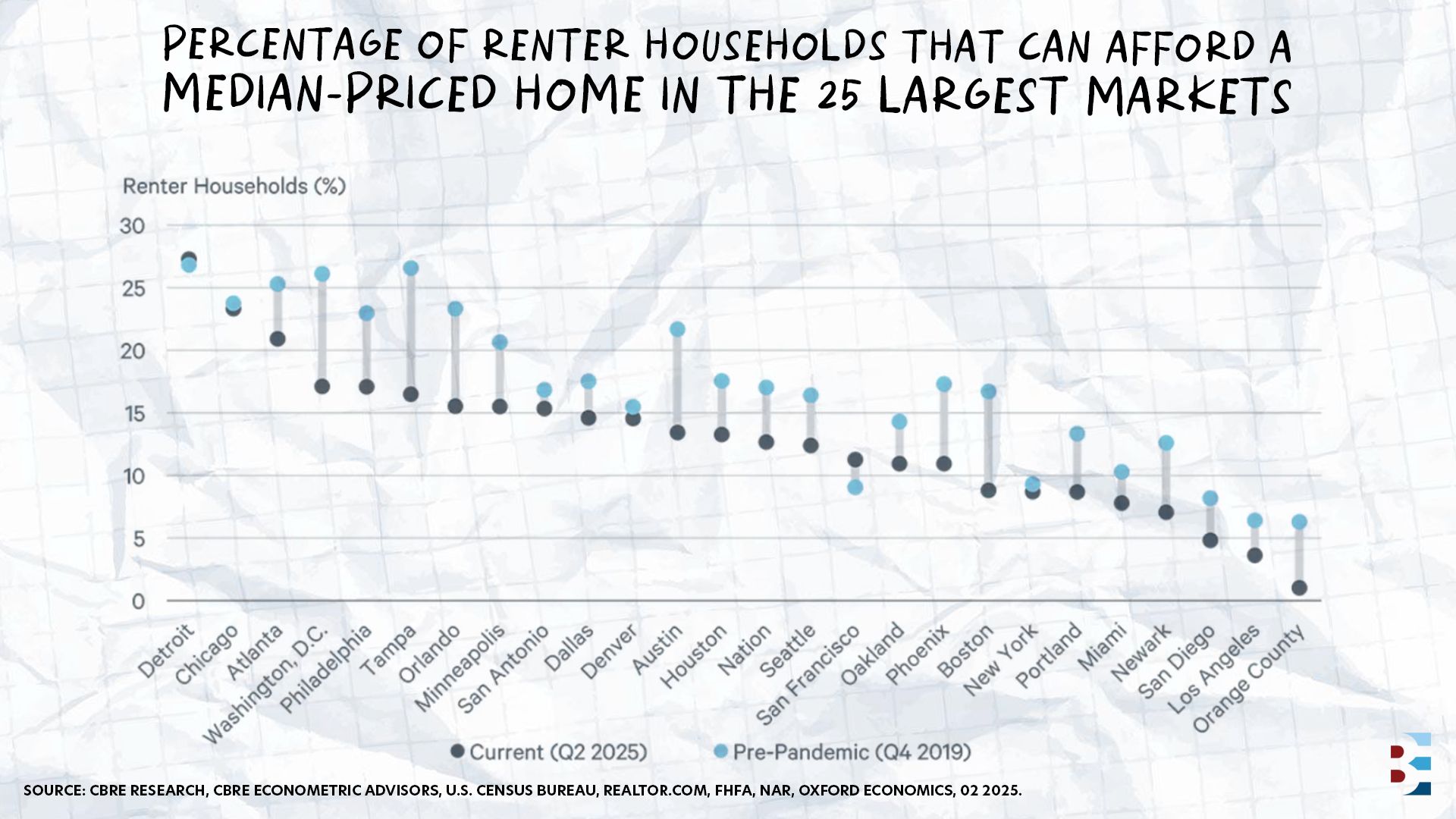

Only 12.7% of renter households can afford a median-priced home in Q2 2025, down from 17.0% in 2019, as 1.8 million renter households lost homebuying ability over five years. The ownership premium reached 108% above renting costs nationally, with some markets like Orange County hitting 303% premiums.

📈 $7.94 Billion

U.S. equity REITs raised $7.94 billion in capital during August, a 243% jump from July's $2.31 billion, led by Simon Property Group's $1.5 billion senior notes offering and Gaming and Leisure Properties' $1.3 billion issuance among notable debt and equity transactions.

🏈 $100 Million

Former NFL quarterbacks Tim Tebow, John Elway, and Blake Bortles are raising $100 million through Momentous Sports for mixed-use stadium developments, targeting less mature markets like Omaha and Charleston while developing a district around Jacksonville's proposed Sporting Jax stadium.

🎓 BEST EVER CONFERENCE X

WIN A FREE GENERAL ADMISSION TICKET

🎯 The Challenge: Be the FIRST to refer 50 new subscribers to our newsletter.

🏆 The Prize: A FREE general admission ticket to Best Ever Conference X, February 18-20 in Salt Lake City.

Your general admission ticket gets you access to all mainstage keynotes and sessions, sponsors and vendors on the event floor, lunch for two days, the Best Ever Party, and so much more!

How It Works (Simple):

Share your unique referral link (find it below)

Track your progress in real-time

First to 50 verified subscribers wins!

⌛ Deadline: September 30th

This is your chance to turn your network into a golden ticket. Ready to start referring?

✂️ RATE CUT IMPACT

FED CUT CREATES RARE CRE OPPORTUNITY … FOR NOW

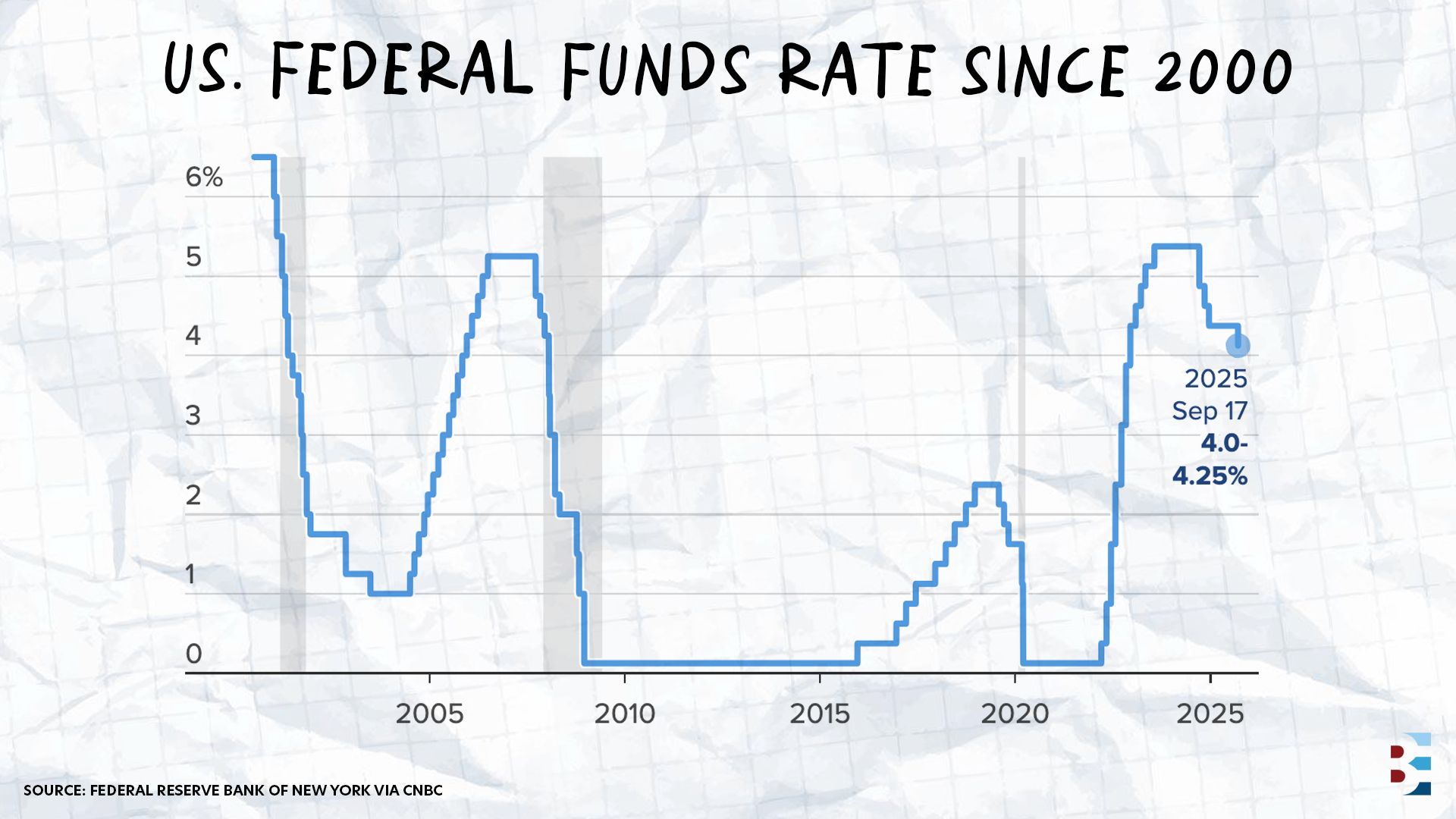

The Fed cut rates by 25 bps yesterday, as many expected. On the Best Ever CRE Show this week, Marcus & Millichap's John Chang identified why this moment adds to a convergence of factors that could make 2025 a standout year for CRE investment.

🧮 What the Numbers Say: The 10-year Treasury has dropped to around 4%, which Chang calls the "magic number" that historically brings institutional investors back to the market. Multifamily agency debt is now available around 5%, with commercial financing in the mid-5% range. When cap rates are hitting 6+ handles in major markets — the highest in a decade — investors can finally achieve positive leverage.

🔀 Why This Cycle Is Different from 2021: What makes this opportunity unique from the ultra-low rate environment of 2021 is supply dynamics. "Unlike 2021, when you had an impending wave of construction, this time we don't have any construction to speak of," Chang explains. Development starts have plummeted due to previously prohibitive financing costs, meaning supply will remain constrained while demand holds steady.

📈 Fundamentals Should Improve Over Time: This supply shortage should drive improving fundamentals as existing inventory gets absorbed without new competition flooding the market. But Chang issues a critical warning: Last year, Treasury rates dropped in anticipation of Fed cuts, then rose after the actual policy change. He expects continued volatility despite today's cut.

The opportunity is real, Chang says, but time-sensitive. Construction costs continue rising due to tariffs and labor shortages, while the supply crunch will eventually boost rents and occupancy rates. For CRE investors, the convergence of low rates, high cap rates, and restricted supply creates a rare window — one that may not stay open long.

📚 EXPERT RESOURCES

ADD 7 FIGURES/YEAR TO YOUR BUSINESS WITH THIS STRATEGY

🤫 You don’t get many chances to sit in on a closed-door conversation with publishing experts who’ve helped dozens of investors grow their business through books.

That’s exactly what you’ll find inside this replay:

How to use a book to attract capital and deals

What actually makes a book sell (and what doesn’t)

The publishing shortcuts that save you months of trial and error

“Love what you’re sharing! I just finished writing my first book and am set to launch, but with what you’re sharing, you can really help me grow my business. I’m already thinking ahead to more books. I’m going to book a call!”- Thomas L., Workshop Attendee

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless