- Best Ever CRE

- Posts

- 🛗 Where job growth is lifting CRE markets

🛗 Where job growth is lifting CRE markets

Plus: QSRs battle, MOBs slow down, net-lease investment takes off, and much more.

👋 Happy Sunday, Best Ever readers!

In today’s newsletter, job growth elevates key markets, QSRs battle, MOBs slow down, net-lease investment takes off, and much more.

📩 You've learned how to spot opportunities. Now learn how to spot the traps that destroy them. Join us November 20 at 1pm ET for our newest webinar with Mark Khuri of SMK Capital Management to learn how institutional investors do things differently. Save your spot.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🏦 Rate Relief: CRE lenders have ramped up activity as mortgage rates dropped below 6% in late 2025. Banks are preparing for a lending rebound after holding over 50% of the $6 trillion mortgage debt market through two years of reduced originations.

🍔 Location Wars: Quick-service chains are battling for neighborhood real estate as brands like Taco Bell and Chipotle abandon highway corridors for hyper-local spots within walking distance of residential clusters.

🏥 MOB Slowdown: Healthcare real estate activity has slowed as material costs surged 80% and labor jumped 20% since 2023, pricing out smaller practices while hospital-backed projects dominate new development.

⚖️ Rent Control: New York landlords filed a federal lawsuit in November challenging rent caps that keep 26,000 apartments vacant, arguing limits as low as $700 make renovations economically impossible.

🎓 Leasing Lag: Student housing pre-leasing for Fall 2026 plunged to a decade-low 3.3% in October, according to RealPage, down from 7.2% last year. Surging rents are testing affordability after some markets saw 19% increases since 2023.

🏆 TOP STORY

WHERE JOB GROWTH IS LIFTING CRE MARKETS

America's employment map is being redrawn. While coastal cities debate return-to-office policies, Sun Belt metros are building economic momentum that's translating directly into CRE demand.

The shift reflects a fundamental realignment in where companies choose to grow and where workers choose to live. Business-friendly policies, lower operating costs, and affordable housing are attracting corporate relocations alongside the tech expansions and professional service firms that create sustained demand across multiple asset classes.

Orlando leads with 25,500 private sector jobs added between April 2024 and April 2025 — a 2.5% growth rate, making it the fastest-growing large employment market in the nation, according to RealPage data.

Austin posted 23.6% growth with 261,100 jobs added, while Las Vegas surged 23.1% with 214,200 new positions — both benefiting from tech expansions and corporate relocations.

Miami and Nashville round out the top five with 18.2% and 17.6% growth, respectively, as financial services, healthcare, and professional services fuel diversified employment bases.

Texas metros dominate the rankings with Dallas, San Antonio, and Fort Worth all posting 15-17% five-year growth, capturing corporate headquarters and distribution operations.

Orlando exemplifies what's working, adding 76,000 residents in a single year — roughly 1,500 new arrivals weekly — split evenly between domestic relocations from expensive coastal markets and international migration.

Tech jobs are spreading beyond traditional hubs, with Orlando adding 1,800 tech positions in 2024, more than Charlotte, Houston, and Dallas combined. The 10,900 hospitality job gains came alongside professional services, healthcare, and construction growth — the kind of multi-sector expansion that sustains performance across asset classes.

THE BOTTOM LINE

Sun Belt metros with 15%+ five-year job growth — particularly those adding tech, healthcare, and professional services alongside traditional industries — see immediate multifamily demand, followed by retail absorption and office stabilization. Orlando, Austin, and Nashville exemplify this pattern, with diversified employment growth mitigating single-sector risk while creating compounding demand across asset classes through 2026.

📩 YOU’RE INVITED

THINK LIKE AN INSTITUTIONAL INVESTOR

What’s the difference between a 20% return and losing your shirt?

Knowing what NOT to invest in.

🗓️ Join us on November 20 at 1 pm ET as Mark Khuri from SMK Capital Management is opens up his playbook for us. With a portfolio spanning 130+ properties worth over $1.5 billion, his team has seen every type of deal — and learned which ones to run from.

In this free live event, you’ll learn:

✅ The Kill Switches: Discover the non-negotiables that make institutional investors pass immediately, even when the numbers look incredible.

✅ The Real Due Diligence: Access the proprietary stress tests and analytical frameworks SMK deploys before writing checks, including the sponsor questions most people never think to ask.

✅ The 2026 Outlook: Find out where sophisticated capital is flowing next, including the property types and deal structures positioned for outsized risk-adjusted gains.

✅ The Portfolio Perspective: Move beyond one-off opportunities and understand how the pros construct resilient, diversified positions across economic conditions.

💰 CRE TRENDS

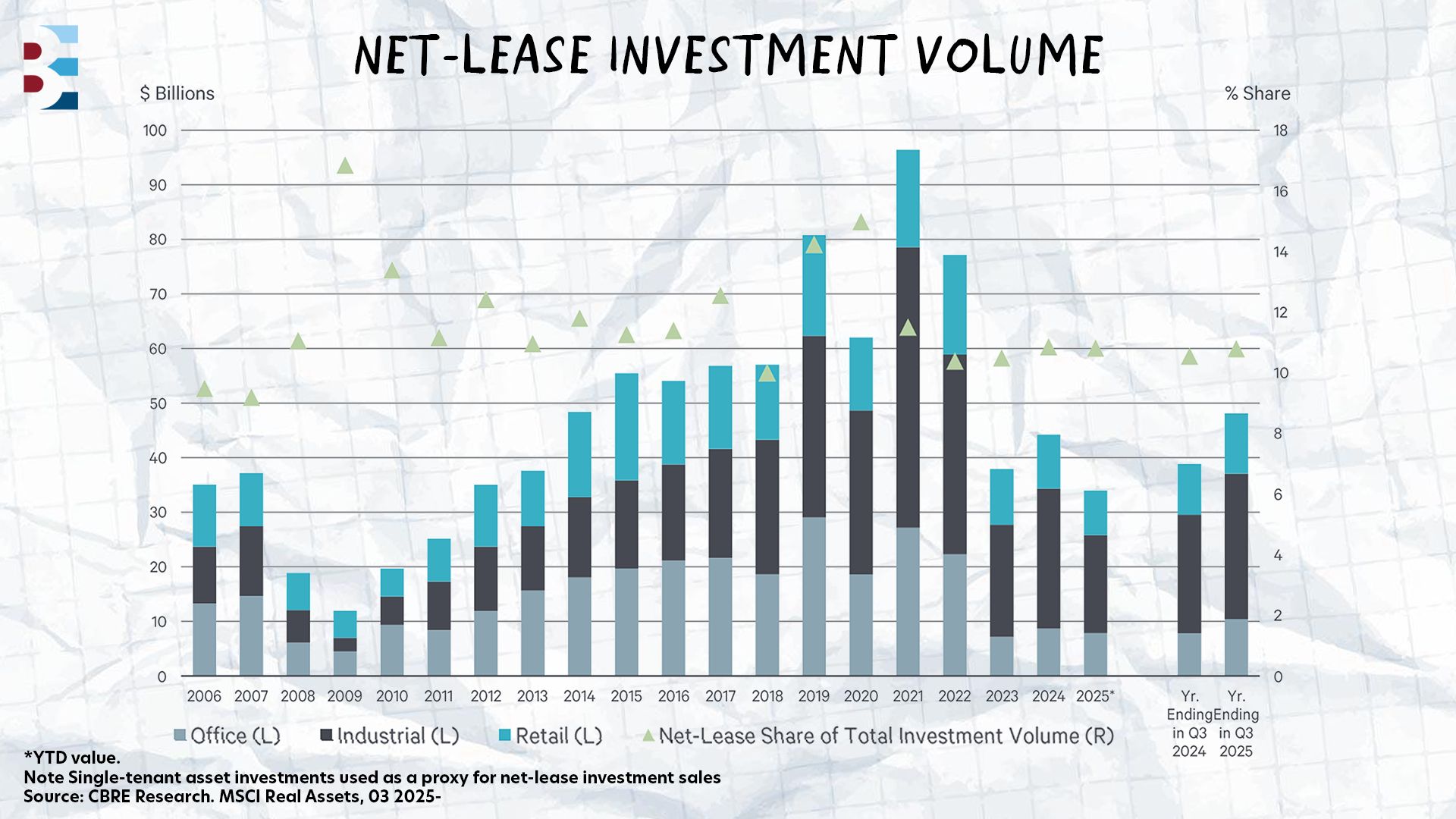

NET-LEASE HITS $48 BILLION AMID SHIFTING DYNAMICS

If you take a 30,000-foot view, net-lease looks strong. Zoom in, and you'll spot some wobbles worth watching.

Investment volume jumped 24% for the year ending Q3 2025, hitting $48.1 billion — a recovery that validates investor appetite for steady cash flows and minimal landlord responsibilities. But Q3 itself dropped 4% sequentially and 9% YoY to $10.6 billion, reflecting capital markets caution around elevated rates.

Office defied expectations, posting 29% YoY growth to $2.6 billion as investors targeted credit-tenant properties with long-term leases as bond proxies.

Industrial fell 19% to $5.6 billion after years of price appreciation, with its share of total volume dropping from 60% to 53%.

Retail declined 10% YoY to $2.4 billion as investors digested recent acquisition activity.

Cap rates held steady around 7%, attractive relative to other fixed-income alternatives, with contractual rent escalations providing inflation protection. Total CRE investment volume grew 21% to $445.9 billion, proving net-lease is capturing growing wallet share.

The quarterly volatility creates opportunity — patient capital moving when others hesitate will find better pricing on quality assets as rates stabilize through 2026.

🎉 BEST EVER CONFERENCE

SAVE UP TO 40% ON YOUR BEC HOTEL STAY

Best Ever Conference is coming to Salt Lake City this February, and our exclusive room block at the Hyatt Regency is filling up fast. Here's why you should book now at our conference hotel rather than staying elsewhere:

Our Rate: $240/night vs. up to 40% more at other downtown hotels

We've compared rates across downtown Salt Lake City, and other hotels are charging $350-360/night or more. That's up to 40% more expensive than our group rate. You'll save hundreds while staying steps from the Conference action. No shuttles, no commutes. Just walk from your room to sessions in minutes, and maximize every networking opportunity from the lobby to the rooftop bar.

🎙️ THE BEST EVER CRE SHOW

JOB GROWTH IS GREAT, BUT YOU ALSO NEED THESE

Regardless of sector, job growth is a critical metric when choosing a market. This week, on the Best Ever CRE Show, Todd Dexheimer joined Matt Faircloth to unpack how his market selection strategy has evolved since the post-pandemic chaos reshaped Sun Belt fundamentals. After watching markets like Austin experience explosive rent growth followed by sharp corrections, he's refined his approach to focus on metrics that signal sustainable performance rather than headline-grabbing appreciation.

Job growth remains critical, but Dexheimer now layers in additional filters. He prioritizes rent-to-income ratios to ensure affordability with room for growth. He studies building permit processes to gauge supply risk. Markets where permits come too easily can overbuild quickly when enthusiasm runs hot.

Austin, Texas, provided the cautionary tale. Rents reportedly declined 21% since 2022 as aggressive construction collided with affordability limits. The pattern repeats across hot markets — rapid appreciation attracts capital, capital floods supply, supply crashes rents. Austin will recover long-term thanks to strong job diversity, but the near-term pain for 2020-2021 buyers was real.

Lexington, Kentucky, exemplifies what works now. The city is surrounded by 400 protected horse farms, creating an urban service boundary that functions like an island. Growth must happen through density, not sprawl. Combined with steady job growth and difficult building permits, Lexington offers supply constraints and economic diversity that support cash flow without boom-bust swings.

Job diversity matters as much as job growth. Markets dependent on single sectors — tourism, energy, manufacturing — face concentrated risk. Dexheimer targets metros that are adding jobs across healthcare, tech, professional services, and traditional industries simultaneously. The diversification creates resilience through economic cycles.

Markets posting 15-20% annual rent growth may grab headlines, but sustainable performance comes from boring fundamentals compounding over decades. In today's environment, Dexheimer says, steady wins.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless