- Best Ever CRE

- Posts

- 🧠 What we learned about CRE in 2025

🧠 What we learned about CRE in 2025

Plus: The good, the bad, and the ugly from 2025, plus much more.

👋 Happy Sunday, Best Ever readers! We hope your holidays have been safe and enjoyable. Next time we see you, it will be in 2026. Until then….

In today’s newsletter, we take a look back at CRE in 2025 — the good, the bad, the ugly, and much more.

🎟️ Plus, see what some of CRE’s top investors have to say about why they choose to go to Best Ever Conference year after year. And we invite you to use the code HURRY10 for 10% off your tickets when you decide to join them.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

📉 Sales Slump: Multifamily sales volume fell 22% YoY to $11.3 billion in November as property values dropped 1.4%. Sellers remain reluctant to accept current market pricing, disappointing investors who expected 2025 would finally unlock activity.

💾 Data Dominance: Data center construction spending doubled between 2024 and 2025 as tech giants poured nearly $400 billion into AI infrastructure, making the sector the backbone of economic growth despite political scrutiny and bubble fears.

🔐 Storage Surge: Self-storage development totaled 51M SF in 2025, down 21% from 2024, as Atlanta and Phoenix each added over 2M SF while smaller markets like Elizabeth City saw inventory surge nearly 49% amid Sun Belt migration trends.

🔮 CMBS Rebound: Moody's projects CRE CLO issuance will reach $32.5 billion in 2026, marking a 274% jump from $8.7 billion in 2024. Falling interest rates enable delayed refinancings while office SASB deals and data center financing drive growth.

🎲 Mixed Signals: Conflicting economic data has analysts guessing about the economy's true direction. Inflation cooled to 2.7% in November while unemployment hit 4.6% and October retail sales stalled, with a government shutdown creating information gaps that deepened the uncertainty.

🏆 TOP STORY

HOW MULTIFAMILY SURVIVED AND BUILT MOMENTUM IN 2025

Multifamily had a year in 2025. But what kind of year, exactly?

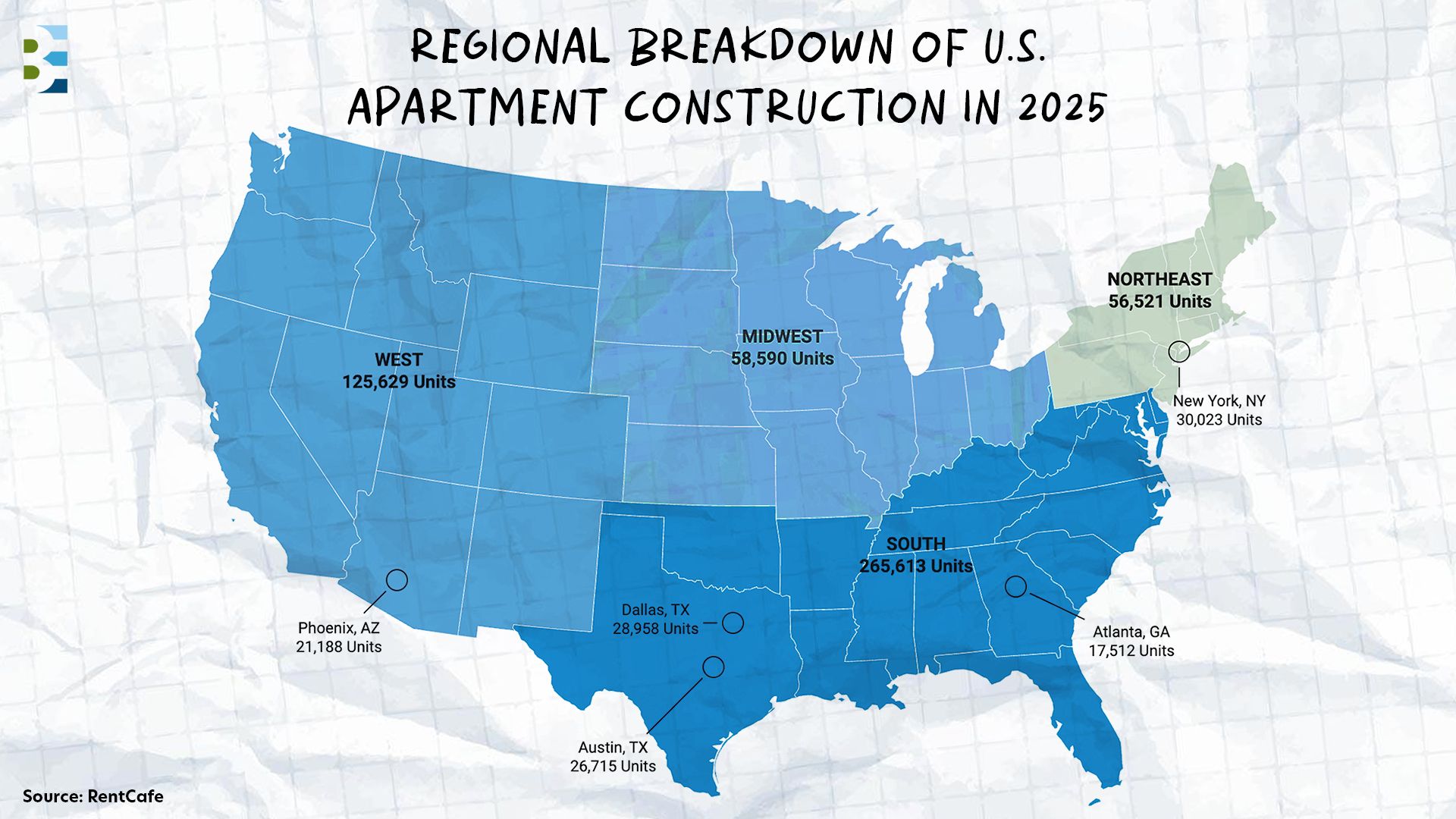

The sector absorbed a historic wave of new supply — more than 506,000 new apartments nationwide, the most since the 1980s — yet emerged remarkably resilient. Annual rent growth slowed to a crawl, but fundamentals held firm as exceptional demand met unprecedented deliveries. Now, at year’s end, the market has settled somewhere between survival and success, proving that even under pressure, multifamily remains CRE's steadiest performer.

🌊 Supply tsunami meets stubborn demand: More than half of the 506,353 new rental apartments opening in 2025 landed in the South, with Texas cities leading construction. Despite the influx, the rental market stayed red-hot, reaching a Rental Competitiveness Index score of 75.2, up from 74.4 in 2024. Miami topped the nation as the most competitive rental market with an RCI score of 92.9, where 19 prospective renters competed for each vacant apartment — double the national average.

📈 Rent growth's comeback: National average advertised asking rents rose to $1,755 in March, climbing 1.0% YoY after months of negative movement early in the year. Coastal markets led the recovery while New York posted 5.5% annual gains, Chicago and Kansas City both hit 3.7%, and Columbus reached 3.5%. High renewal rates at 63% nationwide, up from 62.2% in 2024, kept competition tight as renters chose to stay put.

🗺️ Geographic bifurcation deepened: Sun Belt metros that drove construction during the pandemic boom — Austin, Phoenix, Tampa — experienced continued rent pressure as deliveries peaked. Supply-constrained markets with limited recent construction saw pricing power return as occupiers had fewer alternatives. Washington, D.C., emerged as a magnet for renters, topping livability rankings and adding nearly 23,000 downtown apartments since 2020 — about 80% of all new units in the area.

💰 Capital markets and adaptive reuse surged: Office-to-apartment conversions broke records, with over 70,700 apartments created from former offices in 2025. D.C. led conversion activity with over 6,533 units in the works, among the top cities nationally. Transaction volume rebounded as pricing clarity emerged and investors regained confidence in the sector's fundamentals.

THE BOTTOM LINE

Multifamily weathered its supply test and enters 2026 with momentum building. With hundreds of thousands of new units expected to come online — many from adaptive reuse — renters will see more inventory and housing variety. Competition will remain fierce in hot markets during peak leasing season, but the influx of supply should ease some pressure, with Texas cities offering both affordable and luxury options while coastal markets command premium pricing for limited inventory.

🎉 BEST EVER CONFERENCE

WHY TOP INVESTORS CHOOSE BEC

Here's what attendees are saying about BEC:

📣 "Best Ever Conference is the mother of all conferences if you want to network with fellow real estate investors and hear awesome speakers on complex topics. The biggest value was the quality and number of people who showed up." — Menon

📣 "By day two, it was life-changing. The content and connections helped us 10x our business." — Karl Krauskopf

📣 "This was my first ever conference, and I came in feeling very green. What a great community! The sessions were helpful, the connections were invaluable, and the kindness of attendees truly stood out." — Kirsten Hudson

This isn't hype. It's what happens when serious investors show up ready to connect, learn, and do business. Join us February 18-20, 2026, in Salt Lake City. Use code HURRY10 for 10% off your tickets 👇

💰 CRE BY THE NUMBERS

2025 IN REVIEW: RETAIL RISES WHILE OTHERS REBOUND

🛍️ Retail

Retail defied expectations in 2025, posting strong fundamentals as grocery-anchored centers and Sun Belt markets attracted aggressive capital despite economic headwinds.

Sun Belt cities dominated: Charlotte ranked first among 43 U.S. markets with 7.4% rent growth and 11.6% total return, followed by Tampa and Orlando. Dallas, Norfolk, Nashville, and Phoenix also cracked the top 10.

Investment volume surged on necessity-based bets: Retail sales volume hit $16.1 billion in Q3, up 43% YoY, with full-year investment reaching $64.6 billion, up nearly 22% from 2024. Cap rates compressed to 6.84% in Q3, down from 7.15% a year earlier.

Limited supply kept fundamentals tight: National retail vacancy held at just 2.6% for general retail despite 5,822 store closures representing over 120M SF. Asking rents rose 1.9% YoY, supported by minimal new construction.

2026 outlook: Sun Belt markets will continue attracting development, though tariffs threaten to slow leasing activity for import-reliant retailers. Grocery-anchored centers will remain investor favorites as the flight to quality intensifies.

🏭 Industrial and Self-Storage

The industrial sector navigated a challenging 2025, posting its first negative absorption quarter since 2010 before stabilizing in the second half, while self-storage rebounded sharply with investment activity exceeding 2024's full-year total by November.

Industrial demand rebounded after a midyear slump: Industrial posted negative net absorption of 11.3M SF in Q2 as tariff uncertainty froze decisions, but leasing activity recovered in the second half as businesses adapted. National rents averaged $8.72 PSF by September, up 6.1% YoY — the highest growth of any major CRE sector. Miami led with 9.8% growth at $12.72 PSF.

Investment momentum sustained across both sectors: Industrial sales reached $52.5 billion through September, with Q1 volume jumping 24.4% and lender spreads tightening to 148.89 bps by late 2025. Self-storage transaction volume hit $5.9 billion YTD as of November 21, exceeding all of 2024 as investors returned to the sector.

Self-storage turned the corner on rents: National advertised rents rose 0.6% YoY in November to $16.77 PSF — the first YoY growth in nearly three years. Climate-controlled units outperformed, with 23 of 30 top markets posting positive growth versus 17 for non-climate units. The under-construction pipeline totaled 2.6% of existing stock, down 10 bps MoM.

2026 outlook: Industrial recovery won't arrive until mid-2026, with NAIOP projecting essentially flat absorption. E-commerce and reshoring will keep capital flowing to quality logistics assets. For self-storage, elevated supply will constrain rent growth near-term, according to Yardi Matrix, though undersupplied suburban areas will continue attracting premium pricing.

🏢 Office

Office delivered the year's biggest plot twist — vacancy declined for the first time since 2019, deep discounts sparked a buying frenzy, and Class A properties proved there's life after the pandemic.

Vacancy finally turned the corner: National vacancy edged down 5 bps to 22.5% by the end of Q3. Net absorption surged to 6.1M SF in Q3, more than double the previous post-pandemic high. Sixteen of the 25 largest markets posted vacancy decreases as return-to-office mandates took hold.

Investment sales exploded: Office trades jumped 40% YoY, recording $42.6 billion through October versus $29.2 billion in 2024. Manhattan led with $6.4 billion. Deep discounts drove activity — Houston, San Francisco, Manhattan, D.C., and Dallas saw over 60% of trades marked down in the first half.

Supply drought intensified: The construction pipeline fell to just 40M SF by year-end, down from nearly 160M SF in 2019. Meanwhile, coworking expanded to fill gaps — 22M SF opened in 2025, up 16% YoY, pushing the sector above 2% market share.

2026 outlook: For the first time in decades, more office space will be removed than added in 2026. This will create heightened competition for high-quality inventory as institutional capital returns to chase Class A properties in gateway markets.

🎙️ THE BEST EVER CRE SHOW

BEST EVER HOSTS’ BIGGEST TAKEAWAYS FROM 2025

When they weren’t hosting the Best Ever CRE Show in 2025, our experts were on the ground across asset classes, finding, executing, and raising capital for deals, many investing their own dollars as they discovered opportunities in a dramatically shifting and unpredictable environment. Last week, Best Ever hosts Matt Faircloth, John Casmon, Ash Patel, and Pascal Wagner gathered for a roundtable discussion, reflecting on 2025 and highlighting what they learned from a challenging year.

Matt Faircloth

Biggest Lesson from 2025: LP preferences are fundamentally shifting away from aggressive returns toward capital preservation. After watching half their portfolios pause distributions and writing off 20% of their investments, experienced LPs aren't chasing big IRRs anymore if there's meaningful downside risk. Matt predicts 2026 will see more blended funds that combine higher-upside deals with conservative plays, allowing one hand to wash the other and minimizing the probability of total loss.

📣 "[LPs] are not going to jump into the sexy 22% IRR deal if there's also a chance that that 22% could go to zero or negative," Matt says.

John Casmon

Biggest Lesson from 2025: Real distress finally materialized after years of "the sky is falling" predictions that never came true. For the first time in over a decade, John is watching operators lose projects to banks and receivership, with no buyers left to catch falling knives. Sellers who need out are getting creative with structures like seller carrybacks that were virtually non-existent during the previous cycle.

📣 "We're seeing the operators losing projects,” John says. “We're seeing stuff go to receivership. I have not seen that in 10 years."

Ash Patel

Biggest Lesson from 2025: Office represents a once-in-a-lifetime buying opportunity for operators willing to navigate complexity. While most investors fled the sector before and during 2025, Ash leaned in. The catch: many office properties carry 40% vacancy, creating Wild West-level execution risk that mirrors what the entire CRE market looked like 20 years ago.

📣 "We see these buildings go to auction for 20 cents on the dollar and they cash flow 20% on day one," Ash says, highlighting the opportunity for those brave — and strategic — enough to get in on the office market.

Pascal Wagner

Biggest Lesson from 2025: Now is the time to de-risk debt fund allocations, not chase yield. With $1.5 million spread across debt funds, Pascal is actively repositioning away from funds carrying heavy construction debt or second-position loans. His concern: If property values decline 30-50% as they did in 2008, funds with leverage or subordinate positions could face severe impairment, making wealth preservation more important than incremental returns.

📣 "I am personally in the middle of researching different funds and trying to move away from what I would consider riskier places to allocate my capital,” Pascal says. “I’m willing to take a little bit of a haircut on the return in order to do that."

Despite the tactical adjustments each host is making, the elephant in the room remains timing. "We've had the longest bull run in recorded history,” Ash reminds us. “That doesn't last, right? At some point, [the downturn] is going to happen. There is going to be a time when we pay the piper."

For now, that means stress-testing assumptions, hoarding liquidity when possible, and staying disciplined — because those who do may find themselves in "an amazing spot," Ash says, when the cycle finally turns.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless