- Best Ever CRE

- Posts

- 🗓️ What will CRE look like in 2026?

🗓️ What will CRE look like in 2026?

Plus: Sears’s last dance, alternative investments boom, jobs vs. rents, and much more.

🗓️ Happy New Year, Best Ever readers! What’s your New Year’s resolution? Reply to this email and let us know how you’re going to make 2026 a Best Ever year.

In today’s newsletter, what 2026 could bring for CRE, Sears’s last dance, alternative investments boom, jobs vs. rents, and much more.

🤝 Stop trying to figure it all out alone. The investors who scale fastest find the right partner first, and at Best Ever Conference X, we're making it easier than ever with our exclusive Partner Hunting session for Conference Plus and VIP ticket holders. Get your ticket today.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🏢 Luxury Glut: Luxury apartments have driven rents down as much as 11% in older market-rate buildings, with some aging units now cheaper than regulated affordable housing as new high-end construction floods Sun Belt cities like Austin and Phoenix.

💰 Alts Boom: Alternative investment fundraising reached $185.4 billion through November and is on pace to exceed $200 billion for 2025, with public non-traded BDCs leading at $40.7 billion as Blackstone captured $26.2 billion in total inflows.

🪦 Sears’s Last Dance: Sears is offloading its last real estate assets to pay down a $1.6 billion Berkshire Hathaway loan, with shares that once traded above $50 now at $4 as the iconic retailer's final five stores face closure.

📊 Jobs vs. Rents: Apartment rents have broken from traditional job growth patterns as supply outpaced demand in 2025, with effective asking rents rising just 0.6% YoY while some markets turned negative despite continued employment gains.

🎁 Concession Pressure: Rent concessions are masking true multifamily performance as national vacancy hit 7.2% and median asking rents dropped 1.0% MoM in November, with over 5,300 securitized properties now reporting debt service coverage ratios below 1.0x amid rising insurance and tax costs.

🏆 TOP STORY

WHAT WILL MULTIFAMILY RENT GROWTH LOOK LIKE IN 2026?

After nearly a year of stagnant performance and repeated downward revisions, multifamily rent growth is poised to accelerate in 2026 — though the recovery is projected to be gradual and deeply uneven across markets.

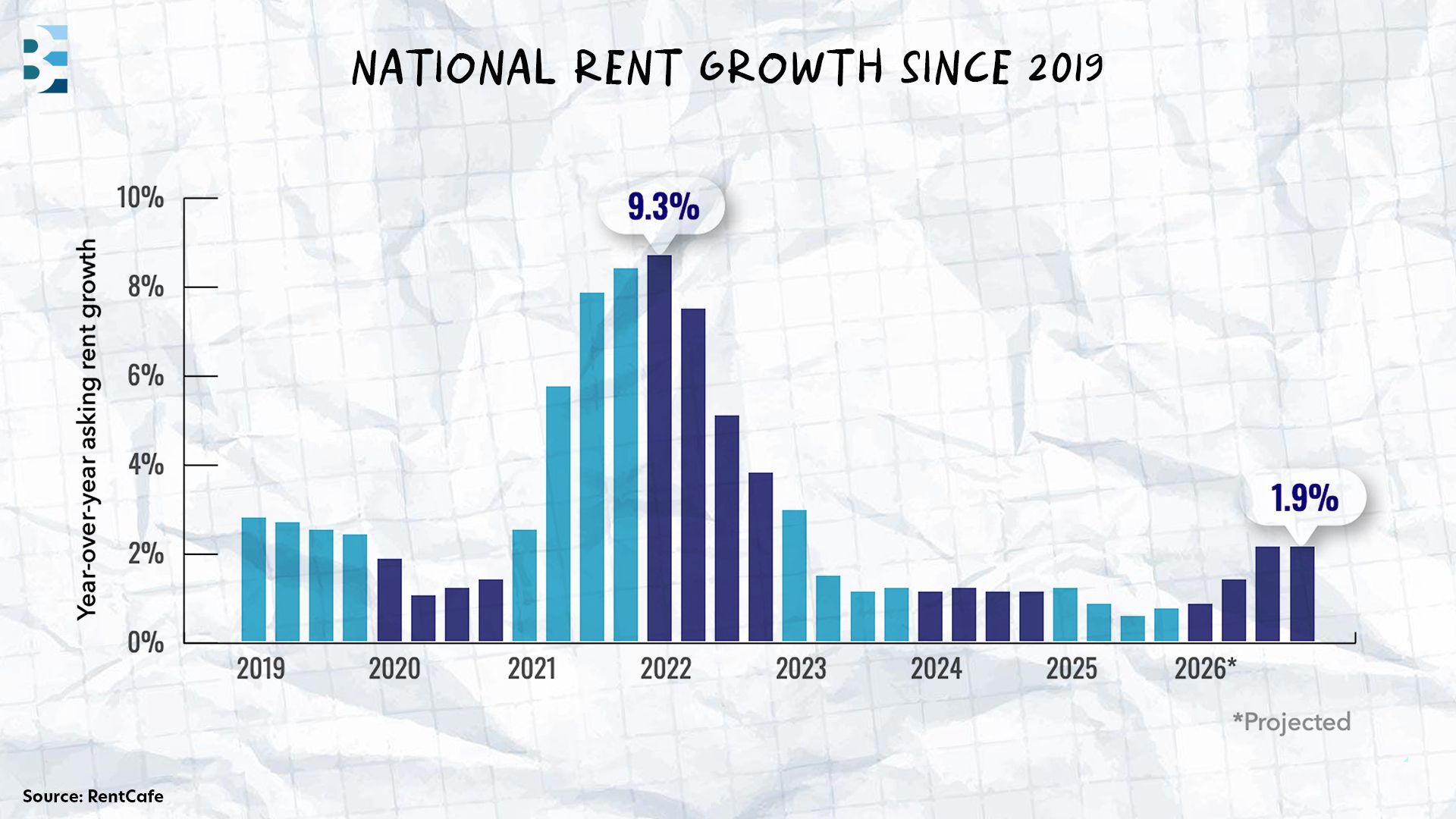

National rent growth is projected to rise modestly to 1.9% by the end of 2026, up from roughly 1% in 2025 but far below the 9.4% peak recorded in 2022. This muted acceleration reflects an ongoing absorption challenge as the market digests a flood of new construction.

West Coast markets could buck regional trends: San Jose and San Francisco are projected to lead the nation with rent growth of 4.3% and 4.2%, respectively — more than double the national average. Strong demand from employers mandating return-to-office policies and explosive growth in AI-related hiring are driving the rebound in these high-priced, supply-constrained markets. Norfolk, Virginia, rounds out the top three at a projected 4.2%, followed by Chicago at 3.4%, Indianapolis at 3.2%, and Philadelphia at 3.1%.

Sun Belt will continue to lag: Markets including Orlando, Austin, Charlotte, Nashville, and Phoenix are expected to see the steepest declines in new deliveries as a share of inventory, with supply dropping between 2.2% and 3.3% from 2025 to 2026. Four- and five-star vacancy rates are projected to remain in double digits across many Sun Belt metros, with stabilized vacancy holding at 6.8% nationally — well above the pre-pandemic five-year average of 4.3%.

Supply pipeline will drop sharply: After peaking at 700,000 units delivered in 2024 — a 40-year record — supply fell 30% to roughly 495,000 units in 2025. Construction starts have plummeted 71% from 210,000 units in Q1 2022 to just over 60,000 units in Q3 2025. Absorption is expected to run between 350,000 and 400,000 units in 2026 as higher financing costs constrain new development.

Vacancy rates are expected to remain above 10% in the luxury segment well into 2026. Properties at the top price point are likely to face the toughest conditions, with luxury stabilized vacancy projected to reach 7.0% in 2026, even as overall vacancy begins to ease.

THE BOTTOM LINE

The 2026 multifamily outlook favors markets with constrained supply and strong employment fundamentals, particularly those benefiting from tech sector growth and return-to-office mandates. Regional bifurcation is expected to intensify, with Midwest and West Coast markets commanding premium pricing while Sun Belt properties compete on concessions and retention strategies.

🎉 BEST EVER CONFERENCE

STOP LOOKING FOR ‘WHO’ — START FINDING ‘HOW’

You don't need another strategy. You need the right partner.

Most investors spend years trying to scale alone. The ones who break through? They find someone whose strengths perfectly complement theirs.

👋 Partner Hunting at BEC X helps you do exactly that through structured exercises, small-group conversations, and regional networking.

How this event works:

Pinpoint whether you're a Visionary or Integrator and where you have the most leverage.

Connect with partners whose strengths balance yours.

Network by region to meet partners active in your target markets.

Exclusive access to Matt Faircloth and the DeRosa Group throughout the conference.

Leave with a clear blueprint for collaboration and real progress post-conference.

Secure your Conference Plus or VIP ticket to the Best Ever Conference to gain access to the Partner Hunting event.

💰 CRE TRENDS

2026 PREVIEW: RETAIL LEADS AS OTHERS STABILIZE

🛍️ Retail

Retail enters 2026 poised for a transaction surge driven by pent-up capital and improving fundamentals, even as consumer headwinds intensify and tariff uncertainty looms.

Liquidity returning out of necessity: Transaction volume is expected to accelerate as institutional and private investors can no longer keep capital sidelined after nearly five years of pandemic uncertainty and rate paralysis. Portfolios are generally overdue for repositioning and underexposed to retail, creating deployment urgency regardless of economic conditions, according to Avison Young.

Fundamentals remain tight despite consumer stress: Cushman & Wakefield forecasts retail vacancy to edge up to 6.0% in 2026 before improving to 5.9% in 2027, with just 12.9M SF of new supply planned. Limited construction and disciplined tenant mix are projected to support pricing even as consumer credit stress rises, with severely delinquent credit card balances hitting 12%, the highest since 2011.

Flight to quality intensifies: Grocery-anchored centers and stabilized value-add projects will attract the strongest investor interest as fundamentals prove resilient. Markets like Los Angeles and Atlanta offer discounted entry points, while Miami and New York deliver premium pricing but longer-term stability.

Retail is likely to lead the CRE recovery narrative as necessity drives deployment, but performance will bifurcate sharply between premier grocery-anchored assets and struggling discretionary retail as household budget pressures mount.

🏭 Industrial and Self-Storage

Industrial is positioned for renewed growth in 2026 after tariff uncertainty eases, while manufacturing incentives create the next major demand catalyst following e-commerce's post-recession boom.

Manufacturing emerges as the new demand driver: The One Big Beautiful Bill's 100% bonus depreciation for qualifying manufacturing facilities is spurring multi-billion-dollar investments across semiconductors, EVs, batteries, and pharmaceuticals. This will likely spur action in H1 2026 before costs escalate.

Supply pipeline shrinks dramatically: Annual deliveries are expected to average just 230M SF from 2026 through 2028, half the 2022 through 2025 rate, with build-to-suit projects rising from 17% of completions in 2023 to 39% in 2025. Vacancy will hold at 7.3% in 2026 as demand matches new supply before improving to 7.0% in 2027.

Capital returns as financing improves: Substantial dry powder remains sidelined, ready for deployment as pricing expectations align and interest rates decline. Stabilized and value-add industrial assets will likely draw strong investor interest supported by improving fundamentals and renewed confidence in long-term manufacturing demand.

Industrial faces short-term headwinds from elevated construction costs and tariff adjustments, but manufacturing reshoring and tightening supply will drive stronger rent growth through 2026 and 2027 as the sector enters a new expansion cycle.

🏢 Office

Office markets remain deeply bifurcated entering 2026, with trophy assets experiencing supply constraints and leasing momentum while secondary properties face extended distress and valuation uncertainty.

Class A outperformance continues: Trophy assets are posting leasing volumes approximately 13% above pre-pandemic averages, though limited availability may constrain growth in certain markets. Nearly one-third of Class A office product is almost fully occupied, creating heightened competition for premium space.

Supply drought reaches historic lows: The under-construction pipeline is projected to hit the lowest level on record dating to the late 1990s, with only 20M SF projected for delivery cumulatively from 2026 through 2028, representing just 0.4% of current stock. Office vacancy is projected to hold at 20.8% in 2026 before edging down to 20.7% in 2027.

AI and tech drive coastal recovery: Technology and AI will lead demand in San Francisco, while traditional sectors like banking, finance, and law anchor leasing in Manhattan and Chicago. AI companies signed over 80 office leases in San Francisco alone in 2025, with many already seeking additional space.

Office will likely experience gradual stabilization, characterized by selective growth across premium assets and well-capitalized landlords, while secondary markets and lower-tier buildings face slower recovery. Loan originations are up 25% to 30% YoY among institutional trophy owners, but broader market health depends on refinancing activity for B and B+ properties.

🎙️ THE BEST EVER CRE SHOW

WHY 2026’s PAIN WILL SET UP A CRE BOOM IN 2027

The Great CRE Reset is on, as the market finds itself caught between softening fundamentals and mounting institutional capital pressure. Jobs numbers have deteriorated sharply since April, absorption is slowing across asset classes, and tariff uncertainty continues to freeze decision-making — but the long-term setup may be exceptional.

John Chang gave us his outlook for the year ahead and beyond on the Best Ever CRE Show this week, walking through the employment collapse that’s weighing on near-term demand and why he believes the current slowdown is building pent-up demand that could fuel a 2027-2029 boom.

Employment market deterioration is the biggest near-term risk. Job creation collapsed from 123,000 per month in the first four months of 2025 to just 17,000 per month from May through November. Unemployment for young adults aged 20-28 has spiked into the mid-sevens, stalling household formation as recent college graduates live with parents instead of moving into their first apartments.

Market geography will determine who weathers 2026 best. Sun Belt markets like Phoenix, Dallas, and Austin face elevated vacancy and are offering concessions as high as three months of free rent. Meanwhile, slow-growth markets such as Chicago, Cleveland, and Detroit are posting some of the strongest rent growth in the country thanks to minimal construction.

Institutional capital is finally coming off the sidelines. After sitting out much of 2023-2025, institutional investors are raising capital at levels comparable to 2017-2018 and are under pressure to deploy. NAICREIF returns have shifted into positive territory across asset classes, and Chang expects this to drive increased transaction velocity in 2026.

Chang sees the current slowdown building significant pent-up demand that will flood through once economic uncertainty clears. "It's like damming up a river and then the dam breaks,” he says. “And then all of that water floods through." For investors willing to navigate 2026's headwinds, the positioning for 2027-2029 could be exceptional as demographics, cost of capital improvements, and institutional capital flows align with that demand release.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless