- Best Ever CRE

- Posts

- 💰 What Trump's crypto bill means for CRE

💰 What Trump's crypto bill means for CRE

Plus: Ash Patel gets audited, landlords get ICE’d, deliveries decline, and much more.

👋 Happy Sunday, Best Ever readers! Michael Jordan’s former Chicago estate is now available to rent on Airbnb, if you have $115,000 to burn for a minimum seven-night stay. Company retreat, anyone?

In today’s newsletter, crypto gets regulated, Ash Patel gets audited, landlords get ICE’d, deliveries decline, and much more.

✉️ Also … you’re invited! Join us for our next FREE live webinar, Hotel Investing Decoded: Cash Flow, Tax Benefits, and Market Opportunities, on July 24 at 7 p.m. EST. Save your seat today.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🥶 Landlord Get ICE’d: ICE is issuing subpoenas demanding tenant files from landlords without judge signatures, stirring legal questions about compliance. Property managers are confused by requests for leases, applications, and forwarding addresses in the mass deportation drive.

🏘️ Cap Compression: Multifamily core cap rates fell 6 bps to 4.75% in Q2 while value-add dropped 8 bps to 5.20%. Core buyer sentiment weakened to 56% from 65%, but value-add surged to 61% from 48% as underwriting metrics improved.

✂️ Subsidy Cuts: Trump's proposed two-year HUD time limit could displace 1.4 million subsidized renters, mostly working families with children. Housing authorities from Seattle to Atlanta are scaling back voucher programs amid funding uncertainty.

♿ Accessibility Rollback: The DOE is rescinding the 1970s accessibility rule for federally-funded buildings via fast-track process despite 20,000+ public comments protesting the Sept. 12 effective date. Disability advocates call it misuse of direct final rules for uncontroversial changes.

🏗️ Labor Crunch: Prologis has raised its development spending forecast $750 million to $2.5 billion amid build-to-suit demand, warning that construction costs will rise "radically" as deportations threaten to remove 15%-23% of workers from an industry already short 450,000.

🏆 TOP STORY

WHAT TRUMP’S GENIUS ACT MEANS FOR CRE

The wild west of cryptocurrency just got a little less wild. President Trump signed the GENIUS Act into law on Friday, establishing the first comprehensive federal framework for digital assets after the House passed it 308-122 in a bipartisan vote. The legislation provides federal oversight for stablecoins — digital currencies pegged to the U.S. dollar — while two additional bills await Senate approval to clarify regulatory authority and ban central bank digital currencies. Bitcoin surged to a historic $123,000 following the news.

The implications for CRE are wide-ranging:

Unlocking Institutional Capital: Major lenders, title insurers, and escrow agents can now operate with federal oversight instead of regulatory uncertainty. Industry experts think this clarity will finally unlock billions in crypto capital that has been sitting on the sidelines.

Faster Transactions and Tokenized Ownership: Stablecoins allow for fractional equity stakes and faster, blockchain-backed transactions. The Rilea Group proved these benefits by selling a Miami condo via wallet-to-wallet bitcoin transaction and receiving payment within minutes — on a weekend, no less.

Bypassing Traditional Systems: Smart contracts can handle settlement and title transfer, potentially bypassing banks and title companies entirely. A $1.6 million Tampa commercial building sold entirely in USDC stablecoin in 2022, with settlement and title transfer handled via smart contract.

Eliminating Foreign Exchange Risk: For international investors, stablecoin settlements eliminate foreign exchange risk and multi-day clearing periods.

📣 “This could be perhaps the greatest revolution in financial technology since the birth of the Internet itself,” Trump said of stablecoins, adding that he is “committed to signing landmark crypto market structure legislation this year.” This comes on the heels of the FHFA’s June demand ordering Fannie Mae and Freddie Mac to consider crypto holdings in mortgage assessments.

THE BOTTOM LINE

While the GENIUS Act removes major barriers to crypto adoption in CRE, implementation won't happen overnight. Legacy systems and steep learning curves mean adoption will be gradual, but industry veterans predict the first serious wave within six months and significant market emergence within a year — assuming regulators can actually turn legislation into workable rules that don't break everything that already works.

🎓 TOGETHER WITH THE DEROSA GROUP

FREE WEBINAR: HOTEL INVESTING DECODED

Join The DeRosa Group for our next FREE live webinar, as they provide a look inside the booming hospitality industry. They'll discuss why they decided to pivot from multifamily to hotels and conduct a deep dive into hotel deal analysis.

Here’s what you’ll learn from this FREE live webinar:

✅ Why Hotels? Discover why hospitality is a strong hedge against inflation and a powerful income generator in this market.

✅ Tax Efficiency: Learn how cost segregation and bonus depreciation can enhance your after-tax returns.

✅ Property Deep Dive: Explore DeRosa Capital 20, a dual-Hilton hotel offering, including business plan, risk mitigation, and projections.

✅ National Branding: Learn how working with a brand like Hilton creates predictable cash flow and long-term appreciation.

Matt, Jacob, and Hait will also give you an exclusive walkthrough of DeRosa Capital 20 — a dual-Hilton hotel offering that delivers immediate cash flow, institutional brand strength, and conservative upside.

💰 CRE TRENDS

APARTMENT COMPLETIONS ARE DECLINING EVERYWHERE

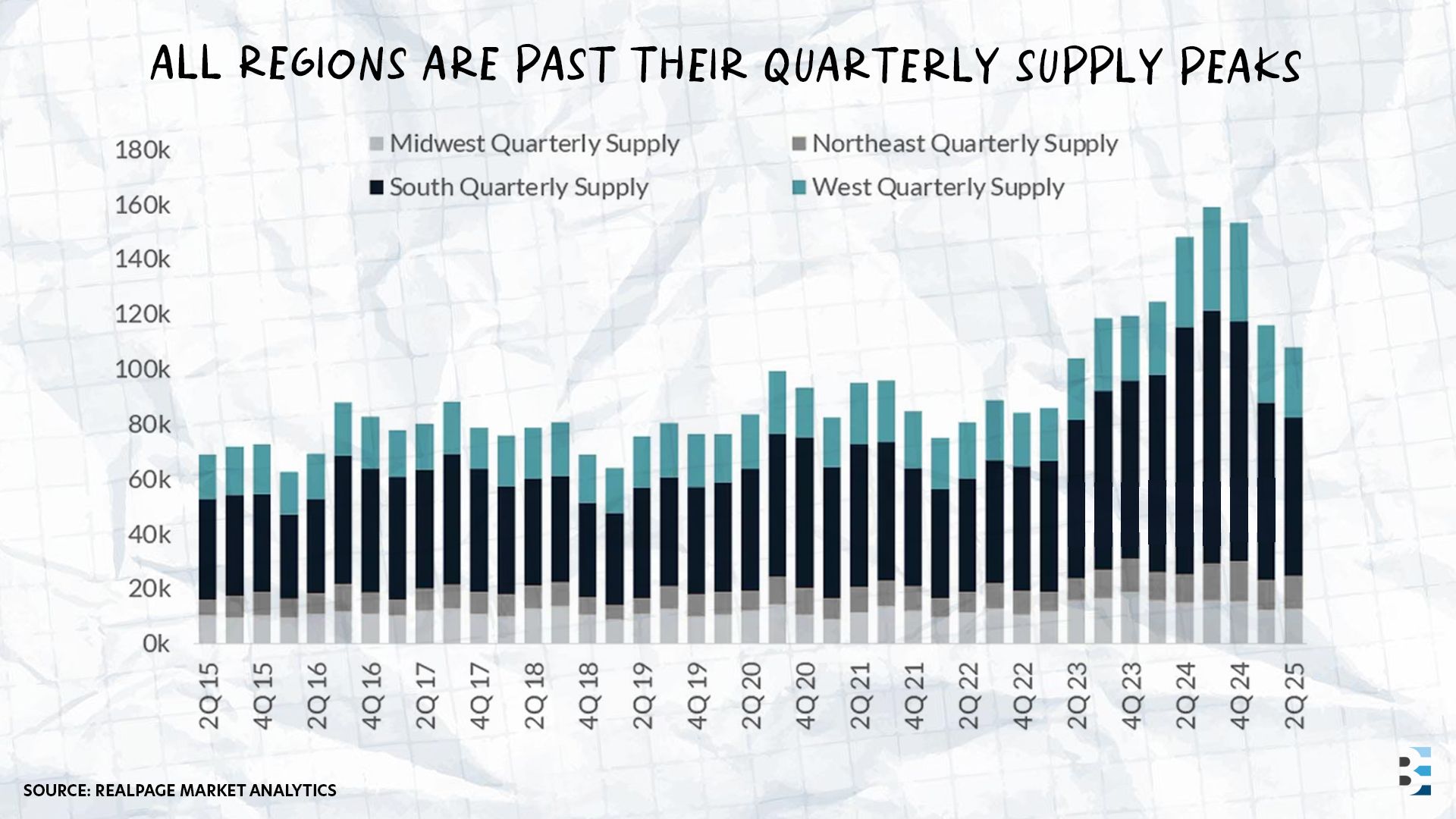

U.S. apartment completions fell to 108,200 units in Q2, according to RealPage, down from the peak of 159,000 units in Q3 2024, though still marking the ninth consecutive quarter above 100,000 units. This represents a significant decline from Q1's 116,000 completions, signaling the wind-down of a historically active construction period that began accelerating in mid-2023.

All four U.S. regions are now past their quarterly delivery peaks, indicating a broader national slowdown:

The South delivered 57,800 units in Q2, down 6,900 units from Q1 and well below the 2024 peak.

The West saw 5,700 units delivered, down 2,500 units from Q1.

The Midwest delivered 12,600 units, a slight uptick from Q1 but below the 2023 peak of 18,900 units.

The Northeast saw 12,200 units delivered, slightly higher than Q1 but trailing the late-2024 peak of 14,600 units.

Major metros continue driving volume, with Dallas, New York, Phoenix, and Austin each topping 5,000 new units in Q2 and exceeding 22,000 annual completions. Despite the slowdown, elevated completion levels continue pressuring rents and leasing velocity in oversaturated markets, though the slowdown is expected to continue amid construction challenges.

🎙️ THE BEST EVER CRE SHOW

AN IRS AUDIT THAT NEARLY WENT OFF THE RAILS

On a recent episode of the Best Ever CRE Show, while discussing cost segregation and IRS audits, Beyond Multifamily host Ash Patel shared a story about an audit he experienced that started with an innocent phone call and nearly spiraled out of control.

Here's what happened, in Ash's words (edited for clarity):

It's a summer weekend. We've just gotten to this lake. I go to check the mail and there's an IRS letter. Heart starts beating faster and faster, right? I open it, and it says they're doing a cursory audit. I call my cousin, who has been through audits before, and he says, "Ash, listen … this is a good thing. If you're not getting audited every three to five years, you're not writing off enough."

"Dude, this is not helping," I say. "I'm shaking right now."

My accountant doesn't respond. We have 30 days to respond to that initial letter. On the 29th day, I call this IRS lady and she's as nice as can be. She says, "Where would you like to meet?"

I say, "I don't know. What are the options?"

"Well," she says, "why don't we just meet at your house?"

I say, "Hell, if you knock on my door, what makes you think I'm going to let you in?"

She gets pissed off all of a sudden and says, "Hey, you claim a home office, so I'm coming to your house."

"Slow down," I say. "I've never in my life claimed a home office." — Because it's one of those things that trigger an audit, right?

So she says, "We'll see about that." Spends a minute on hold, whatever, comes back. You can see the life just gets taken out of her. She says, "Fine, where would you like to meet?"

"At this rate," I say, "how about my accountant's office?"

She says, "You have representation? Well, then I can't even talk to you."

My accountant calls me back literally like an hour after this and says, "Hey, I'm calling about your audit letter."

And I say, "Bro, where have you been? I've been calling you, emailing you … I just got off the phone with her."

He says, "Don't tell me you talked to her…."

"Yeah," I say. "She's all pissed off."

He says, "Oh my God…."

🎙️ To hear how Ash's audit went and for more on avoiding IRS trouble, listen to the full episode here.

✍️ BEST EVER SURVEY

YOUR OPINION MATTERS

HELP US BRING YOU THE BEST CONTENT EVER

After more than 10 years and over 45 million downloads, we’re still trying to bring you the best podcast guests and topics possible. So we want to hear from you, Best Ever CRE Show listeners! Please take two minutes to complete this brief survey to let us know what we’re doing well and what we can do even better. Each survey enters you for your chance to win a $150 Amazon gift card.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless