- Best Ever CRE

- Posts

- 🎲 Uber founder makes a big multifamily bet

🎲 Uber founder makes a big multifamily bet

Plus: ICE deals get canceled, fraud declines (sort of), cinemas are back, and much more.

Together With

👋 Hello, Best Ever readers!

In today’s newsletter, Uber’s founder takes on multifamily, ICE deals get canceled, fraud declines (sort of), cinemas are back, and much more.

Today’s edition is presented by M1 Real Capital. Built through $3B+ in transactions and trusted by more than 1,000 operators, fund managers, and capital allocators. M1 Real Capital installs the systems used to create predictable private capital. Book a Capital Constraints Call to diagnose exactly where your raise breaks and what needs to be fixed.

▶️ Get the free replay of our latest webinar: Grow Your Real Estate Business by 6-Figures with a TEDx Talk is now available! Learn how platforms like TED can help you build authority, shorten trust cycles, and increase deal flow. Get the free replay.

Let’s CRE!

🗞️ NO-FLUFF NEWS

CRE HEADLINES

🏭 ICE Deals Canceled: Owners of industrial properties in Virginia and Oklahoma City have withdrawn plans to sell to the Department of Homeland Security as local opposition to immigration detention facilities intensifies across multiple states.

🔍 Fraud Falloff: Multifamily fraud investigations at Fannie Mae fell to 12 in 2025 from 193 in 2024, but industry experts question whether misconduct has disappeared or simply shifted to CMBS and other markets.

🏙️ Selective Strength: Only 14 of the largest 50 U.S. apartment markets posted positive demand in Q4 2025, according to RealPage, with New York leading at 4,300 units absorbed while most markets saw seasonal net move-outs.

💰 New Normal: CRE investors have stopped betting on rate normalization and are underwriting deals with lower leverage and durable cash flow as a $190 billion maturity wall approaches between 2026 and 2028.

🏨 Hotel Surge: U.S. hotel transaction volume climbed 17.5% YoY to $24 billion in 2025, driven by private equity activity and debt costs falling nearly 300 bps since September 2024 Fed rate cuts.

🏆 TOP STORY

UBER’S FOUNDER MAKES A BIG MULTIFAMILY BET

The founder of Uber is getting into the multifamily game. Travis Kalanick, the entrepreneur who started Uber and pivoted to ghost kitchens with CloudKitchens, is targeting the $600 billion U.S. multifamily market with Sekra, a tech-focused apartment brand he's launching alongside Oliver Ripley, founder of luxury hospitality company Habitas.

👨🏫 The Thesis: Young, wealthy renters want more than basic amenities. They want community, wellness features, and seamless technology — and they'll pay above-market rates for it. With 80% of people under 40 globally renting and U.S. rental households hitting 46 million last year, according to Fast Company, Kalanick sees an industry ripe for disruption. Sekra has already raised $12.5 million from a suite of VC firms and investors and plans to open locations later this year in coastal U.S. cities plus Riyadh and Dubai.

Ripley claims Sekra can double typical retention rates while commanding premium rents through integrated technology and community building — a tech-hospitality approach that includes:

Proprietary operations platform with a resident app controlling in-unit IoT devices, lighting, and appliances while delivering curated programming.

Sleep optimization features, including noise insulation, blackout shades, and circadian rhythm lighting.

Ambassador-led community building focusing on game nights, wellness programming, and social events.

But there's a disconnect between amenity hype and resident reality. Recent surveys show surging interest in experiential features — outdoor cinemas jumped nearly 700 bps in popularity while gaming rooms gained 626 bps. Yet a 2024 NMHC survey of 172,000 renters reveals that 70+ percent still prioritize fundamentals like cell reception, fitness centers, and covered parking. Party rooms and maker spaces barely crack 50% interest.

Renters say they'll pay $78/month premiums for covered parking and pools but only $57 for gaming rooms and $52 for maker spaces. The gap raises questions about whether hospitality-style curation can command sustainable rent premiums.

THE BOTTOM LINE

Will premium renters pay above-market rates for curated experiences that rank below basic amenities in actual behavior? Sekra's launch will test whether hospitality-style branding can command sustainable rent premiums in a market where parking spots consistently outrank party rooms. For multifamily operators, the next 12 months of Sekra's performance will provide critical data on whether tech-enabled curation creates genuine pricing power or simply adds operating costs without corresponding revenue gains.

🤝 TOGETHER WITH M1 REAL CAPITAL

IT’S NOT THE MARKET. IT’S YOUR SYSTEM.

If you’ve raised capital before, this will sound familiar.

Your early raises came together through hustle. Personal relationships. Timing. Manual follow-up. Then the business grew, but the process did not.

Suddenly, raises feel heavier. Investor attention is harder to secure. Conversations drag. Soft commitments stall. Timelines slip. Pressure builds.

👉 It feels like a market problem. It’s not.

What breaks is the system. Most operators never build investor acquisition infrastructure. They rely on one-off outreach and reactive conversations, even as raise sizes increase. That approach caps growth and turns every raise into a grind.

Operators who raise consistently do something different. They create investor demand before a deal exists.

M1 Real Capital installs investor acquisition infrastructure with experienced operators raising from $1M to multiple 8 figures per year. This includes investor-ready positioning, predictable investor flow, and capital conversations already happening before a raise opens.

This is not coaching. This is not content. This is infrastructure.

If you’re raising capital without a system, you’re leaving growth to chance. Book a Capital Constraints Call to diagnose where your raise is breaking and how to fix it.

💰 CRE BY THE NUMBERS

A BUYER’S MARKET, CINEMAS ARE BACK, AND MORE

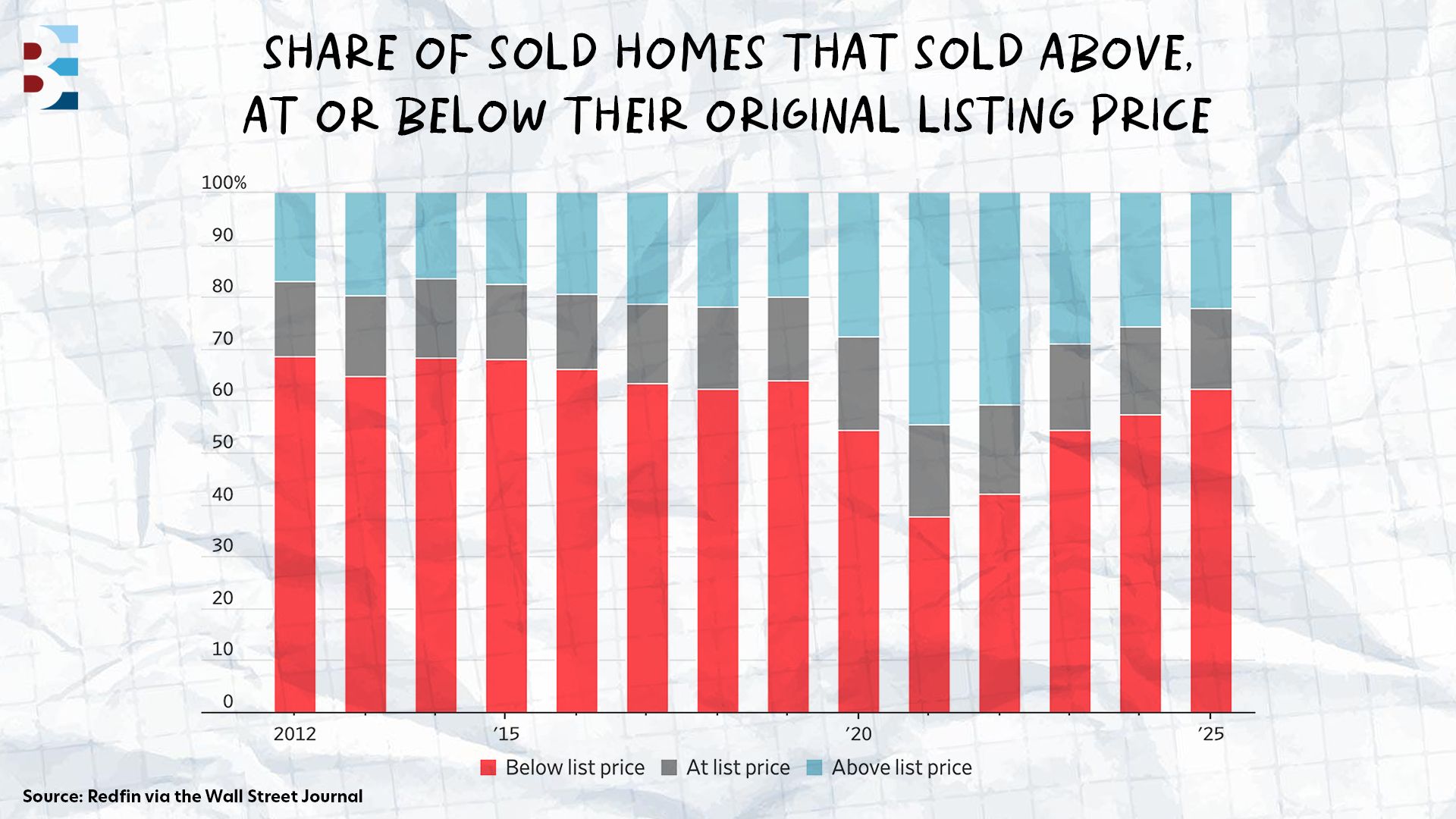

🏠 62%

About 62% of home buyers in 2025 purchased below the original listing price, the highest proportion since 2019. The average discount for homes selling under asking price reached 8%, the largest since 2012, as the market tilts decisively toward buyers.

📦 82.2%

National self-storage occupancy dropped to 82.2% in September 2025, down 4.3% YoY and marking the steepest decline since August 2024. REIT-managed facilities outperformed at 92.1% occupancy while sophisticated operators registered 82.1%, highlighting widening operational gaps across management types.

🎬 15%

Premium large format theaters captured nearly 15% of all U.S. and Canadian ticket revenue in 2025, up from 9.8% in 2019. Theater operators committed $1.5B to cinema upgrades between September 2024 and September 2025, driving the industry's K-shaped recovery.

🏭 52.6%

The Manufacturing PMI registered 52.6% in January, marking the first expansion in 12 months after 26 straight months of contraction. New orders jumped to 57.1%, the highest reading since February 2022, though tariff uncertainty continues weighing on sentiment.

▶️ GET THE REPLAY

THE TEDX PLAYBOOK FOR REAL ESTATE INVESTORS

Growth, influence, and capital all follow trust. In real estate, the investors who command the best terms and exclusive deal flow have built unshakeable authority — so capital comes to them.

▶️ Watch the replay of our recent webinar with Nate Hambrick of Leadr to learn how strategic platforms like TEDx can shorten trust cycles, attract pre-sold investors, and turn public visibility into private deal flow.

You’ll learn how to:

✅ Build authority through high-leverage speaking opportunities like TEDx

✅ Convert public visibility into private deal flow

✅ Create self-sustaining deal flow that attracts pre-sold partners

✅ Institutionalize your reputation to secure better terms and reduce capital acquisition costs

🎙️ THE BEST EVER CRE SHOW

HOW THIS GP SOLVED HIS CASH FLOW PROBLEM

Reed Goossens has spent 11 years building a multifamily empire with nearly $1 billion in transactions. But the last two years forced a reckoning: When deal flow slows and equity raising gets harder, where does GP cash flow come from?

This week on the Best Ever CRE Show, Goossens joined John Casmon to explain how he's solving this problem by pivoting into CPA firm acquisitions alongside his multifamily business. Goossens discusses how he and his partners were searching for cash-heavy businesses with retiring owners and antiquated systems where their operational expertise could deliver outsized returns. They landed on accounting firms for reasons that go beyond simple diversification.

The model is digital and remote. Unlike HVAC or restoration companies tied to specific geographies, CPA firms can serve clients nationwide and scale without physical constraints.

Clients are sticky. Once someone finds a good CPA, they stay for decades. Firms Goossens targets have 20+ year client relationships that provide predictable recurring revenue.

Baby boomer CPAs are retiring en masse. The talent shortage isn't about finding clients — it's about attracting qualified accountants, creating M&A opportunities for buyers who can build culture and career paths across multiple firms.

The deal structure differs dramatically from real estate. Goossens gets 40% debt, 20-30% seller financing, seller equity rollover, then brings fresh capital. He targets firms with $1.5+ million EBITDA to avoid key man risk and ensure second-level management exists. Goossens has already acquired firms in New Jersey and L.A.

The execution looks familiar. Weekly asset management calls track accounts receivable, marketing costs, and revenue per employee — the same KPIs that drive NOI optimization in multifamily, just applied to professional services instead of rent rolls. For GPs struggling with inconsistent cash flow, the lesson is clear: your core competency isn't real estate, it's assessing deals and optimizing operations. That skillset transfers.

🙏 Thanks for reading!

Stay in the loop with us! If you received this newsletter from someone else, subscribe here. You can also find us on LinkedIn, Instagram, and YouTube.

Have a Best Ever day!

— Joe Fairless