- Best Ever CRE

- Posts

- ⚔️ There are new weapons in the amenity wars

⚔️ There are new weapons in the amenity wars

Plus: Trump targets Powell, insurance rates decline, renter households hit an all-time high, and much more.

Together With

👋 Hello, Best Ever readers!

In today’s newsletter, the amenity wars heat up, Trump targets Powell, insurance rates decline, renter households hit an all-time high, and much more.

Today’s edition is presented by M1 Real Capital. When investor flow is inconsistent, raise timelines slip, leverage disappears, and every deal becomes a scramble. M1 installs repeatable investor acquisition infrastructure for operators raising $1M to $100M+, turning unpredictable capital raises into scalable systems. Learn more.

🗓️ Join us TODAY at 1 pm ET for a private lending masterclass with Property Llama to learn their framework for protecting capital, how to analyze loan portfolios, and why private credit outcomes are predictable. Register now.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🏛️ Powell Investigation: A criminal investigation into Fed Chair Jerome Powell by Trump appointee Jeanine Pirro has crossed a historic line, marking the first time a sitting president has attacked Fed independence this way as Powell faces questions over office renovations.

🌀 Premium Drop: U.S. property insurance rates have declined 9% YoY following 2025's hurricane-free season, the first in a decade. Double-digit decreases are expected through mid-2026 as insurers retain more cash and face increased competition despite $100 billion in disaster losses.

🏪 Rent Rising: Retail landlords have entered a new pricing cycle as robust tenant demand collides with limited supply from fewer bankruptcies and muted construction, positioning owners to grow rents across well-performing shopping centers after years of elevated build-out costs.

🤖 AI Permitting: Louisville has launched a pilot program with Govstream.ai to streamline permitting using AI, alongside appointing its first chief AI officer, joining cities like Los Angeles and Austin in deploying technology to address housing development delays and antiquated approval systems.

📊 CMBS Decline: CMBS special servicing rates dropped to 10.71% in December, down 15 bps MoM, as office fell 52 bps and lodging declined 54 bps while retail drove $884 million in new transfers, including the $310 million Penn Square Mall loan.

🏆 TOP STORY

WHAT RENTERS WANT IS DRASTICALLY CHANGING

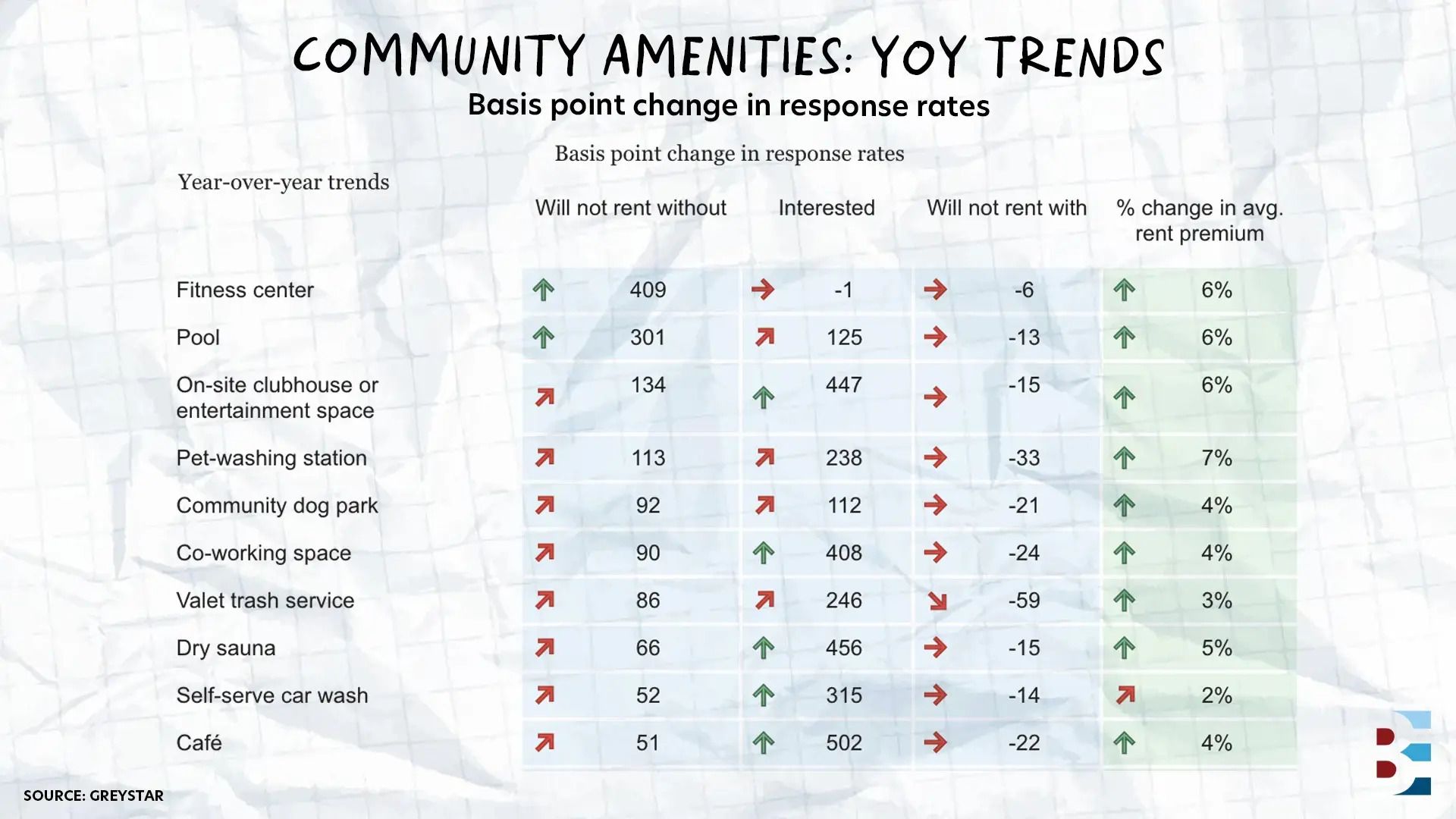

What renters want from their apartments is changing. According to Greystar's 2025 Design Survey Report, which surveyed more than 137,000 residents nationwide, renters are shifting from purely functional needs toward lifestyle-driven experiences that emphasize community, convenience, and technology.

Walk-in closets and natural light still top the list, but deeper changes are reshaping the rankings below them. Fitness centers have cracked the top five most desired amenities for the first time, outdoor cinemas are closing in on majority appeal, and gaming rooms are gaining ground fast.

Fitness centers exemplify this shift. Eighty-three percent of renters now consider them important or essential, with 68% reporting regular use. Demand is particularly strong for free weights, 24/7 access, and water stations, reflecting expectations that landlords deliver not just equipment, but around-the-clock functionality.

Here are the key trends that are reshaping amenity preferences:

Social amenities are surging: Outdoor cinemas gained nearly seven percentage points in popularity, now favored by 50% of renters nationwide, while gaming rooms jumped 626 bps and community clubhouses rose 581 bps. Renters increasingly seek opportunities to connect with neighbors and enjoy shared experiences, signaling that amenities are no longer just functional but central to lifestyle.

Tech features command growing premiums: Controlled community access, smart locks, and managed Wi-Fi all ranked in the top half of preferred features, reflecting renters' desire for convenience and safety. Electric vehicle charging stations saw their expected rent premium jump 10% YoY to $66, even as interest declined 306 bps, suggesting that those who value the feature are willing to pay significantly more.

Traditional staples are losing ground: Interest in reserved parking declined 248 bps YoY, while covered parking demand also softened. Among apartment features, space for dining tables dropped from 68% to 65% interest, suggesting that renters are deprioritizing conventional lifestyle staples in favor of experiential and tech-forward offerings.

Regional differences further complicate the amenity equation. Southern markets prioritize pools and green space, while Pacific Northwest renters demand fresh-air ventilation and eco-friendly pest control. California renters emphasize indoor-outdoor living with large windows and patios, while Sun Belt residents see pools, fitness centers, and outdoor cinemas as essential.

THE BOTTOM LINE

One-size-fits-all amenity packages no longer cut it. Renters are shifting from functional needs to lifestyle-driven preferences, forcing landlords to differentiate through social, tech-enabled, and experience-focused amenities. The next wave of competitive advantage will come from creating community and convenience, not just square footage. Operators who adapt their amenity mix to regional preferences and emerging trends will capture pricing power in an increasingly competitive market.

🤝 TOGETHER WITH M1 REAL CAPITAL

PREDICTABLE PRIVATE CAPITAL FOR SERIOUS INVESTORS

Most operators don’t have a capital problem. They have an investor acquisition problem.

When investor flow is inconsistent, everything breaks: timelines slip, leverage disappears, and every deal turns into a scramble.

M1 Real Capital installs a repeatable investor acquisition system for operators raising $1M to $100M+ across single assets, portfolios, and fund structures. This isn’t coaching or content. It’s infrastructure.

✅ What gets installed:

Investor-Ready Positioning – Your unfair advantage packaged so investors instantly understand why you win

Predictable Investor Flow – Systems that attract accredited investors before a deal is announced

High-Intent Capital Conversations – No chasing. No convincing. Allocation discussions only

Network Leverage – Plug into a vetted ecosystem of 1,000+ capital raisers, fund managers, and serious operators

Scalable Raise Infrastructure – Built to repeat across multiple raises

With a 9-figure capital raising track record and 506(c)-compliant, institutional-grade positioning, M1 has worked with 1,000+ operators and some of the biggest names in the business.

👉 Book a Capital Diagnostic Call to identify where your investor acquisition process breaks, what’s limiting your raise, and how to fix it before your next deal goes live.

If you want capital that scales with your business, this is where it starts.

💰 CRE BY THE NUMBERS

RENTERS HIT ALL-TIME HIGH, STARTS PLUMMET, AND MORE

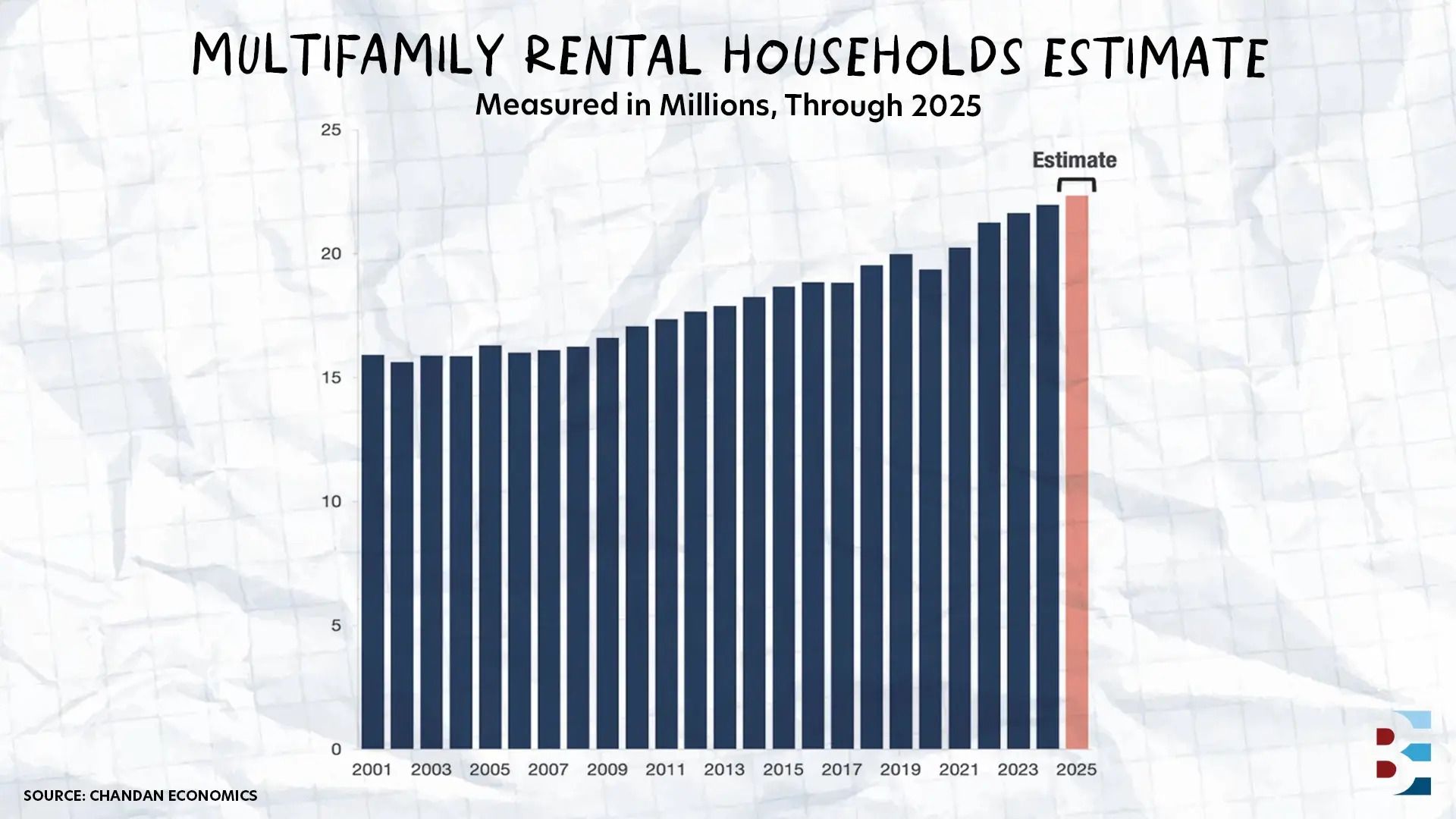

📊 22.4 Million

U.S. multifamily rental households reached an estimated 22 million in 2024, the highest level on record, with projections pointing to 22.4 million in 2025. The five-year gain of roughly three million units marks a 15.4% increase, the largest jump in more than two decades.

🏢 6.64%

Multifamily CMBS delinquency rates fell 34 bps to 6.64% in December, marking the second consecutive monthly decline after peaking at 7.12% in October. Despite the improvement, the rate remains elevated compared to 4.58% a year ago as lenders continue working with borrowers rather than seizing properties.

🏗️ 347,000

Multifamily starts plummeted 25.9% MoM and 10.8% YoY to a seasonally adjusted 347,000 units in October, dragging overall housing starts to the lowest level since 2020. Developers pulled permits for 481,000 apartments, but stubbornly high inventory and expensive preferred equity have made breaking ground difficult.

💼 45%

American M&A activity surged 45% in 2025, with megadeals over $10 billion up 74% as light regulation and tax cuts create conditions for corporate consolidation. CRE brokers stand to cash in as merged companies need to rightsize portfolios within 18 months before transformation inertia sets in.

📩 YOU’RE INVITED

PRIVATE LENDING MASTERCLASS TODAY AT 1 PM ET

Today at 1 pm ET, Richard McGirr and Chris Lopez are breaking down the private lending framework that delivered 21.28%+ cash returns across 100+ loans in 2024 without losing a single dollar. 💰

While equity investors are stuck waiting for exits, private lenders are collecting monthly distributions and sleeping well at night.

Join us today to learn:

🎯 Why private credit delivers predictable outcomes while equity depends on everything going right

🛡️ What actually protects capital beyond LTV ratios (hint: it's not what most people think)

📈 How to analyze loan portfolios like institutions do — and spot red flags before they become problems

💡 Why proven track records beat projected pro formas every single time

Can't make it? Sign up anyway and get the replay. 🎥

🎙️ THE BEST EVER CRE SHOW

HOW THIS OPERATOR REDUCED UNIT TURNS TO 7 DAYS

Speed is everything in value-add multifamily. Justin Spillers, co-founder of Real Estate Alpha, joined John Casmon on the Best Ever CRE Show this week to share how his firm has compressed unit turn timelines from 30-40 days to seven days or less, unlocking faster lease-ups and higher returns across their 720-unit Ohio portfolio.

A recovering real estate attorney turned multifamily operator, Spillers explained that the breakthrough came from challenging assumptions. "We had a guy just say, 'Why can't you do it in seven days?'" Spillers recalls. "We're like, 'Well, we probably can, so let's do the math.'"

His team now completes full renovations — LVP flooring, paint, trim, countertops, cabinets, appliances, bath fixtures, blinds, and all bolt-ins — in seven days using three-man crews and detailed time studies.

Here's how he does it:

Pre-closing renovations create immediate momentum: Spillers negotiates contract provisions allowing his team to turn vacant units before closing, enabling pre-leasing and waitlist generation while still in escrow. "We've already turned the vacant units in these properties we don't own yet," he says about two January acquisitions.

Vertical integration eliminates third-party delays: Spillers' firm brings acquisitions, leasing, property management, maintenance, and construction in-house with W2 employees, giving them full control over timelines and quality in tertiary markets where reliable contractors are scarce.

The "unscalable work" philosophy drives differentiation: From $50 quarterly wine bottles to brokers to personalized selfie videos texted to prospective tenants on showing day, Spillers' team executes touches competitors won't replicate. "What is someone else not willing to do?" he asks his team constantly.

His advice for operators: Challenge every assumption. "We used to turn properties in two and a half years,” he says. “Now, we'll turn an entire property in 12 months or less. Just constantly ask: How do we do it better, faster, cheaper, quicker?"

🎉 BEST EVER CONFERENCE

4 DAYS LEFT TO SAVE $110+ PER NIGHT AT BEC

Have some time this weekend? If you haven't booked your hotel room for Best Ever Conference yet, you have 4 days left to lock in our exclusive rate before it disappears.

💸 Our exclusive group rate: $240/night

⌛ Deadline: January 18th

After that? Our room block closes, and you'll be paying regular rates of $350-$360/night.

The Hyatt Regency isn't just cheaper—it's right in the action. You're staying where the conference is held, where all the events take place, and where the real networking happens. It happens in hallways, over breakfast, and at the hotel bar after hours. You can't experience that if you're staying across town.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless