- Best Ever CRE

- Posts

- 🥊 Where the housing bubble will hit hardest

🥊 Where the housing bubble will hit hardest

Plus: The FTC sues Zillow, capital raising is back, the government shuts down, and much more.

Together With

👋 Hello, Best Ever readers! After today, there are only 90 days left in 2025. If you haven’t gotten after it yet, what are you waiting for?

In today’s newsletter, the housing market bubbles, the FTC sues Zillow, capital raising is back, the government shuts down, and much more.

Today's edition is presented by our NNN Fast Track Course, a 5-module video masterclass on building passive income through triple-net commercial real estate. Join Ash Patel as he teaches the exact system he used to close dozens of NNN deals.

🤖 Plus, join us Tuesday, October 7, at 3 pm for The AI Investor Magnet, a free workshop where you’ll learn Marcin Drozdz's AI-powered system that nurtures thousands of leads into dozens of investors every month.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

⚖️ FTC Lawsuit: The FTC sued Zillow and Redfin over an alleged $100 million deal giving Zillow exclusive syndication rights for multifamily rental listings, eliminating competition and forcing Redfin to end advertising contracts for up to nine years in February 2025.

🏪 Retail Resurgence: Retail real estate has become a preferred investment as institutional bid volume jumped over 300% since H1 2024. With strong leasing fundamentals and cap rates compressing for core properties, transaction activity is forecast to rise 12% this year amid returning capital.

🚨 Fraud Alert: Multifamily fraud has evolved from rent skipping to sophisticated AI-powered document alteration and organized "fraud as a service" operations, while consumer demands for instant leasing decisions compress screening timelines and challenge security protocols.

📉 Vacancy Peak: National multifamily vacancy hit a record 7.1% in September as median rents fell 0.4% to $1,394, down 0.8% YoY. Austin led declines at 6.5% annually, while San Francisco rebounded with 4.9% growth.

💼 1031 Revival: The restoration of full 100% bonus depreciation in 2025 has supercharged 1031 exchanges for institutional investors, allowing immediate substantial write-offs on acquisitions but amplifying recapture risks at disposition if exits occur outside the exchange structure.

🏆 TOP STORY

MARKETS AT BIGGEST RISK OF A REAL ESTATE BUBBLE

Rising government debt may become an unexpected driver of housing demand over the next decade, with implications for multifamily investors who are tracking affordability and rental market dynamics. With public debt approaching 100% of global GDP by 2030, policymakers face limited options — and several of those options favor real assets.

In its recent bubble index, UBS identified three policy responses to mounting debt: austerity (raising taxes and cutting spending), allowing inflation to rise, or "financial repression" where central banks suppress borrowing costs. The latter two make real assets like housing more attractive, and they risk creating bubbles when prices disconnect from fundamentals.

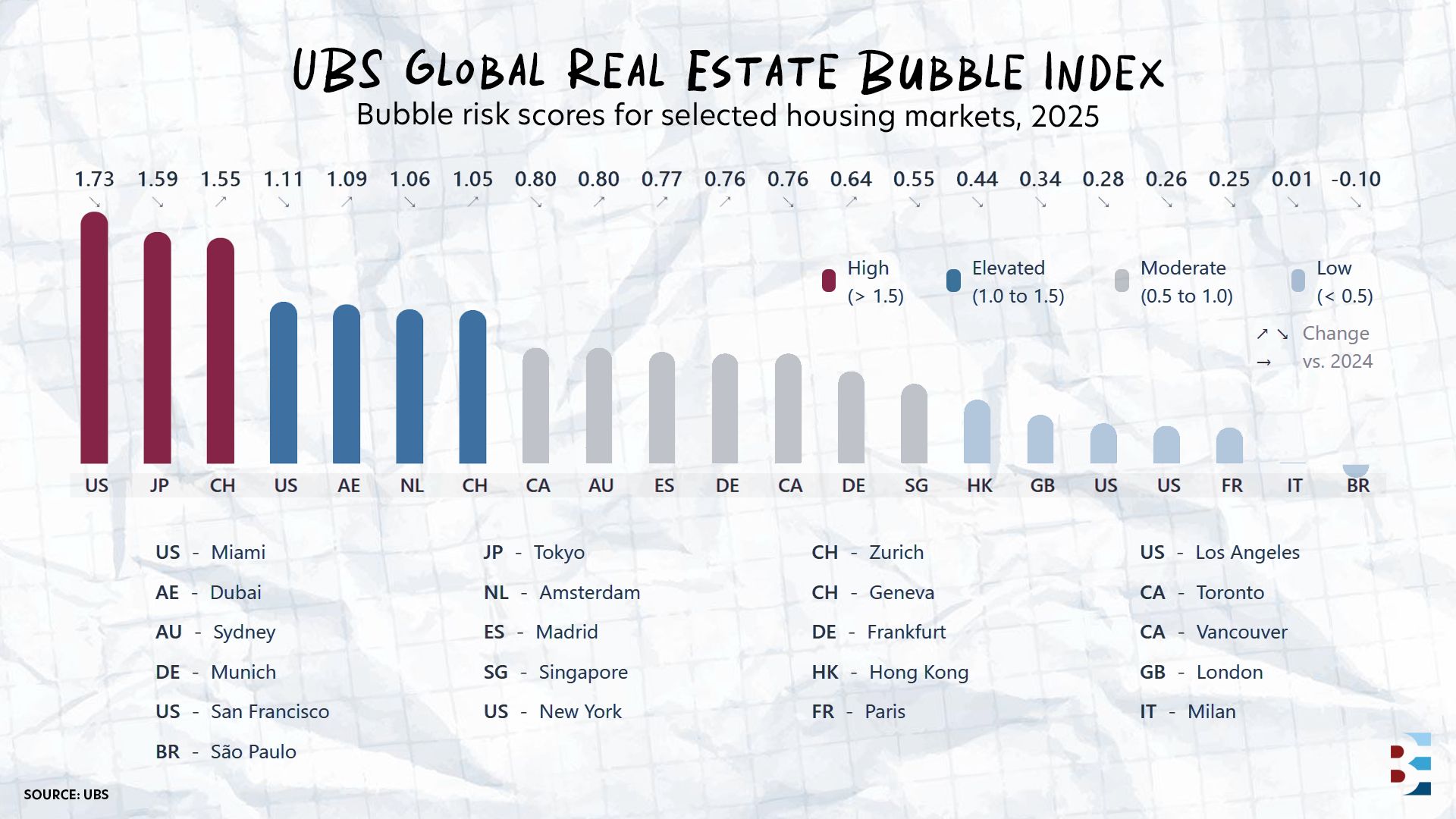

Among 21 global cities examined, U.S. residential markets showed starkly divergent bubble risks based on price-to-income and price-to-rent ratios:

🔴 Miami: Highest U.S. Bubble Risk — Real prices surged 6.8% annually over the past decade while rents rose just 1.2%, creating the study's strongest appreciation but widest disconnect between owner and rental values. Though the boom has cooled recently, UBS notes prices remain detached from rental fundamentals but expects stabilization rather than a sharp correction.

🟡 Los Angeles: Elevated Risk — Limited supply and luxury segment strength have pushed prices higher, but rents haven't kept pace with inflation due to quality-of-life concerns and regulatory constraints. Weak absorption of new supply has made LA among the least accessible U.S. markets.

🟢 San Francisco: Low Risk — Just 0.7% real price gains over a decade, with rental values declining 2.1% in real terms. Prices remain 10% below their 2022 inflation-adjusted peak, though affordability challenges persist.

🟢 New York: Low Risk — Real prices fell 0.5% over 10 years while rents dropped 0.8%. Return-to-office mandates and job growth have increased renter competition, but condo prices have stagnated once inflation is factored.

THE BOTTOM LINE

The divergence between coastal markets reflects fundamentally different supply-demand dynamics. Miami's speculative surge and LA's regulatory constraints present bubble risks, while San Francisco and New York show more balanced price-to-rent ratios, though affordability remains challenging. All told, government debt management strategies could provide tailwinds for real estate over the next decade.

✍ BEST EVER COURSES

FAST TRACK YOUR WAY TO PASSIVE CRE INCOME

Are you tired of getting outbid on 5% cash-on-cash multifamily deals? Managing tenants, repairs, and property managers? How about feeling stuck because every "good" asset is overpriced or picked over?

The Triple Net (NNN) Fast Track is a 5-module video masterclass where you'll learn directly from Ash Patel, who's closed dozens of NNN deals across the country, and Matt Faircloth, a veteran multifamily operator who asks the questions you're thinking. Each module includes worksheets and materials to help you apply what you're learning immediately.

What you get in this course:

5 focused video modules: Watch Ash and Matt break down NNN investing from deal sourcing to closing.

Complete toolkit: Worksheets, templates, and materials included to support every lesson.

Real-world examples: See how students have found strip malls and retail properties that no one else noticed.

Practical frameworks: Master retail pro forma analysis, CAM calculations, and tenant evaluation with step-by-step guidance.

Stop competing in crowded markets for mediocre returns. Get the fast track to passive commercial deals with expert video instruction and all the tools you need to succeed.

💰 CRE BY THE NUMBERS

NEW CAPITAL, LOW CONFIDENCE, SLOW SALES, AND MORE

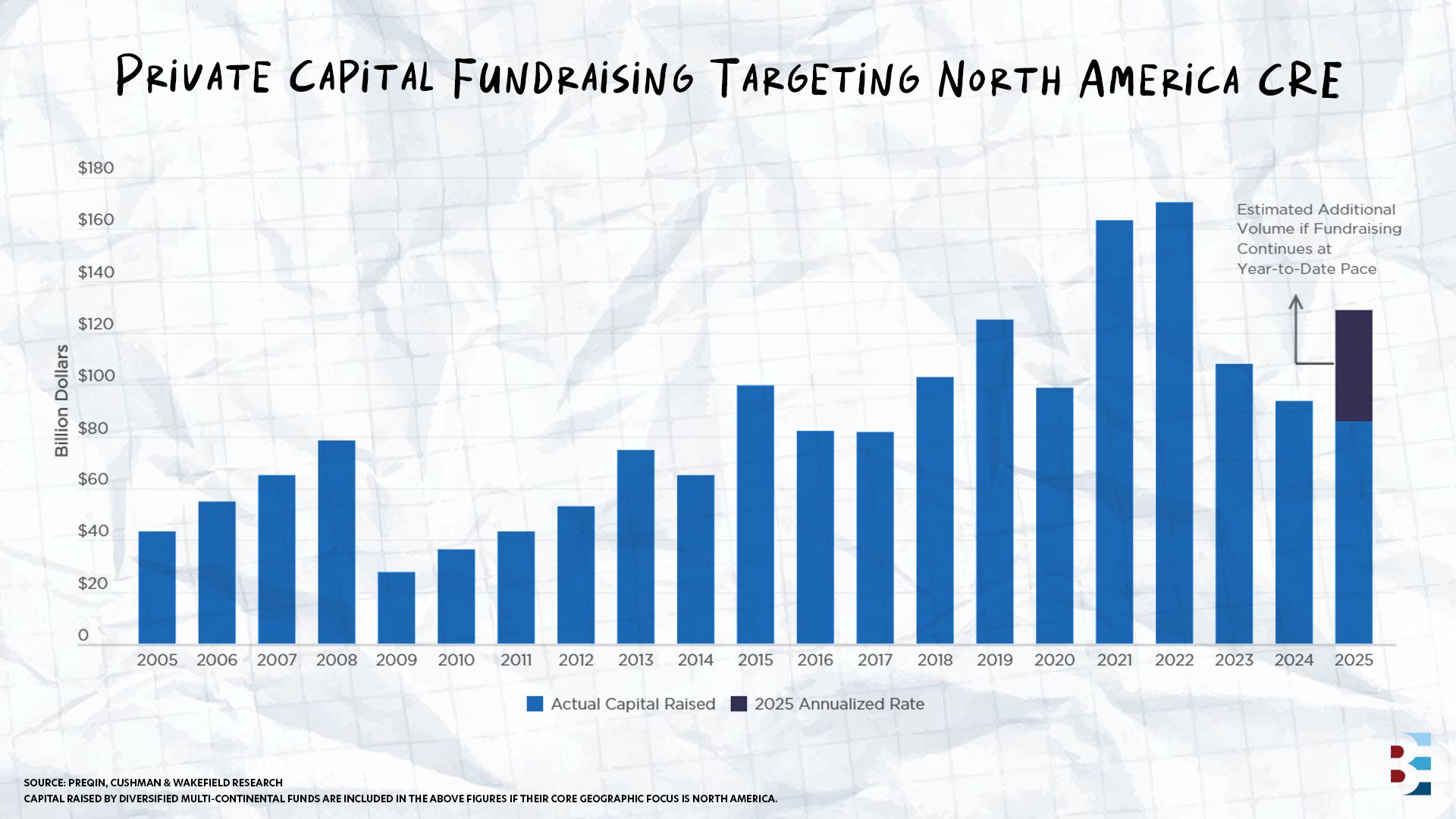

💰 $129 Billion

Private CRE fundraising is on track to hit $129 billion in 2025, up 38% YoY. Multifamily and industrial dominate fund targets, while loan originations rose 30% YoY in H1 as institutional investors commit fresh capital, signaling renewed confidence.

🏗️ 403,000

Multifamily permitting dropped 10.8% YoY to 403,000 units, according to RealPage, while construction underway decreased 20.2% annually to 686,000 units. Single-family home permitting fell to 856,000 units in August, down 11.5% YoY and marking the fourth consecutive month below 900,000 units.

📉 94.2

U.S. consumer confidence dropped to 94.2 in September from 97.8, falling more than expected as consumers' assessment of job availability declined for the ninth straight month to reach a multi-year low, reflecting ongoing labor market concerns despite rate cuts.

🏢 $12.5 Billion

Apartment sales volume fell 8% YoY to $12.5 billion in August, though individual property sales rose 11% to $11.2 billion while portfolio activity plunged 64%. Cap rates remained flat at 5.5% since August 2024 as property prices ticked up 0.2% YoY.

📦 $8.66

National industrial rents rose to $8.66 PSF in August, up 6.1% YoY, while vacancy dropped 30 bps monthly to 8.7% as industrial outdoor storage attracted over $900 million in institutional investment with rents surging 123% since 2020.

🔒 GOVERNMENT SHUTDOWN

WILL THE SHUTDOWN HIT CRE WHERE IT HURTS MOST?

Washington missed its funding deadline Tuesday night, triggering a partial government shutdown that threatens to compound uncertainty for CRE investors. Prediction markets suggest this won't be quick. As of this newsletter send, Kalshi pegs the duration at 11.5 days with 89% odds that the shutdown stretches past five days, while 53% of Polymarket bettors lean toward 10 to 29 days.

The immediate CRE impact centers on three critical areas.

🐢 Loan Processing Slows: Government-backed loans — FHA, VA, and USDA mortgages — face processing delays as staff are furloughed. The National Flood Insurance Program, used in thousands of daily closings, could force lenders to pause sales requiring flood coverage, particularly in coastal and flood-prone markets. IRS approvals also slow, creating friction for Fannie Mae and Freddie Mac transactions.

☣️ Tenant Risk in Federal-Heavy Markets: Landlords in Washington, D.C., and other federal-heavy markets face direct tenant exposure as agencies serve as anchor tenants across millions of square feet. Extended shutdowns could trigger space consolidations and lease renegotiations as agency budgets tighten.

⚫ Data Blackout: Friday's BLS jobs report has been shelved, cutting off crucial labor market intelligence just as ADP reported a shocking 32,000-job loss in the private sector for September. For CRE operators making underwriting decisions, the timing compounds existing headwinds with yields slipping and equities dipping.

Will the shutdown last long enough to dramatically impact CRE? It’s difficult to tell. Past shutdowns show deals get delayed rather than killed, but uncertainty slows transaction velocity exactly when markets need clarity most.

🤖 YOU’RE INVITED!

FREE WORKSHOP: THE AI INVESTOR MAGNET

💸 Complete beginners are raising their first million in 90 days. Here's how.

Marcin Drozdz has raised nine figures using an AI-powered system that converts cold leads into active investors automatically. In this 30-minute free workshop (Tuesday, October 7, at 3 pm ET), he's pulling back the curtain on the exact tools and workflows he uses.

You'll discover:

✅ The AI tech stack that identifies high-potential investors before they're actively looking

✅ Automated workflows that build trust and credibility while you sleep

✅ The "Investor Attraction Algorithm" that scores and categorizes leads by capacity

✅ Real case studies: How newcomers closed seven figures in their first 90 days

✅ Why this works in any market condition or deal type

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless