- Best Ever CRE

- Posts

- 🏙️ These code changes could revive downtowns. Here's how.

🏙️ These code changes could revive downtowns. Here's how.

Plus: Self-storage booms, inflation rises, REITs keep raising money, and much more.

👋 Hello, Best Ever readers! As CRE gets more competitive, some developers explore building data centers on the moon. What a world universe.

In today’s newsletter, zoning laws change, self-storage booms, inflation rises, REITs keep raising money, and much more.

🎙️ Also, we want to hear from you, Best Ever CRE Show listeners! Please take two minutes to fill out this brief survey and enter for your chance to win a $150 Amazon gift card.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

✂️ Florida Cuts Tax: Florida has eliminated commercial rent tax after 50+ years, potentially saving tenants millions and boosting the state's business appeal. Previously reaching as high as 6%, the tax will end effective October 1.

💰 Housing Boost: Tennessee, Georgia, and Michigan have launched new affordable housing funding tools to unlock stalled projects amid rising costs, including state tax credits, federal LIHTC matches, and tax increment financing for select developments.

🔮 Rent Forecast: A new RealPage forecast projects 2.3% national rent growth over the next 12 months amid tariff uncertainty and slowing apartment supply. Only San Jose and Pittsburgh are projected for 4%+ growth, while San Antonio and Denver face declines below 1%.

📈 Storage Boom: Self-storage sales reached $855 million in Q1, up 37% YoY, as investors target undersupplied markets. Over 12 MSF traded hands with prices rising 31% PSF, led by West Coast cities like Costa Mesa at $387 PSF.

🏢 Owner Occupied: Tech firms have increasingly bought office buildings rather than leasing, with Apple, Amazon, and Bet365 closing over $1 billion in recent purchases. Owner-occupier deals made up nearly 30% of all U.S. office acquisitions in 2024, three times the historical average.

🏆 TOP STORY

HOW NEW ZONING COULD SAVE AMERICA’S DOWNTOWNS

Cities across America are rolling back decades-old zoning restrictions to welcome small-scale manufacturers back into downtowns and residential neighborhoods. From New York to Seattle, municipalities are rewriting land-use codes to accommodate coffee roasters, furniture makers, food processors, and artisan manufacturers that were pushed out during the industrial boom of the early 1900s.

New York City has updated manufacturing zoning for the first time since the 1960s, allowing coffee shops to roast beans on-site without special permits.

Baltimore has passed 2022 legislation permitting small food processing and art studios in commercial zones.

Elgin, Illinois, now allows retailers to manufacture and sell products in the same space.

Seattle plans to vote this fall on allowing artisan producers in residential areas.

Small-scale manufacturing businesses offer unique advantages for real estate investors, as they don't rely on foot traffic and typically employ 1-30 people. However, rising urban rents remain a threat. Nashville's early “maker zone” efforts were undermined by soaring real estate costs, prompting the city to offer density bonuses to developers who include manufacturing in mixed-use projects.

In response to these kinds of challenges, cities are developing comprehensive support ecosystems. Elgin is creating a downtown incubator for expanding makers. Maryland has allocated state funding for maker spaces in every county. Columbia, Missouri, made zoning changes that have incubated a commercial kitchen that supports 52 food startups, 25 of them minority-owned.

THE BOTTOM LINE

Small-scale urban manufacturing offers CRE investors recession-resistant tenants and portfolio diversification. As consumer demand for local products grows, properties accommodating flexible manufacturing uses will command premium rents. To find out if any of these initiatives are on the table for your city — or if you want to put them up for discussion — you can contact your city planning department, city council, or elected officials.

🎓 TOGETHER WITH THE DEROSA GROUP

FREE WEBINAR: HOTEL INVESTING DECODED

Join The DeRosa Group for our next FREE live webinar, as they provide a look inside the booming hospitality industry. They'll discuss why they decided to pivot from multifamily to hotels and conduct a deep dive into hotel deal analysis.

Here’s what you’ll learn from this FREE live webinar:

✅ Why Hotels? Discover why hospitality is a strong hedge against inflation and a powerful income generator in this market.

✅ Tax Efficiency: Learn how cost segregation and bonus depreciation can enhance your after-tax returns.

✅ Property Deep Dive: Explore DeRosa Capital 20, a dual-Hilton hotel offering, including business plan, risk mitigation, and projections.

✅ National Branding: Learn how working with a brand like Hilton creates predictable cash flow and long-term appreciation.

Matt, Jacob, and Hait will also give you an exclusive walkthrough of DeRosa Capital 20 — a dual-Hilton hotel offering that delivers immediate cash flow, institutional brand strength, and conservative upside.

💰 CRE BY THE NUMBERS

INFLATION RISES, REITs KEEP RAISING, AND MORE

💰 2.7%

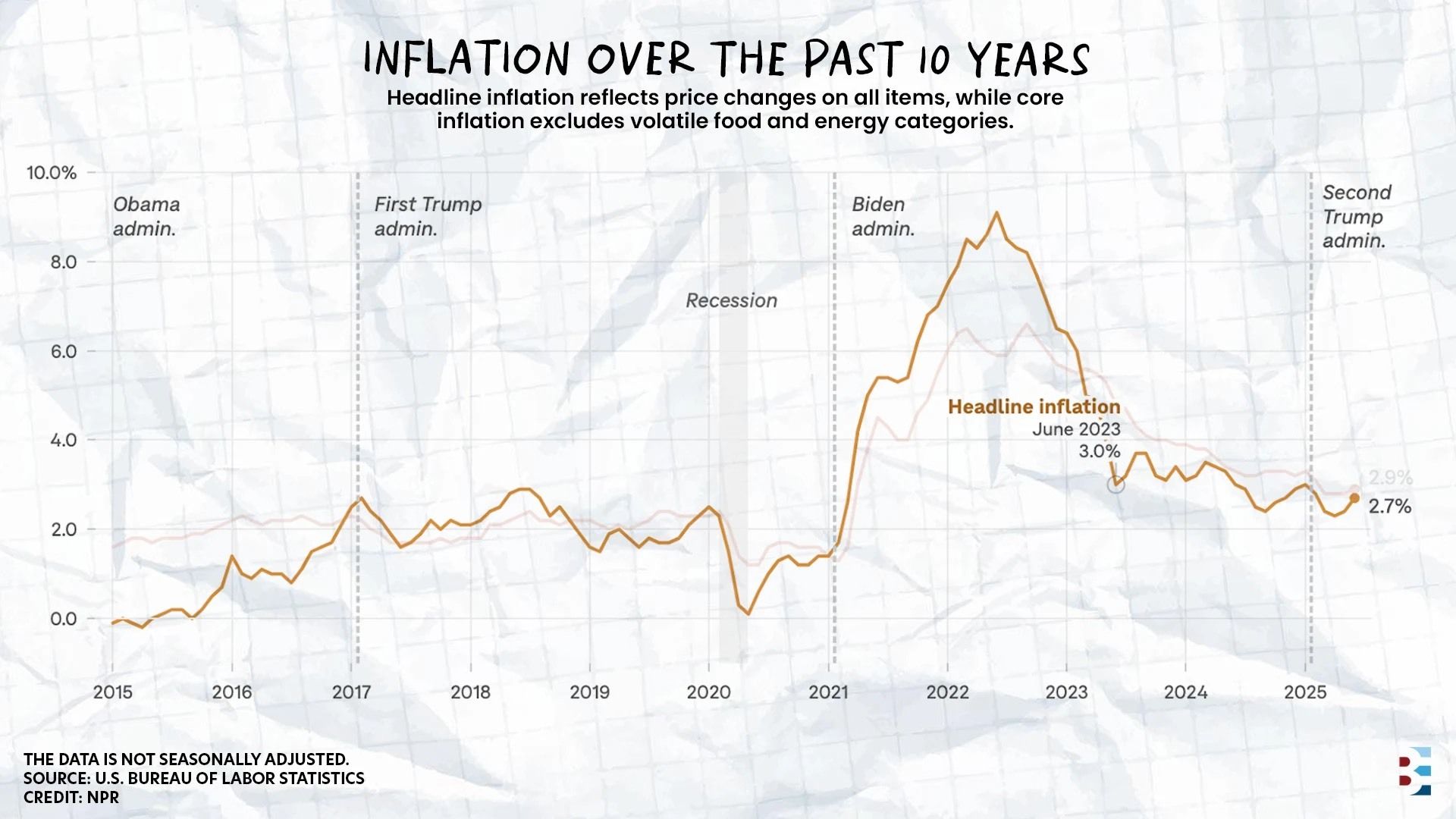

Inflation accelerated to 2.7% YoY in June as Trump's tariffs began impacting consumer prices. Rising rents drove overall inflation while clothing, appliances, and toys jumped nearly 2%, reflecting import tax effects on shoppers.

🏢 $22.5 Billion

U.S. REITs raised $22.5 billion in Q2 capital offerings, with $16.3 billion from debt and $6.1 billion from equity. The YTD total reached $39.7 billion as M&A activity remained muted, with zero deals announced in the first half.

📈 10.57%

The CMBS special servicing rate hit a 12-year high of 10.57% in June, driven by office distress reaching a record 16.38%. More than $2.9 billion in loans were transferred to special servicing, with office properties making up 57% of total transfers.

🏠 70%

Fresno, Calif., multifamily demand surged 70% YoY in Q2 with 741 units absorbed, well above the historical average of 354 units. Vacancy dropped to 4.5% while rent growth slowed to 1.78%, limiting new construction activity.

🏘️ DEAL OF THE WEEK

$7 MILLION IN VALUE ADDED IN JUST THREE YEARS

Sam Bates and the team at Bates Capital Group added $7 million to this property in less than three years and exceeded the projected IRR by 20%.

Here's how they did it 👇

🏢 Property Details: This 134-unit Class B multifamily property is located in Killeen, TX, and was purchased in September 2019.

💸 Finances: The property was purchased for $11,150,000, and the team raised $3,225,000 in capital. They also secured a Fannie Mae loan at 75% LTV and 3.44% interest.

💼 Business Plan: The team renovated 50% of the units to leave “meat on the bone” for the next buyer, updating flooring, paint, cabinets, and fixtures. They also added a green energy program, a washer/dryer rental program, and a cable/internet package program to boost NOI. They capped it all off by installing third-party property management.

🍾 Results: They sold the property in 2022 for $18,075,000. The average annual return for investors was 48.8% with a 38.63% IRR and 2.22X equity multiple. Rents at the time of sale were $1,151, raised from $873 at the time of purchase.

👉 If you have a deal you'd like us to feature, share it with us!

🎓 EXPERT RESOURCES

FREE DOCUMENT DOWNLOAD

EVERYTHING YOU NEED TO KNOW ABOUT SALES ASSUMPTIONS

This document outlines the six key sales assumptions needed when underwriting apartment deals: net operating income at sale, exit cap rate, projected sales price, closing costs, remaining mortgage debt, and final sales proceeds. It also details various sale-related expenses, including broker commissions, disposition fees, and prepayment penalties that affect investor returns.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless