- Best Ever CRE

- Posts

- 💼 What's driving co-working's unlikely comeback?

💼 What's driving co-working's unlikely comeback?

Plus: HUD’s ultimatum, hotels’ very bad year, the top buyers of 2025, and much more.

Together With

👋 Hello, Best Ever readers!

In today’s newsletter, co-working’s comeback, HUD’s ultimatum, hotels’ very bad year, the top buyers of 2025, and much more.

Today’s edition is presented by Tribevest. Capital raising is becoming more structured, regulated, and professionalized — and sponsors who adapt early gain a real advantage. Learn how experienced Lead Sponsors are building compliant, scalable capital programs with the Institute for Structured Capital. Join the waitlist.

▶️ Get the free replay of our latest webinar: Grow Your Real Estate Business by 6-Figures with a TEDx Talk is now available! Learn how platforms like TED can help you build authority, shorten trust cycles, and increase deal flow. Get the free replay.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🏛️ Tenant Sweep: HUD has given landlords 30 days to verify citizenship for 200,000 tenants in federally funded housing or face sanctions, after identifying 25,000 deceased renters and 6,000 ineligible non-citizens currently receiving aid.

🏨 Hotel Slump: U.S. hotels posted their first full-year occupancy decline since 2020 last year, falling 1.2% to 62.3%, while RevPAR dropped 0.3% to $100.02 despite average daily rates rising 0.9% to $160.54.

🏀 Slam Dunk: NBA star Giannis Antetokounmpo paid $21 million for a 56-unit Chicago apartment building, his latest acquisition in a buying spree totaling $69 million across 186 units in Wisconsin, Chicago, and Brooklyn since the fall.

🎁 Concession Season: U.S. apartment concessions reached 15.6% in December with average discounts of 10.5%, according to RealPage, the highest December rate since 2016 as operators offered deals during the slow holiday season.

🛍️ Retail Expansion: U.S. retail store openings are projected to rise 4% in 2026 while closures slow by the same margin, with discount and beauty retailers expanding into spaces vacated by struggling department stores.

🏆 TOP STORY

WHAT’S DRIVING CO-WORKING’S UNLIKELY COMEBACK?

The shared-workspace business that once made WeWork Manhattan's largest office tenant before collapsing into bankruptcy is staging an unlikely comeback. But this time, it's not scrappy startups filling the desks — it's Pfizer, Amazon, and JPMorgan Chase.

Co-working space in the U.S. has surged from 115.6M SF three years ago to 158.3M SF today across nearly 8,800 locations, according to Yardi. The resurgence is driven by hybrid work models and economic uncertainty pushing even the world's largest companies toward flexible workspace solutions. WTW's global head of corporate real estate says when entering new markets, one of the first things the company does is look for a co-working space.

Small operators dominate: The expansion looks dramatically different from co-working's first wave. Single-site operators have grown 66% over three years to over 3,500 locations — double the growth rate of the top 20 operators. These independent spaces are helping companies in smaller cities adapt to hybrid work.

Workers want more: Remote workers expect satellite offices to match headquarters-level experiences, forcing companies to upgrade basic desks and conference rooms into fully amenitized workspaces.

Enterprise clients fuel momentum: Large corporations are using co-working to create satellite offices closer to where employees live, offering headquarters-level amenities without requiring long commutes.

The enterprise shift, especially, is reflected in the numbers:

Co-working now represents 2.2% of U.S. office stock, up from 1.7% three years ago, with Yardi predicting eventual growth to 10%.

Industrious added 50+ locations last year for a total exceeding 250 in the U.S. and Europe after CBRE acquired a controlling stake.

40-50% of companies surveyed say 20% to 30% of their corporate portfolio will shift to flexible leases.

Even WeWork is participating in the comeback, emerging from bankruptcy protection in 2024 with Yardi as its controlling shareholder. CEO John Santora, who took over last year, says the company now takes smaller spaces and shares risk with building owners rather than repeating the aggressive expansion that led to bankruptcy. Some landlords remain hesitant after getting burned, but many are signing deals again — including those whose leases were rejected in bankruptcy proceedings.

THE BOTTOM LINE

Co-working's resurgence reflects a fundamental shift in how companies approach office space. As hybrid work becomes permanent and AI creates workforce uncertainty, flexibility trumps long-term commitments — turning what was once a niche amenity into a mainstream corporate real estate strategy.

🤝 TOGETHER WITH TRIBEVEST

BUILDING THE NEXT STANDARD FOR CAPITAL RAISING

As more sponsors work with capital partners and Independent Capital Aggregators (ICAs), structure and compliance are no longer optional — they’re foundational.

✍️ The Institute for Structured Capital is a new education initiative designed for experienced real estate sponsors who want to move beyond one-off raises and build durable, repeatable capital programs. Through practical frameworks, real-world examples, and infrastructure-first thinking, the Institute helps sponsors understand how to structure Fund-of-Funds programs, work responsibly with ICAs, and scale capital raising without increasing risk.

If you’re focused on doing more deals — and doing them the right way — this is where it starts.

👇 Join the Institute for Structured Capital waitlist.

💰 CRE BY THE NUMBERS

TOP BUYERS OF 2025, DEVELOPMENT WOES, AND MORE

🏢 $2.5 Billion

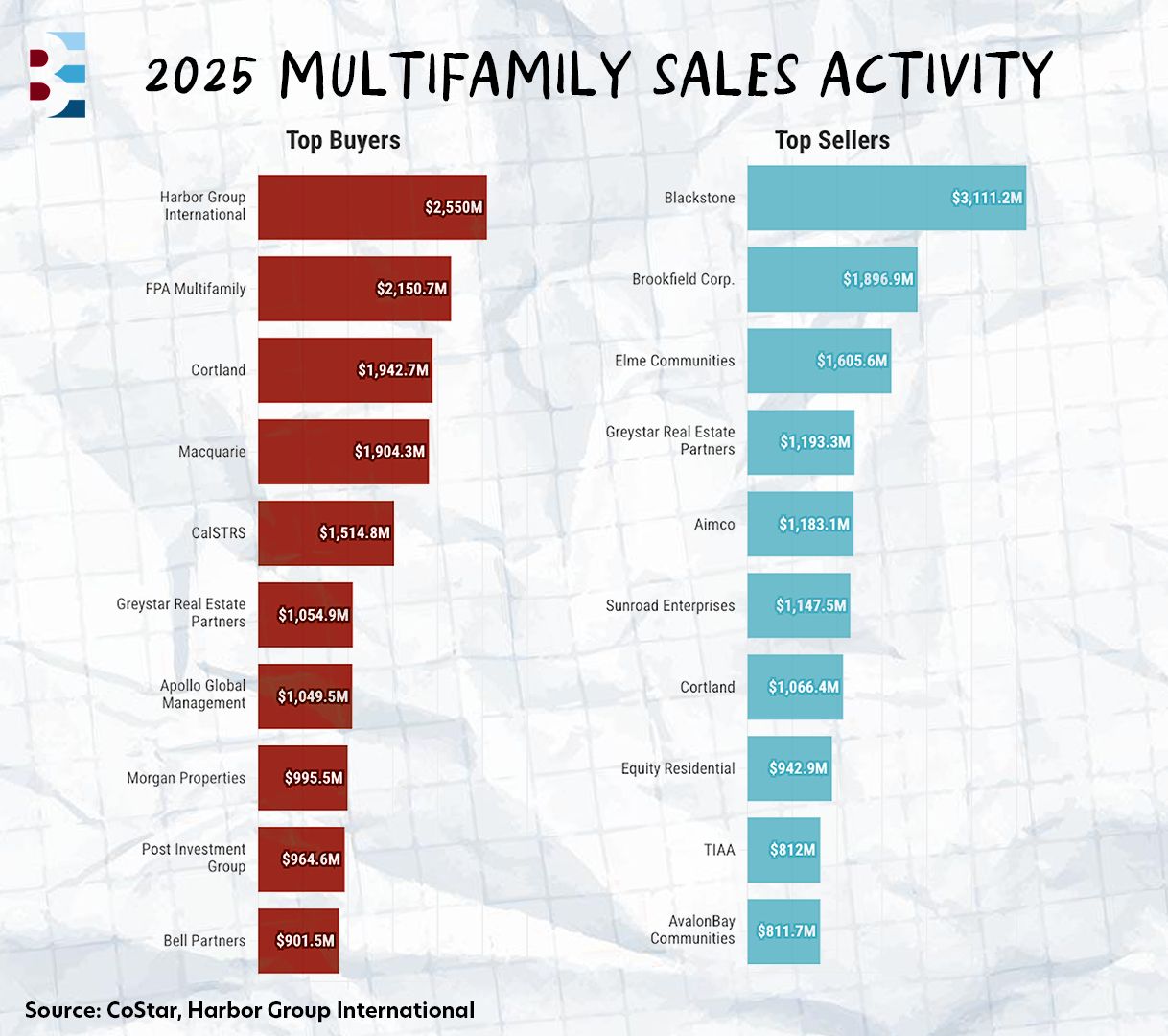

Harbor Group International led all multifamily buyers in 2025 with $2.5 billion in acquisitions, including a $740 million purchase of five New England properties and a $625 million Sun Belt portfolio deal, as investors deployed $115 billion total across the sector.

📊 40%

Nearly 40% of data center industry respondents say the current pace of development is unsustainable, with 63% anticipating a strategic market correction by 2030 as energy availability emerges as the greatest obstacle, cited by 54% of executives.

🏭 $772 Billion

Nearly 80% of the 500+ major U.S. manufacturing projects announced since 2020 have proceeded to construction or operation, representing $772 billion in investment tied to 350M SF of expansion as high-tech manufacturing leads the next growth phase.

🚫 75%

Three-quarters of multifamily developers have either cut back on investment in rent-regulated markets or avoid them entirely, up from 58% in 2022, as 35% reduce exposure and 41% stay away altogether amid rising rent control measures.

▶️ GET THE REPLAY

THE TEDX PLAYBOOK FOR REAL ESTATE INVESTORS

Growth, influence, and capital all follow trust. In real estate, the investors who command the best terms and exclusive deal flow have built unshakeable authority — so capital comes to them.

▶️ Watch the replay of our recent webinar with Nate Hambrick of Leadr to learn how strategic platforms like TEDx can shorten trust cycles, attract pre-sold investors, and turn public visibility into private deal flow.

You’ll learn how to:

✅ Build authority through high-leverage speaking opportunities like TEDx

✅ Convert public visibility into private deal flow

✅ Create self-sustaining deal flow that attracts pre-sold partners

✅ Institutionalize your reputation to secure better terms and reduce capital acquisition costs

🏘️ DEAL OF THE WEEK

18-MO VALUE-ADD DELIVERS 5.4x RETURN, 294% NOI GROWTH

Justin Spillers and the team at Real Estate Alpha acquired this 111-unit Class C multifamily property for $4.25 million and refinanced 18 months later at a $12.9 million valuation — creating approximately $7.1 million in total value through a targeted renovation program while the property remained in the LIHTC program.

Here's how they did it 👇

🏢 Property details: This acquisition included 111 Class C units spread across two buildings (55 and 56 units each) located in Sidney and Wapakoneta, OH. The property was acquired in June 2024 for $4.25 million and was significantly under-rented relative to the surrounding market.

💸 Finances: The team raised $1.5 million in capital for the down payment and approximately 25% of the CapEx budget. They secured a $4,470,750 combined loan ($3,187,500 purchase loan + $1,283,250 CapEx loan) at 7.75% interest with 24 months interest-only and a 20-year amortization.

💼 Business plan: This was a classic acquisition-to-refinance value-add strategy executed over approximately 18 months. The team invested over $1.6 million in total CapEx, averaging approximately $6,800 per unit, focused on:

Unit Interiors: Complete gut renovations to studs/drywall, replacing kitchens (cabinets, counters, appliances), bathrooms (tile, vanities, fixtures), flooring (LVP), doors/trim, and lighting — delivering a brand-new feel and driving $250-$400 per door rent premiums.

Exterior Improvements: Full building repaints, new signage/lighting, landscaping refresh, and parking lot repairs to accelerate leasing velocity.

Operational Efficiencies: Vertical integration with in-house property management, construction, and acquisitions eliminated third-party costs and delays. Palletized kits, three-man crews, and live scoreboards achieved seven-day unit turns (81% faster than industry average), maintaining a 44.71% expense ratio and 96%+ occupancy.

The property remained within the Low-Income Housing Tax Credit (LIHTC) program throughout execution and exited in 2025 as the 30-year restrictive covenant period lapsed. The team targeted this aging LIHTC asset where rents were capped below market, bought at a discount reflecting restrictions, then repositioned to market rates post-compliance.

🍾 Results: This deal materially outperformed initial underwriting assumptions:

Topline revenue increased from approximately $813,000 at acquisition to $1.39 million at refinance — a 71% increase

NOI grew from approximately $223,000 at acquisition to $880,000 at refinance — a 294% increase

Refinance valuation of approximately $12.9 million at a 6.75% cap rate

Approximately $7.1 million in total value created

5.4x equity multiple while maintaining conservative leverage

20%+ stabilized cash-on-cash returns on remaining invested equity

💪 Biggest Challenge: “The properties remained within the LIHTC program throughout execution, which required additional compliance oversight, documentation, inspections, and financial audits beyond a typical value-add project,” said Spillers. “Executing the renovation and stabilization plan while remaining compliant with LIHTC requirements added complexity and required close coordination across asset management, property management, and third-party consultants.”

“Changing the culture from a C to a B+ community in a little over 12 months had operational challenges,” he continued, “but they were overcome with experience and systems. While this increased execution demands, it ultimately strengthened the durability of the cash flow and supported the refinance valuation. Zero compliance issues in nine years make these our highest-IRR plays."

👉 If you have a deal you'd like to share with us, please email us here.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless